8 October 2020

Most countries are now seeing mini-outbreaks of Covid-19 and, in several large countries, those outbreaks are spreading to the general population. In the US, whose second wave appeared to have abated, the seven-day average number of new Covid-19 cases is rising again. Last week, 15 states had test positivity rates in excess of 10%, and five had rates above 20%. Adjusting for population sizes, the number of new cases in the US is about one third above the UK level, which in itself is causing alarm. And this is despite the US having the inbuilt advantages of being less densely populated, and having less reliance on public transport. With such high positivity rates, it's likely that these states have thousands of unrecorded cases with the potential to seed much wider outbreaks.

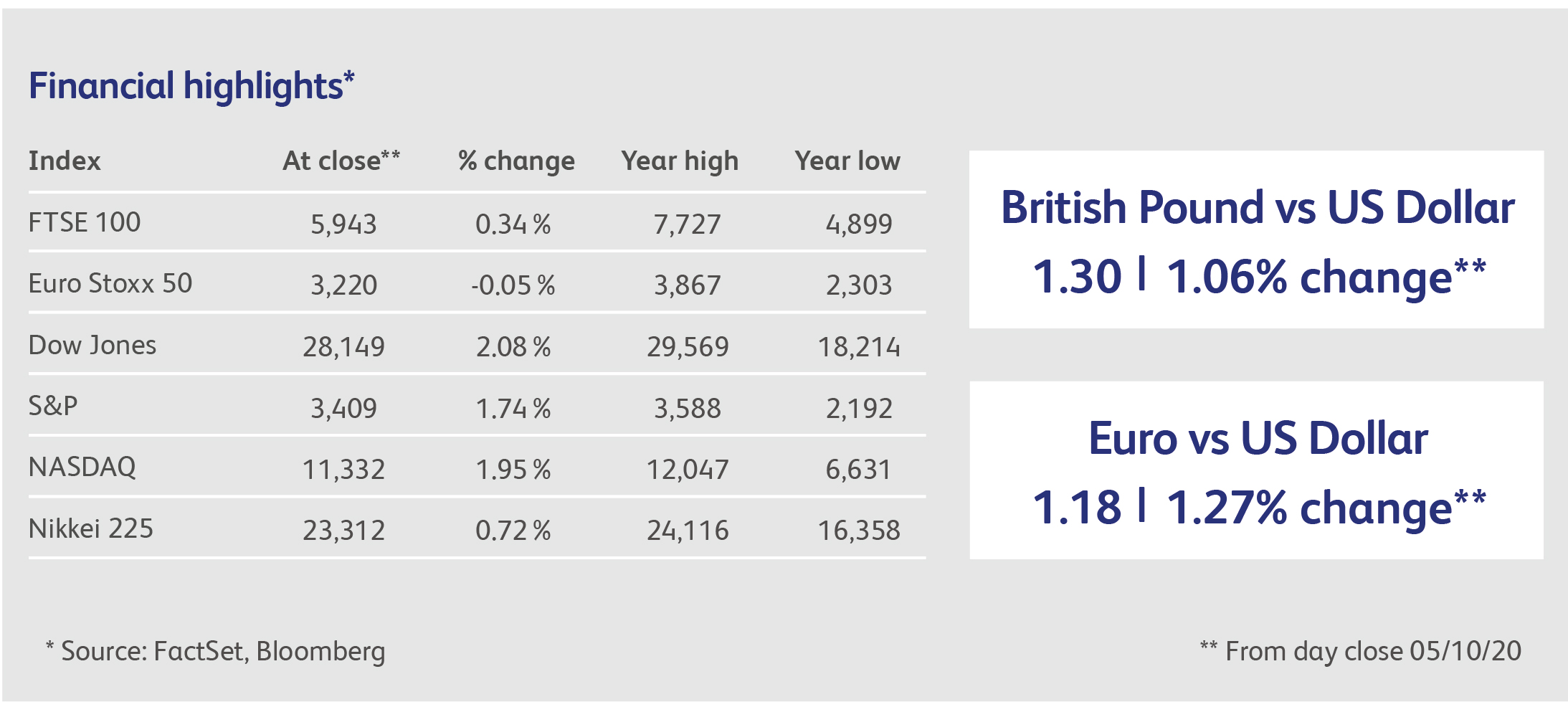

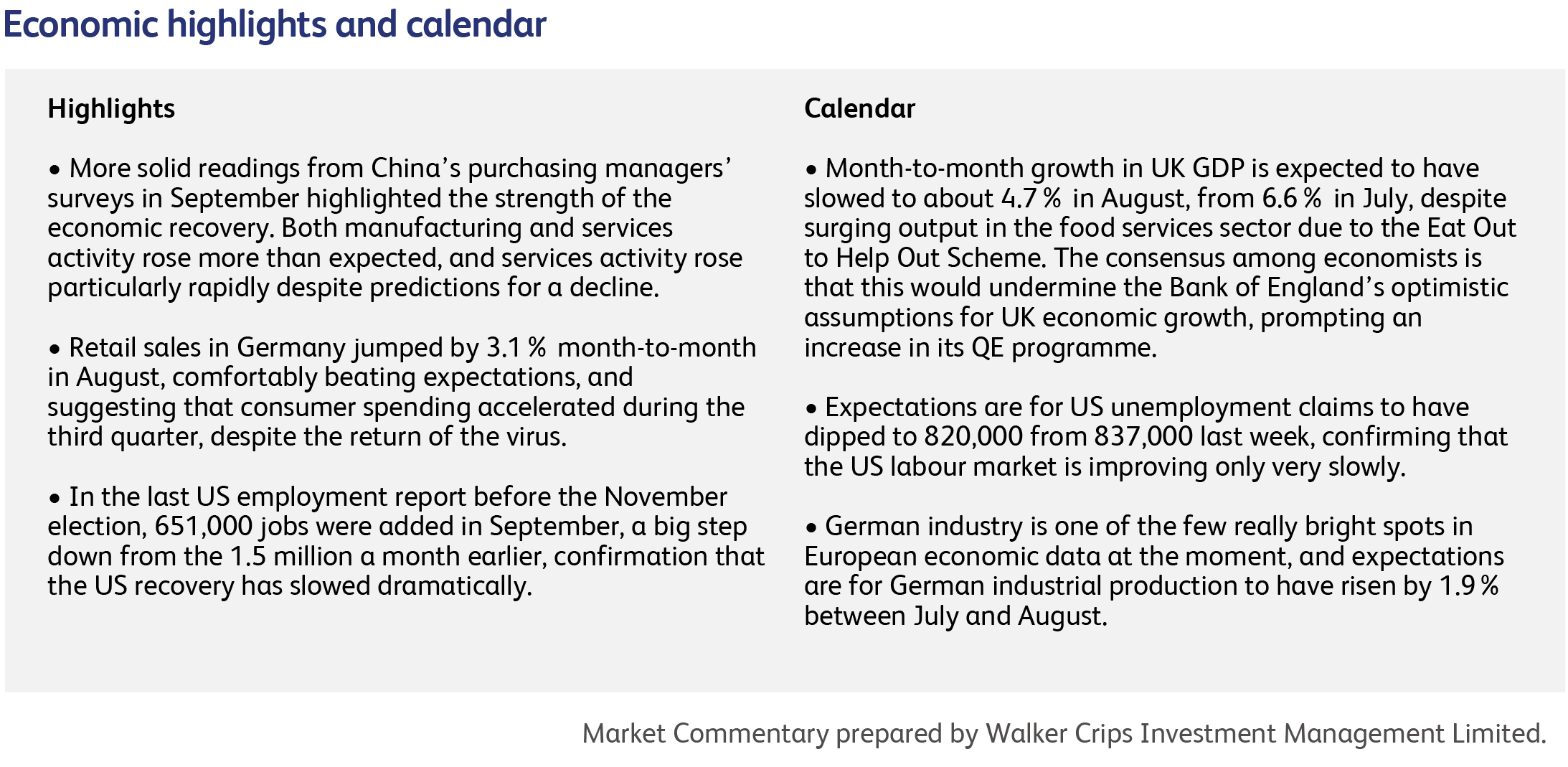

Common sense suggests that a low rate of infection will encourage consumers to return to relatively normal behaviour, and economic data increasingly confirm this. While all countries are affected to some degree by the pandemic’s impact on international trade, the domestic economic effects are proportional to each nation’s success in containing the virus. Last week saw further evidence confirming China’s economic rebound and, among European nations, Germany stood out with an unexpected acceleration in consumer spending. This aligns with the medical evidence: Germany’s new cases, though on the rise, are only a fraction of those in other large European countries and, in China, the virus has all but disappeared. In the US, on the other hand, the labour market continues to lose momentum. Last week’s release of employment data for September showed that 651,000 jobs were added, a big step down from the 1.5 million a month earlier. A simple extension of this trend suggests there is even a possibility that employment growth turns negative in October. Fortunately for the incumbent, the next employment report is due three days after the presidential election.

The possibility of another round of lockdowns, causing a drag on the recovery, confirms that the one, concrete solution to the pandemic is mass vaccination. However, the vaccines currently being rushed to market use relatively untested technologies that make distribution impractical, to say the least. The two leading vaccine candidates in the US (developed by Moderna and Pfizer) have to be frozen; in Pfizer’s case, at -70 degrees centigrade. This will limit how and where they can be shipped. Pfizer has devised “thermal shippers” that, unopened, can keep the vaccines frozen for up to 10 days. These shippers can be opened no more than twice a day to take out vials, and must be closed within one minute. Once opened for the first time, they have to be replenished with dry ice within 24 hours. Both Moderna’s and Pfizer’s vaccines require two doses per person, and the second dose has to be administered several weeks after the first dose. Having the right number of vaccines for the right people will require an extensive database and new software. Things will really get complicated when multiple vaccines are available at the same time. Governments that have failed to accomplish some quite basic tasks, such as persuading citizens to wear masks, are expected to accomplish extraordinary logistical feats that have never been tried before. All this means that vaccination, when it is available, will take many months to implement.

The US Treasury Department announced that American Airlines Group and United Airlines Holdings are among seven US airlines taking federal loans. American announced earlier that it will take a $5.48 billion loan, an increase on its original proposal to take $4.75 billion. American has forecast that third quarter revenue will be down 75% from a year earlier, and also expects a 65% drop in the fourth quarter. Alaska Airlines, Frontier Airlines, JetBlue Airways, Hawaiian Airlines and SkyWest Airlines also accepted the loans. Accepting federal loans is seen as a last resort when no other funding is available and companies accepting federal loans are required to put a cap on executive compensation.

Regeneron Pharmaceuticals got an unlikely boost when, following President Trump’s hospitalisation, the White House issued a press release saying the president had received an 8-gram dose of one of its anti-Covid 19 drugs. This experimental drug hasn't yet been authorised or approved by the US Food and Drug Administration (FDA). The FDA was itself in the news recently, when it became the latest government department to have its leadership replaced by an overtly political appointee.

Cineworld Group is drawing up plans to close all its UK cinema sites, saying the industry has become unviable due to film studios postponing big-budget releases. The closures would put as many as 5,000 jobs at risk.

Tesla delivered 139,300 cars worldwide in the third quarter, beating analysts’ estimates by nearly 10,000, but will still struggle to meet its target of 500,000 cars for the calendar year. Sales are now being driven by the mass market “Model 3”, rather than the more upmarket “S” and “X” classes. Tesla bulls point to the data as evidence that Tesla has, once again, broken the mould. Bears point to the ten price cuts in China this year as the likely driver.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.