3 November 2020

A cardinal rule of elections is that people don’t turn out in record numbers to support incumbents and, if the polls are to be believed, this evening will seal the fate of President Trump’s eccentric policy of economic nationalism and, in particular, tariffs. Although a potent political force, there is little evidence that Trumponomics has made a positive impact on US economic growth. The economy briefly sputtered into life after the “Tax Cuts and Jobs Act” at the end of 2017, but did not grow fast enough to prevent one of the largest government deficits in peacetime. Prior to the pandemic, the Act was forecast to add $2 trillion to the national debt. Trump’s anti-China policy has certainly hurt the prospects for US companies in China, the world’s fastest-growing economy. At home, moreover, Americans continue to pay the majority of tariff-induced costs, and subsidies to US farmers will approach $46 billion this year. All in all, Trump’s policies amount to a transfer of wealth from future generations of taxpayers to boost an economy threatened by trade wars on every front.

In this respect, the result of the US election carries implications for the UK: Brexit partly relies on a similar strategy of increased economic self-sufficiency and less cross-border integration. A strong anti-Trump vote could indicate that, having experienced such policies first-hand, voters are no longer interested. Absent Trump and his own vehemently anti-EU policies, the UK will indeed be “standing alone”, and this may change the political desire, as well as the economic ability, to strike out independently of the EU.

While Biden’s policies do not amount to a U-turn on China, they are likely to reposition the US closer to its former economic allies on the subject of global trade. Corporate planning should benefit from a more stable geopolitical environment. However, it’s difficult to see how Biden could be better for equity markets: Trump has, effectively, presided over a massive transfer of wealth from holders of government debt to holders of equities. He has the CEOs of the biggest US companies on speed-dial. His administration steamrollered a multitude of regulations designed to protect consumers and the environment from US corporates. Trump even uses the level of the stockmarket as a key indicator of the economy, frequently sending out his team of economic advisers to prop up investor confidence. For now, investors are, supposedly, keener on a Democratic stimulus than on a second Trump term, but the reality is that Biden is not anything like as beholden to corporate donors.

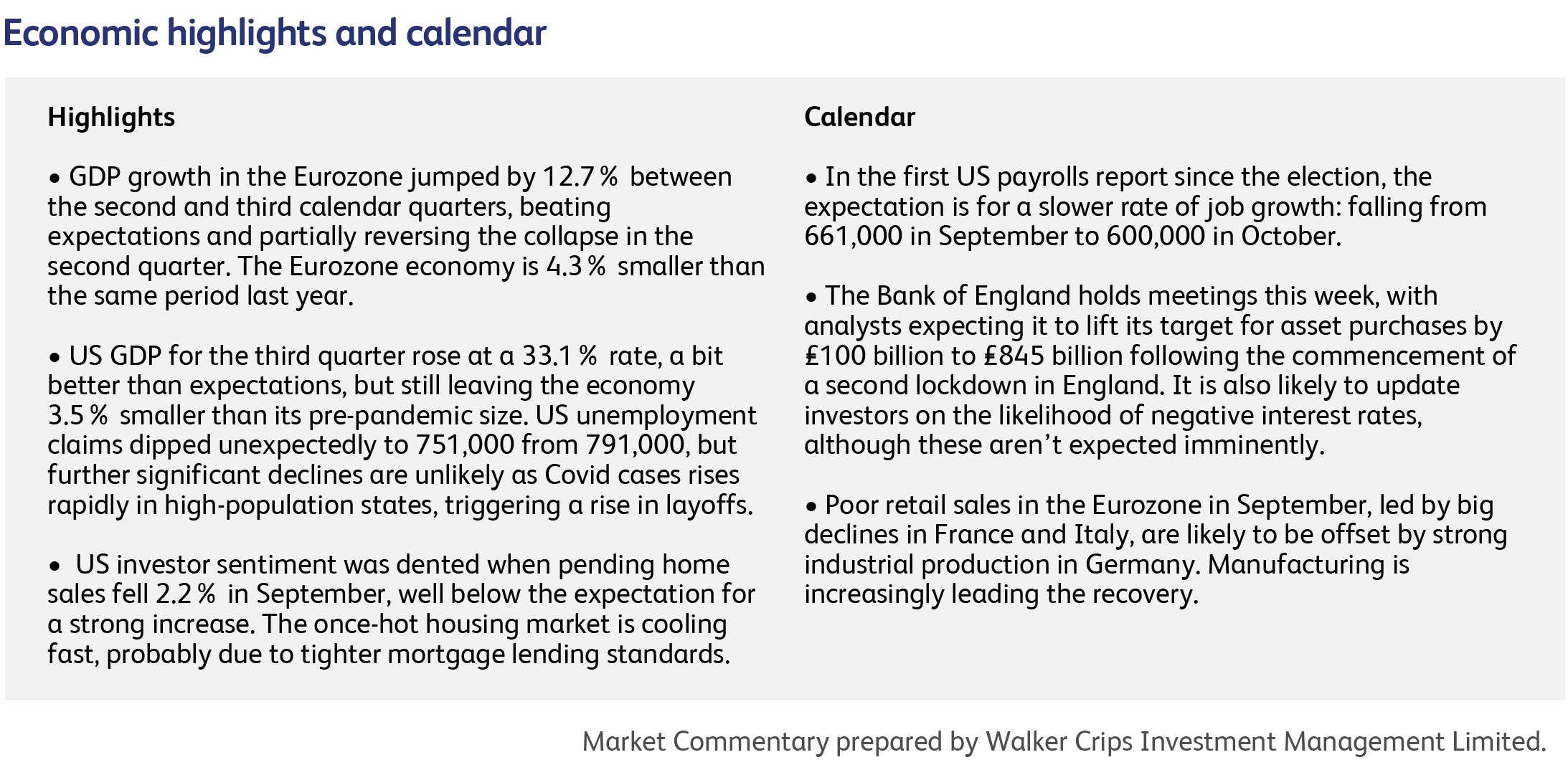

With most people and, it seems, even politicians now getting their news and views from social media, central banks play an increasingly useful role in reminding everyone of the economic reality. Last week’s meeting of the European Central Bank did not produce any immediate changes to policy, but it did reveal to investors which way the ECB’s expectations are moving. ECB president Lagarde said that the return of the virus presents a "new challenge" to the economy, adding that growth is now "losing momentum quicker than expected", and that the near-term outlook has been subject to a "clear deterioration" in the past month. The president also admitted that the forecast for fourth quarter economic growth will be revised down. A clear indication of further stimulus was transmitted by the governing council agreeing unanimously that it is "now necessary to take action" by adjusting "all" its policy tools at the next meeting in December

Individual investors in Hong Kong and Shanghai placed orders worth at least $3 trillion for shares of Jack Ma’s Ant Group, enough money to buy banking giant JPMorgan Chase ten times over. Bidding was so intense in Hong Kong that one brokerage’s platform briefly shut down after becoming overwhelmed by orders. Demand for the retail portion in Shanghai exceeded initial supply by more than 870 times.

The retail giant Walmart Inc. has ended its contract with robotics company Bossa Nova Robotics Inc. with whom it joined over the past five years in an effort to use robots in stores to keep track of its inventory. This represents a reversal on a years long push to automate and comes after finding during the coronavirus pandemic that humans can help get similar results. Covid-19 concerns have accelerated a shift to online delivery and pickup, which has led to more workers walking the aisles to collect orders, helping to collect new data on inventory problems.

Two major US mall owners CBL & Associates Properties Inc. and Pennsylvania Real Estate Investment Trust (PREIT) have filed for bankruptcy protection as steep falls in retail foot traffic continue to ravage the commercial property sector. CBL operates 107 shopping centres mainly in the Midwest and Southeast of the US, and has had more than 30 retail tenants file for bankruptcy in 2020, including J.C. Penney Co. and GNC Holdings Inc. PREIT is also facing substantial difficulties as the department chains it relies on are cutting down store counts.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.