2 February 2021

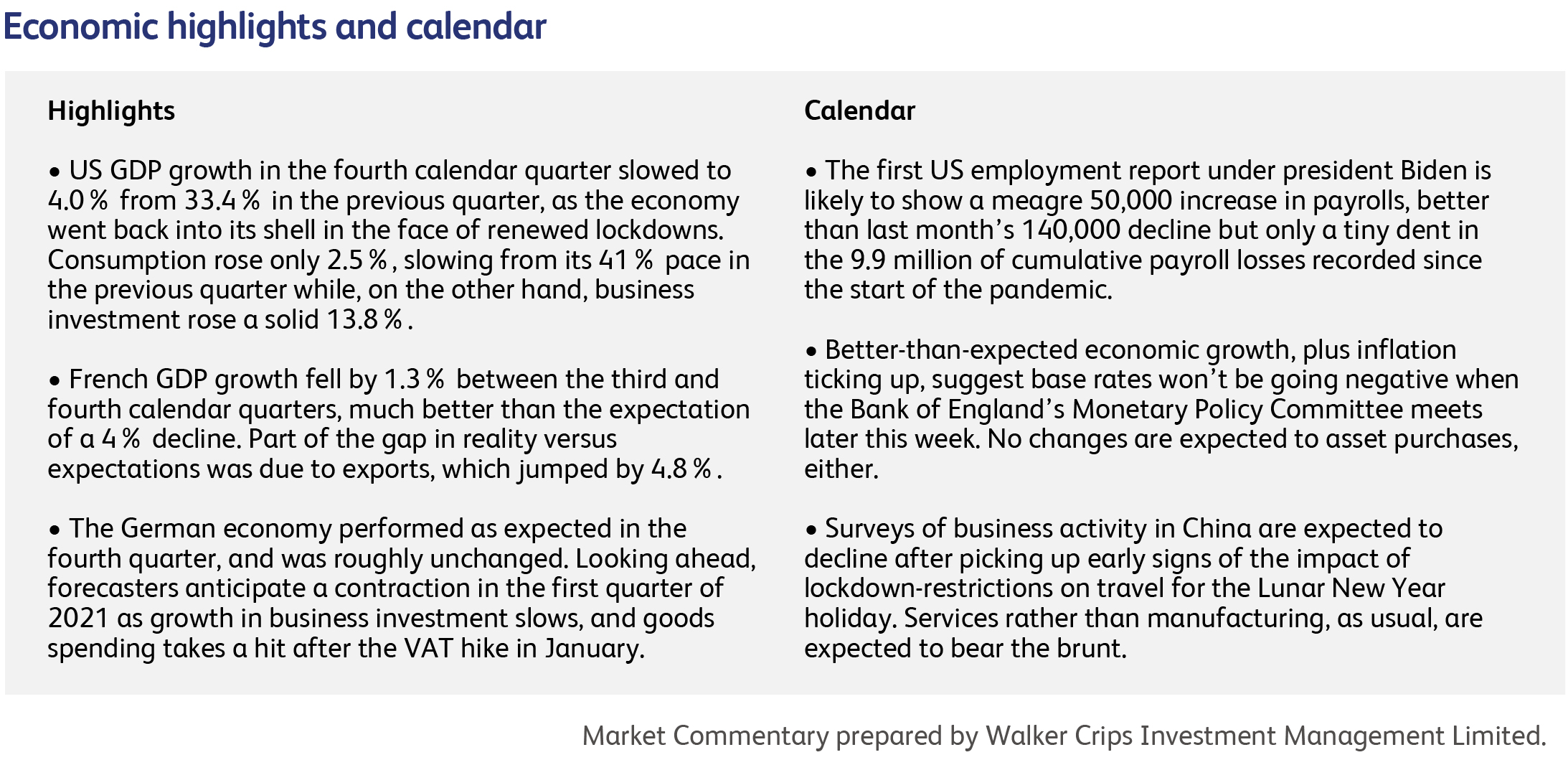

Stockmarkets turned sour last week for the first time since the vaccine announcements in early November sparked a stupendous, 15-20% rally across most stock indices. While a setback of some kind was long overdue, it did not help that the world’s three largest central banks refused to come riding to the rescue. First up was the People’s Bank of China (PBoC), which had already disappointed investors the previous week by unexpectedly pulling money out of the economy, inviting short-term interest rates to tick higher. That action was interpreted as an attempt to deter the speculative fervour which, in China, has led to abnormally high levels of borrowing short-term to buy equities. Last week, the PBoC put an exclamation mark on that message, draining substantially more money and warning of asset bubbles. When the authorities speak in China, people take notice: short-term lending rates spiked higher.

Next up was the European Central Bank (ECB), which tempered its enthusiasm for asset purchases despite acknowledging the sustained drag on the economy from lingering virus restrictions. The exact message was only very marginally less supportive, saying in effect that the central bank might not have to use all of the asset purchase programme’s remaining EUR1 trillion. But what was remarkable was that the ECB would risk any change in tone, however mild, given the fact that investors are currently paying to lend money to Greece and the other less credit-worthy governments in the EU.

Finally, the US Federal Reserve (Fed) met for the first time since the election, uninhibited for a change by the threat of abusive tweets from ex-President Trump. Like the ECB, the Fed acknowledged the recent softening in economic growth, and especially the weakness in employment, noting bluntly that “The pace of the recovery in economic activity and employment has moderated in recent months, with weakness concentrated in the sectors most adversely affected by the pandemic”. And, like the ECB, the Fed did nothing about it. Whether that’s because policymakers are nervous about the impact of further easing on the bond market or the dollar, or simply because they think the slowdown will end as the economy starts to reopen, or both, is not clear. Either way, the bar for the Fed to increase the pace of asset purchases appears to be higher.

The news, meanwhile, was largely occupied with “David versus Goliath” stories in which gangs of day-traders bullied, and profited from, the distress of naïve hedge funds. There were loud complaints when the rules and regulations, which were put there to protect the naïve little guy from the likes of bullying hedge funds, got in the way. Bizarrely, that speculation was immune to the attack of nerves and continued while the broader markets sold off. It even metastasised, spreading from small company stocks to the global market for silver, which hit an eight year high as a result of another frenzy of coordinated buying. Such anecdotes confirm the extraordinarily frothy degree of speculation in US stocks, which may deter some investors faced with the serious business of growing a pension-pot over the long-term.

It's been a wild ride recently for the stocks targeted by retail investors on Reddit's WallStreetBets. The favorite, GameStop Corp. (GME), was $76.79 at the close of business last Monday, and reached a high of $483 and finished yesterday at $225 - representing a 193% increase. The story has been widely reported in the press, so I won't repeat too much of it here, other than to say it seems to have morphed into a moral crusade against Wall Street.

Another company at the center of the WallStreetBets vs Wall Street storm is Robinhood Markets, Inc. the brokerage company with its easy-to-use app. Robinhood courted controversy when they restricted buying in more than a dozen stocks (including GameStop) and related options last Thursday. The move angered many Robinhood customers, a popular broker for retail investors on WallStreetBets, who saw it as Wall Street closing ranks. Robinhood has since explained the restrictions by saying the clearinghouse that processes and settles its trades asked for more collateral to cover potential losses on the transactions. By restricting trades in the shares that were experiencing wild prices swings they were able to lower the amount of collateral they needed to post. Robinhood has subsequently raised $3.4 billion from shareholders since last Thursday, which should give them a cushion to cover a surge in collateral requirements and allow them to remove many of the trading restrictions.

In other news, the Ford Motor Company announced on Monday that it has entered into a six-year agreement with Alphabet Inc.'s Google to use its Android operating system to power its vehicle display screens on all Ford models outside of China, starting in 2023. Ford also plans to involve Google's cloud services to help develop in-car features and manage the massive quantity of data streaming from its vehicles.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.