8 December 2020

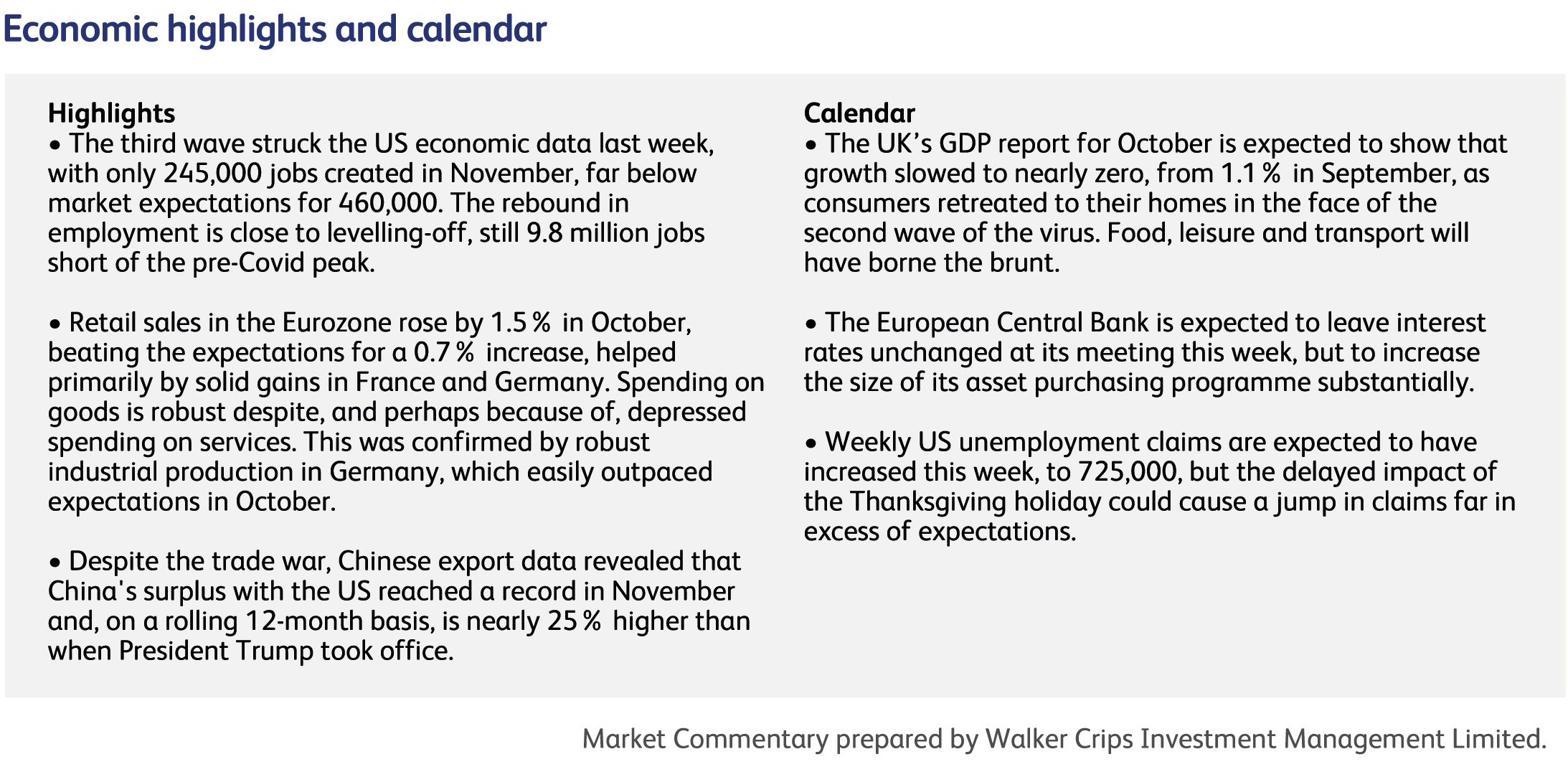

Bullish markets stared down the pandemic again last week, despite some of the worst US economic and medical data since its onset in March. US job growth slowed markedly, again, in November, reflecting the failure of politicians to agree a new stimulus package in the run-up to the election. It's likely that the jobs report for December will be far worse, and probably negative, partly for the same reason but mainly because the impact of the third wave is still gaining in severity. The seven-day average number of new US cases reached a new high over the weekend, and the trend appears to be strongly upwards (though the data has been distorted by the impact of the Thanksgiving holiday). The impact of Winter may have been underappreciated: in the UK, the end of the second lockdown did not result in a lasting downtrend in case numbers, and hospitalisations have since nudged higher. Countries that had previously appeared to have crushed the virus, such as South Korea and Japan, are experiencing resurgences. It seems almost inconceivable to say it, but hospitalisations and deaths in the same numbers as the original wave of the pandemic may still lie ahead, despite the simultaneous distribution of vaccines.

None of this seems to affect stockmarkets, which rise on the prospects for economic recovery, and also rise on the prospects for bigger stimulus to shore-up any weakness. Bond markets, which might be regarded as the more sober, elder brother of equities, have recently begun to buy into the recovery story a little, but still imply that future economic growth will be disappointingly slow. The problem for equity investors is how far to chase the rally. On one hand, some components of the bullish argument are irrefutably attractive: vaccines mean there will inevitably be an economic recovery, enforced savings will be spent, and incomes will recover as many jobs in the industries most affected by the virus return. One might add that those who are most likely to buy equities had, in any case, not been affected by the pandemic in the first place. On the other hand, it is virtually impossible to assess how much stock prices already reflect the positives.

On a number of measures, stock prices have not only priced in a return to normality but, also, an economic boom of historic proportions. To put it another way, asset prices may have become inflated far beyond the capacity of the economy, or corporate profits, to justify them. This can be seen in valuations, which now outstrip the expectations for profits in some industry sectors by historically high amounts. Moreover, those profit expectations look seriously optimistic. A canary in the coal mine may be the explosion in option trading among retail investors in the US, with a historically high proportion of their trades being on stocks rising. And the bond market is not immune: the yields available on high-quality US corporate bonds recently went lower than the expectations for inflation for the first time ever, and the yields available on the riskiest public debt markets have fallen to all-time lows, despite defaults being near the levels experienced during the Credit Crunch.

As the CEO of a Wall Street bank famously said in 2007, "As long as the music is playing, you've got to get up and dance. We're still dancing.”

Companies going public on US stock exchanges have already raised a record $156 billion this year and December promises more of the same, with private companies that sat out the market chaos early in the pandemic, and then avoided the US election, now rushing to go public. Airbnb and DoorDash are expected to be among the top five biggest Initial Public Offerings in the US in 2020, and both recently increased the price at which they will sell shares to the public. They will quickly be followed by three other multi-billion-dollar listings: Affirm Holdings, which lets online shoppers pay for purchases such as Peloton bikes in instalments, online video-game company Roblox, and ContextLogic, the parent of discount online retailer Wish.

Universal Music Publishing Group has purchased the entire songwriting catalog of iconic singer-songwriter Bob Dylan. The details of the deal weren't disclosed, but it is estimated to be worth hundreds of millions of dollars. Owning and selling the rights to music has become more lucrative in recent years, as music streaming services such as Spotify Technology SA and Apple Music, part of Apple Inc., have seen their revenues rise on the back of the increasing popularity of music streaming. Universal Music Publishing Group is part of the Universal Music Group, which is itself a subsidary of Vivendi SA and Tencent Holdings Ltd.

Uber Technologies Inc. has sold its self-driving-car unit to Aurora Innovation Inc., a software company focused on autonomous driving technology. As part of the deal Uber will make a $400 million cash investment in Aurora, giving it a roughly 26 % stake on completion of the deal. The deal comes as Uber continues to restructures its business as it aims to deliver on a promise to make the company profitable.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.