12 January 2021

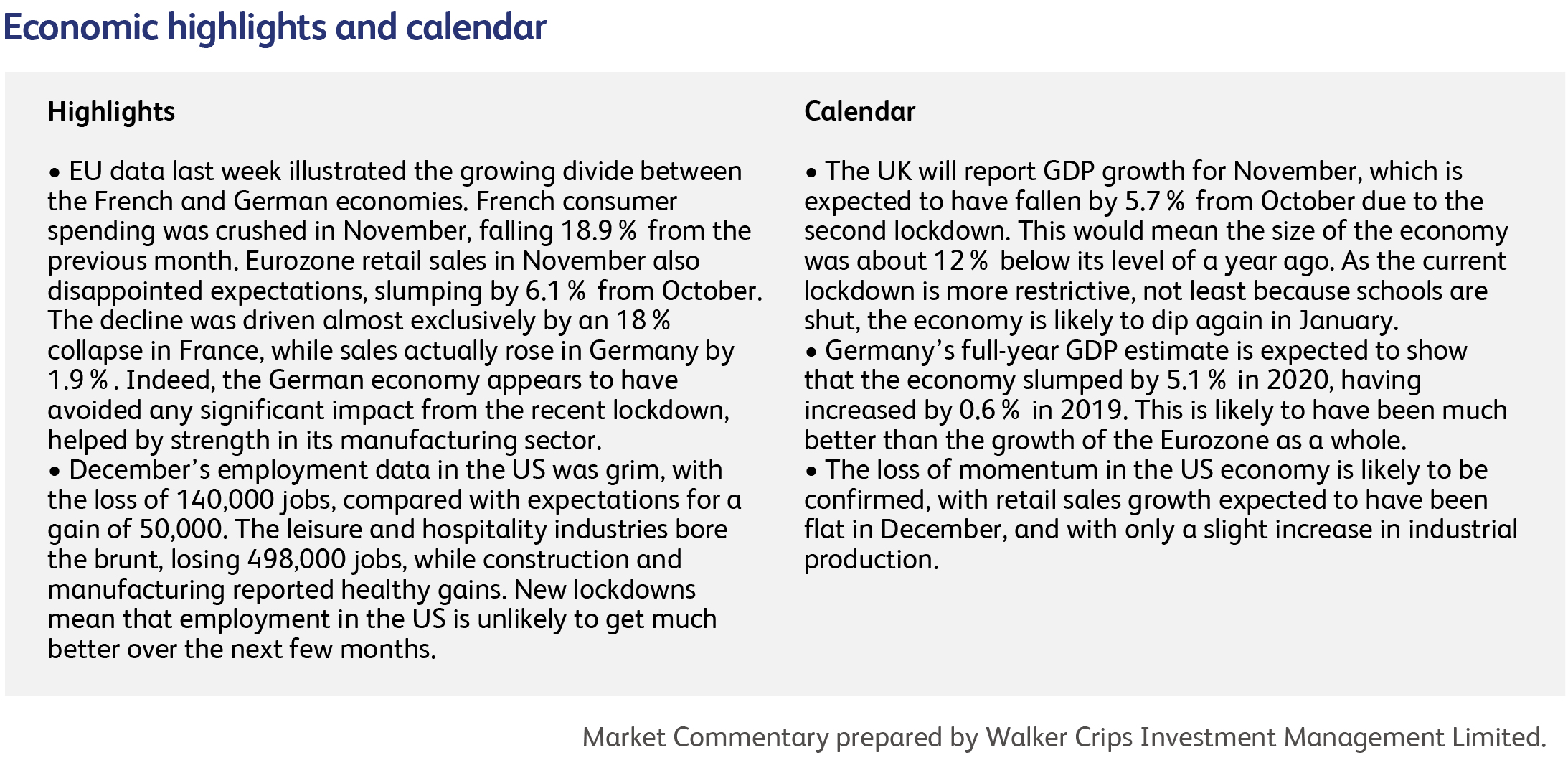

This was not your average week, of course, with a mob taking over the US government’s buildings in Washington DC, causing multiple deaths and leaving pipe-bombs behind. All of which was incited by the President, and other leading politicians, propagating false rumours of electoral fraud. In a YouGov survey afterwards, 45% of Republican voters supported the rioters’ actions. For good measure, on the same day, US Covid deaths hit a single day record and, the following day, employment data showed that the US had lost 140,000 jobs in December. None of this could dent investor enthusiasm, however, and the US stockmarket ended the week several percent higher than its starting point, at new all-time highs.

Should investors be concerned? The answer is “probably”, but such events are very hard to price into short-term valuations. Economists refer to “social capital” - an intangible but essential ingredient for economic growth. Social capital is the trust between citizens that greases the wheels of everyday commerce; it benefits consumers and economies because, if I can trust my fellow citizens to not behave like lunatics, and to adhere to the rule of law, I don’t need to spend time and money checking the provenance of their goods and services. Though long-term investors should be concerned about the disintegration of social capital in America, such intangible concepts are simply too vague to factor into their short-term thinking.

But you don’t have to be a social scientist to see that risks to the long-term growth and stability of the US economy are being overlooked. Nearly 27 million workers have been hit by the pandemic, concentrated in industries where the median worker’s age is 29 years old. Meanwhile, booming stock valuations serve to highlight the widening inequality between the very, very rich and everybody else. Will the next generation of voters be returning to the old norms, or will they be more disaffected and willing to try something even more extreme?

Can investors look to the world’s second largest economy for more stable long-term prospects? China’s brand of authoritarian capitalism has been one of the main beneficiaries of the stumbling western, democratic approach to capitalism. President Xi Jinping issued an unusually upbeat assessment about China’s future this week, saying “The world is undergoing profound changes unseen in a century, but time and the situation are in our favour”. China’s booming stockmarkets now represent about 15% of the world’s listed equity values (dwarfing third-placed Japan).

Investors in China have also had to overlook some super-sized risks, however. Trump’s US-China “Phase One” trade deal has been honoured more in the breach than the observance, and China’s trade surplus with the US is now higher than before tariffs were imposed. Trade is just one of the areas in which the US-China relationship has been spiralling downwards. Even more pertinent to investors has been the collapse in the share price of Alibaba, one of China’s biggest internet stocks, after a falling out between its founder and the government. Alibaba’s founder, meanwhile, has mysteriously disappeared…

Is Twitter going mainstream? Last week the website permanently disabled President Trump’s account for inciting violence, as well as about 70,000 other accounts spreading “QAnon” conspiracy theories. If nothing else, Twitter’s action concedes the argument that it is partly responsible for the spread of political mayhem.

In the wake of last week's riot at the Capitol an increasing number of big businesses are deciding to review or suspend their political campaign donations. Over the weekend JPMorgan Chase Inc. and Citigroup Inc. said they were halting their Political Action Committees (PAC) donations. They were followed on Monday by AT&T Inc., ConocoPhillips, Dow Inc., Facebook Inc. and United Parcel Service Inc. in announcing they are halting or reviewing political campaign donations. Others, including Amazon.com Inc., Comcast Corp. and General Electric Co., have pledged to stop donations to the Republican lawmakers who objected to President-elect Joe Biden's victory in the Electoral College.

American pharmaceutical company Eli Lilly and Company (Eli Lilly) announced on Monday that an experimental Alzheimer's drug, Donanemab, has helped patients suffering with mild Alzheimer's. The findings of Eli Lilly's small Phase 2 trial showed the drug slowed the decline in memory and ability to perform activities of daily living by 32% after 18 months compared to those who got a placebo. While the number of subjects in the study was relatively small, if the findings continue to hold up to scrutiny it suggests researchers have found a drug that can slow Alzheimer's.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.