13 October 2020

It was another week in which the pandemic worsened across most of the northern hemisphere and expectations for economic growth in the fourth calendar quarter were downgraded. Most large European countries have tightened their restrictive measures recently, and the number of local lockdowns has increased dramatically. More importantly, the number of new cases in people aged 70 and over, a good leading indicator for hospitalisations, is rising rapidly. Prospects for positive economic growth in the latter months of the year are quickly turning to expectations of a decline in the UK, France and Spain. At the other end of the spectrum, tourism-related consumption bounced back over China's National Day holiday. China is the only country in the G20 likely to experience positive economic growth this year, but even China is far from being back to normal: certain occupations are still limited by interprovincial travel restrictions, including students, teachers and public servants, and tourism-related revenues over the holiday period were down 30% from the previous year.

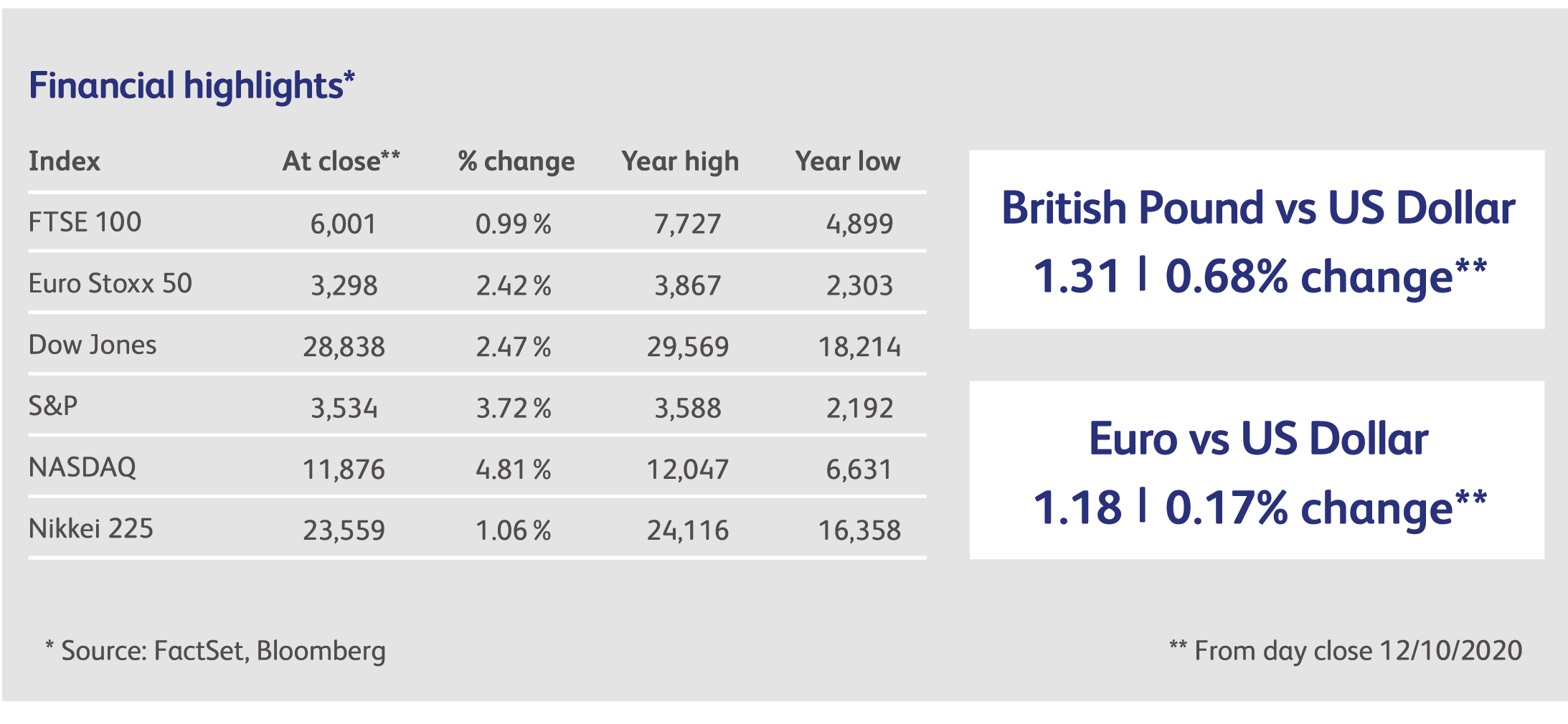

Stockmarkets barrelled through the bad news last week. Neither the implosion of President Trump's re-election campaign in the polls, the on again-off again nature of US stimulus negotiations, nor the publication of a Democratic Party-inspired report calling for an anti-trust investigation into US tech companies could derail the rally in asset prices. One new-found explanation for the level of markets is the idea that a Democratic presidency would be good for investors, because it would mean a bigger stimulus. However, such stimulus wouldn't arrive until February at the earliest and, in the meantime, a lot of economic damage would occur. Moreover, Trump has been an assiduous, even a minute-by-minute, supporter of the US stockmarket: in an interview with Fox News last week, former White House chief of staff Mick Mulvaney admitted, "We always needed to put Kudlow (Director of the US National Economic Council) on TV - on your show - when we needed the markets to go up." Only a few weeks ago the consensus view among investors was that Democrats would be more likely to increase corporate taxes and regulation.

The residential housing market in the UK is red hot. Last week's index of surveyors reporting that house prices have increased to its highest level since June 2002, and the short-term indications of demand also look solid. The same is true of the US, where every aspect of the housing market is booming. The phenomenon of rising house prices reflects the desire of many workers to upgrade, in the expectation that they will spend more of their careers working from home. But will surging house prices feed through into higher rents? Rental costs make up a large part of the basket of goods and services used to calculate inflation, so this would almost certainly lead to rising inflation.

Another upside risk for inflation is the behaviour of corporations. There is evidence that healthcare providers are now lifting prices for procedures postponed during the lockdown. Patients may have little choice but to pay up. If other companies think the same way, and consumers are willing to bear the extra cost, inflation could begin to rise across a range goods and services. The consensus among economists is that this is unlikely in the short-term, because inflationary costs in some parts of the economy will be more than offset by deflationary influences in others. Some rents may increase, for example, but others will be lost through defaults and increased vacancies. With consumer behaviour changing so quickly, though, the outlook for the medium-term is not so certain.

A report released by Democratic staff of the US House Antitrust Subcommittee capped a 16-month inquiry into the market power of Amazon, Facebook, Alphabet (which owns Google) and Apple. According to the report, America's biggest technology companies have leveraged their dominance to stamp out competition and stifle innovation. The report recommended that Congress should consider forcing the tech giants to separate their dominant online platforms from other business lines.

Robert Whaley, the man who created the VIX Index that measures volatility in US stockmarkets, alleged that investors in options linked to exchange-traded funds have been short-changed. This happens when the funds become potentially unviable due to extreme market conditions: the product providers change their investment approach in order to stay in business, but options linked to those products are not adjusted accordingly. A good example is the United States Oil Fund which, designed to track the oil price, started buying less volatile, longer-dated oil futures as prices for shorter-term futures crashed. Anyone who had bought options on the fund, betting the oil price would drop, saw the value of their positions plunge.

All clinical trials of Johnson & Johnson's experimental Covid-19 vaccine have been paused after a study volunteer had an unexplained illness. Announced on Monday, the pause affects all trials of J&J's vaccine, including the large phase 3 trial that began in September, which aimed to enroll as many as 60,000 people in the US and several other countries.

The Walt Disney Company (Disney) has formed a new content and distribution arm as part of a major reorganisation, which pushes its streaming business closer to the centre of the company. Disney has been particularly hard hit during the Covid-19 pandemic as many Disneyland theme parks remain either closed or operating far below normal. Disney's streaming services, Disney+ and Hulu, have been performing well during the pandemic, like other streaming services. The new distribution group will be overseen by Kareem Daniel, the former president of games/publishing in the company's consumer products, and is part of a move that recognises the shift that is happening in consumer habits.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.