2 March 2021

The squall in stockmarkets last week, with the FTSE index suffering its worst day in the last six months, was a consequence of the thunderstorm in bond markets. Government bond markets all over the world sold off, led by rapidly falling prices of US government bonds - one of the financial world’s most important benchmarks. Government bonds are not only considered to be among the world’s safest assets, but have also become symbols of how central banks’ vast bond-buying programmes have been able to maintain calm in capital markets. By buying bonds and suppressing interest rates over the last decade, central banks have stabilised markets and economies, but only by reducing the returns available on the safest asset classes and forcing investors to seek returns in ever-increasingly risky assets.

The problem is that risky assets are, still, risky. Their prices wobble from time to time and, faced with a potential failure of such dearly-bought confidence, central banks have doubled down on their strategy – buying more bonds to stabilise markets, reducing further the returns available in safer assets and pushing investors even more towards riskier ones. The pandemic, of course, exacerbated these trends, forcing the central banks into “shock and awe” tactics; bond-buying programmes so immensely huge, and stretching so far into the future that they can overwhelm any opposition.

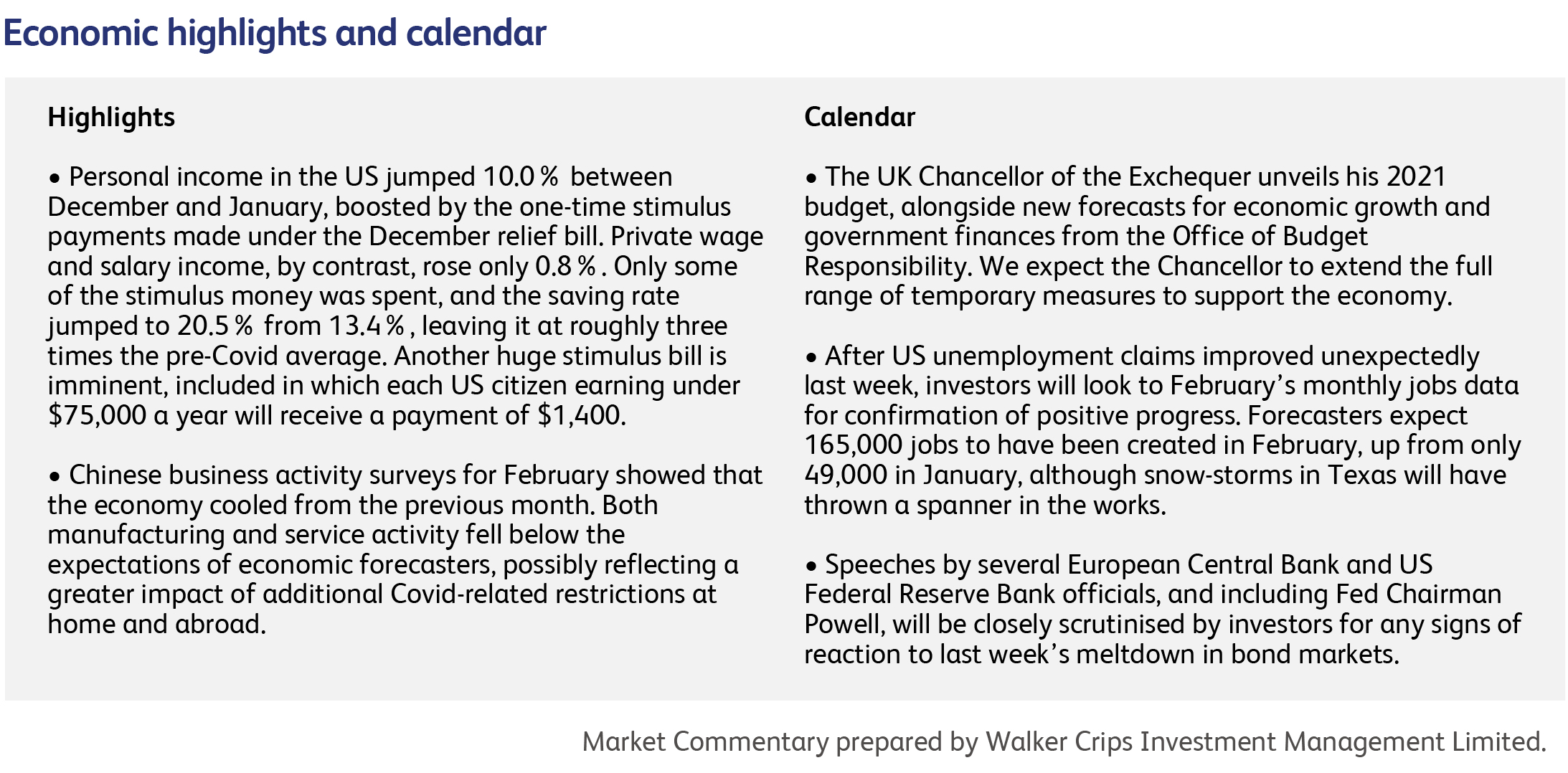

In addition, pandemic-related government stimulus programmes have been very effective at supporting consumer incomes. Indeed, some governments (especially in the US) have flooded consumers with money. As the pandemic thins out, much of that money, accumulated by consumers who literally could not find ways to spend it, plus another $1.9 trillion of US stimulus still to come, is about to hit the global economy.

The consequences of such a robust response to the pandemic will include inflation, and inflation is bad for bonds. In fact, inflation is the one factor that, more than any other, threatens the ability of central banks to keep all the balls up in the air at the same time. Worryingly, key gauges of inflation have already begun to rise, even as lockdowns persist. Commodity prices have been rocketing, driven in part by China’s resource-heavy stimulus. Plus, there are pandemic-related shortages of other manufacturing inputs, including labour, all of which is contributing to factory-gate inflation readings that have not been seen since the Credit Crunch. A rebound in energy usage and prices also has to be factored in. Add the unknown impact of inflation in the services sector as economies reopen, and most economies are going to experience a doubling or tripling of current rates of inflation as the year goes on. In a speech last week, the Bank of England’s Chief Economist described “central bank complacency allowing the inflationary big cat out of the bag” as a bigger threat than prematurely tightening interest rates.

The good news is that any pick-up in inflation will occur from very low recent levels (1% or less in the major economies), and few professional economic forecasters think that these higher rates of inflation will be sustained. But will investors and central bankers be able to hold their nerve in the face of inflation readings of two, three or even four percent? Last week it seems, some investors decided they didn’t want to wait around to find out.

Zoom Video Communications, the lockdown-favourite for video calls in the corporate world, announced results for the last three months that comfortably beat expectations. The company reported 467,100 companies with more than 10 employees using the service, a jump of about 8% from the previous quarter. Management projects revenue growth will fall to 43% per annum this year, from a growth rate of over 300% in the last fiscal year. Zoom shares have risen almost fivefold over the last year.

The Swedish car company Volvo Cars has announced it is only going to sell electric vehicles by 2030. Carmakers are increasingly feeling the pressure from governments and consumers around the world to move to producing electric cars as part of climate change agenda. The company said that by 2030 it will phase out all car models with internal combustion engines, including hybrids.

Renishaw Plc, the British engineering company, has put itself up for sale after the founders and two largest shareholders Sir David McMurtry and John Deer announced that they would sell their combined 53% holding in the company. They started the business, which makes precision measurement and health equipment, in 1973 and are now in their 80s.

Over the weekend the US Food and Drug Administration (FDA) granted emergency use authorisation (EUA) for Johnson & Johnson's Janssen COVID-19 vaccine. The EUA clears the way for immediate distribution and vaccination of the Janssen vaccine to US individuals 18 and older, and is the third vaccine to be approved under an EUA, with the Pfizer/BioNTech and Moderna vaccines being the others.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.