16 June 2020

Markets themselves were in the news last week, as the rally in risk assets came to an end with a vengeance. The world’s stockmarkets corrected quickly and violently, with declines approaching 10% in some cases, while the nascent bounce in government bond yields was quickly stamped out. Analysts struggled to point to a single catalyst; however, the White House accused Federal Reserve Bank (Fed) Chairman Powell of being insufficiently optimistic in his post-open market committee press conference. The Fed reacted by announcing the commencement of its $600 billion lending program for medium-sized businesses. Under that “Main Street” program, the Fed will buy 95 percent of bank loans to companies with up to 15,000 employees or $5 billion in annual revenue; the Fed then followed this up with the immediate start of a $750 billion programme to purchase individual corporate bonds. Separately, the Bank of Japan also boosted markets with an increase in its contribution to lending support for struggling companies of JPY35 trillion (£40 billion).

A second wave of Covid-19 emerged clearly in the US, with notable increases in hospitalisations in California, Texas, Florida and other southern states covering about 18% of the US population. It seems likely that the number of deaths is going to rise sharply in these states over the next few weeks, though this will be offset at a national level by declining numbers of deaths in the north-east. The reactions of state governors will tell us whether medical concerns still triumph over economics. Sensibly, President Trump’s re-election campaign asked people attending his rally in Oklahoma this week to waive Covid-19 liability.

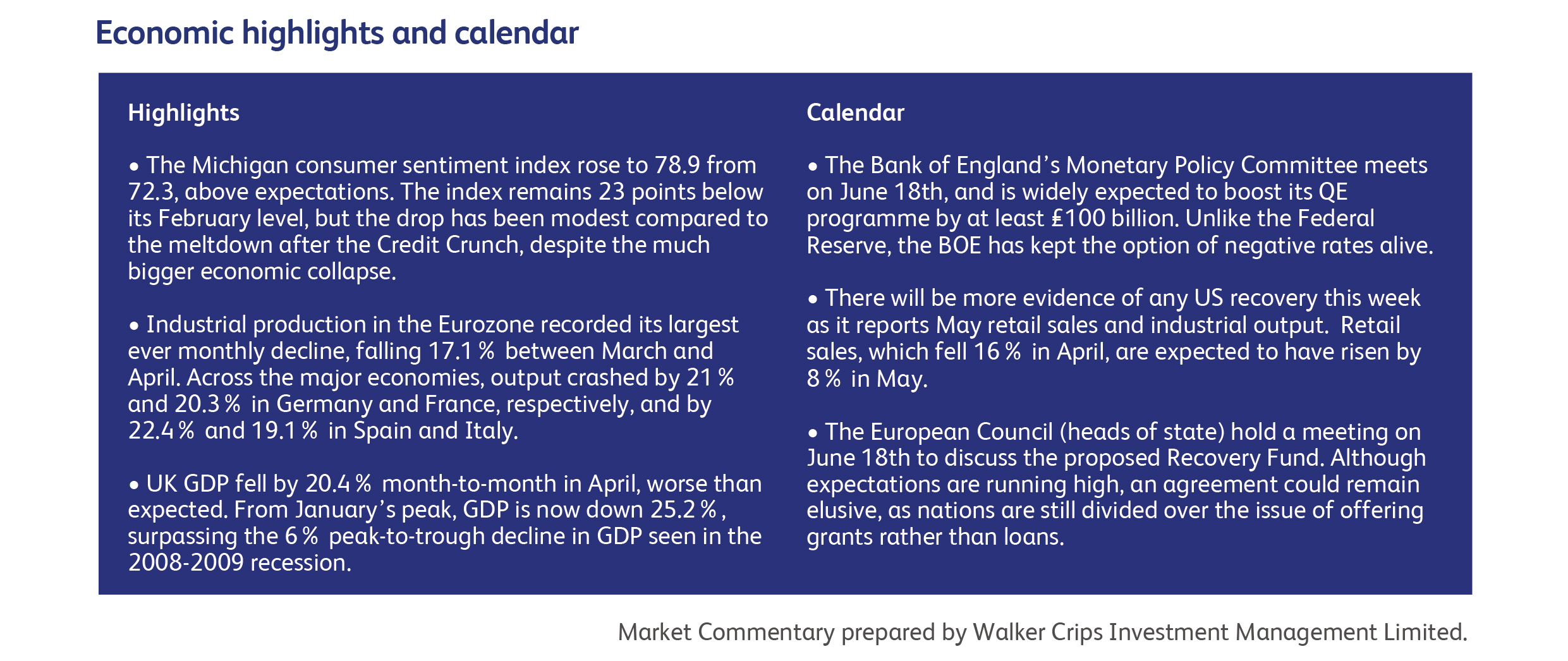

An area of Beijing was put under strict lockdown after the city's first coronavirus cases in more than 50 days. The outbreak was linked to the city's largest wholesale market, where 106 workers tested positive for Covid-19, despite none displaying symptoms. Lockdowns have been imposed in 11 nearby neighbourhoods, while 10,000 market staff will be tested. The latest OECD forecasts were published during the week, and envisage a global second wave of the pandemic reducing world output by the end of 2021 to 10% below its end-2019 level, as opposed to 6% lower if that second wave is avoided. These negative impacts are roughly double the declines predicted in the International Monetary Fund’s equivalent forecast, published only two months ago. The US Federal Reserve’s new forecasts were similarly grim, with US GDP now forecast to continue declining rapidly through the end of the year. Next year is expected to bring a healthy rebound of 5.0%, but GDP will only return to pre-virus levels towards the end of 2022.

Nevertheless, the Fed did all the right things, promising to keep its Treasury and mortgage purchases “at least at the current pace”, implying that the pace of purchases could increase if the recent rise in yields continues. The Fed’s dotplot shows that rates are expected to remain at current levels until 2023. Chairman Powell said the Fed is “not even thinking about thinking about raising rates”, but stopped short of moving to yield curve control.

More governments are preparing specific, industry-targeted bailout programmes to follow the more general pandemic responses. Following on from Germany’s rescue of Lufthansa, the French government announced EUR15 billion euros in rescue money for the aerospace industry, including plane maker Airbus and national airline Air France. Later in the week, the Spanish government unveiled an EUR3.8 billion stimulus program for the country’s car industry, Europe’s second-biggest. The Spanish government also announced that it will present a stimulus plan for the tourism industry on June 18. The two industries combined account for about 22% of Spanish gross domestic product, with car production accounting for a fifth of the country’s exports.

Finally, in (perhaps) a sign of things to come, Lebanese protesters burned down their central bank.

The U.S. video-conferencing company Zoom closed the account of a group of prominent U.S.-based Chinese activists after they held a Zoom event commemorating the 31st anniversary of the June 4 Tiananmen Square Massacre. Zoom has faced growing scrutiny over security concerns and its ties to China. A Zoom spokesperson confirmed that the account had been closed "to comply with local law" and said it had now been re-activated.

Twitter removed more than 170,000 accounts tied to a Beijing-backed influence operation that deceptively spread messages favorable to the Chinese government, including about the coronavirus. The company said the network was largely an echo chamber of fake accounts without much further traction. The company also removed two smaller state-backed operations that it attributed to Russia and Turkey.

Tesla, the electric car company, confirmed that it recently cut the price of the 2020 Model S Long Range Plus by $5,000. They also boasted that the EPA-rated range for this Model S version has increased to 402 miles - the number of miles the vehicle can travel per single charge in testing conditions. The 402-mile range claim remains unconfirmed by government offices and representatives from the Environmental Protection Agency could not immediately verify Tesla's statement.

AT&T, the American telecommunications company, is considering selling its Warner Bros. gaming business in a possible $4 billion deal. According to CNBC, AT&T is looking to reduce its $165 billion debt, and potential buyers include Take-Two Interactive Software, Activision Blizzard and Electronic Arts. Some of the most well known games that fall under the business are the Harry Potter Games, Batman: Arkham series, Mortal Kombat and The Witcher 3: Wild Hunt. Many of the games are tied to Warner intellectual property, and so a sale could include some commercial licensing agreements where AT&T can still draw revenue.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.