9 March 2021

It has taken only a few weeks for inflation to have established itself as the biggest bugbear for capital markets. A sustained, significant rise in inflation would strike at the heart of several trends that have propelled asset prices over the last two decades: persistently low inflation has given central banks the leeway to maintain ultra-low interest rates and quantitative easing, enabling governments to use debt to finance spending, companies to accumulate debt to buy back their own shares, and consumers to borrow to buy houses, cars and other goods. All these things helped economies to eke out some growth. Low interest rates and quantitative easing have also fed into asset prices: most notably housing and government bonds, but with positive knock-on effects for equities. In other words, a lot of dominoes have been lined up.

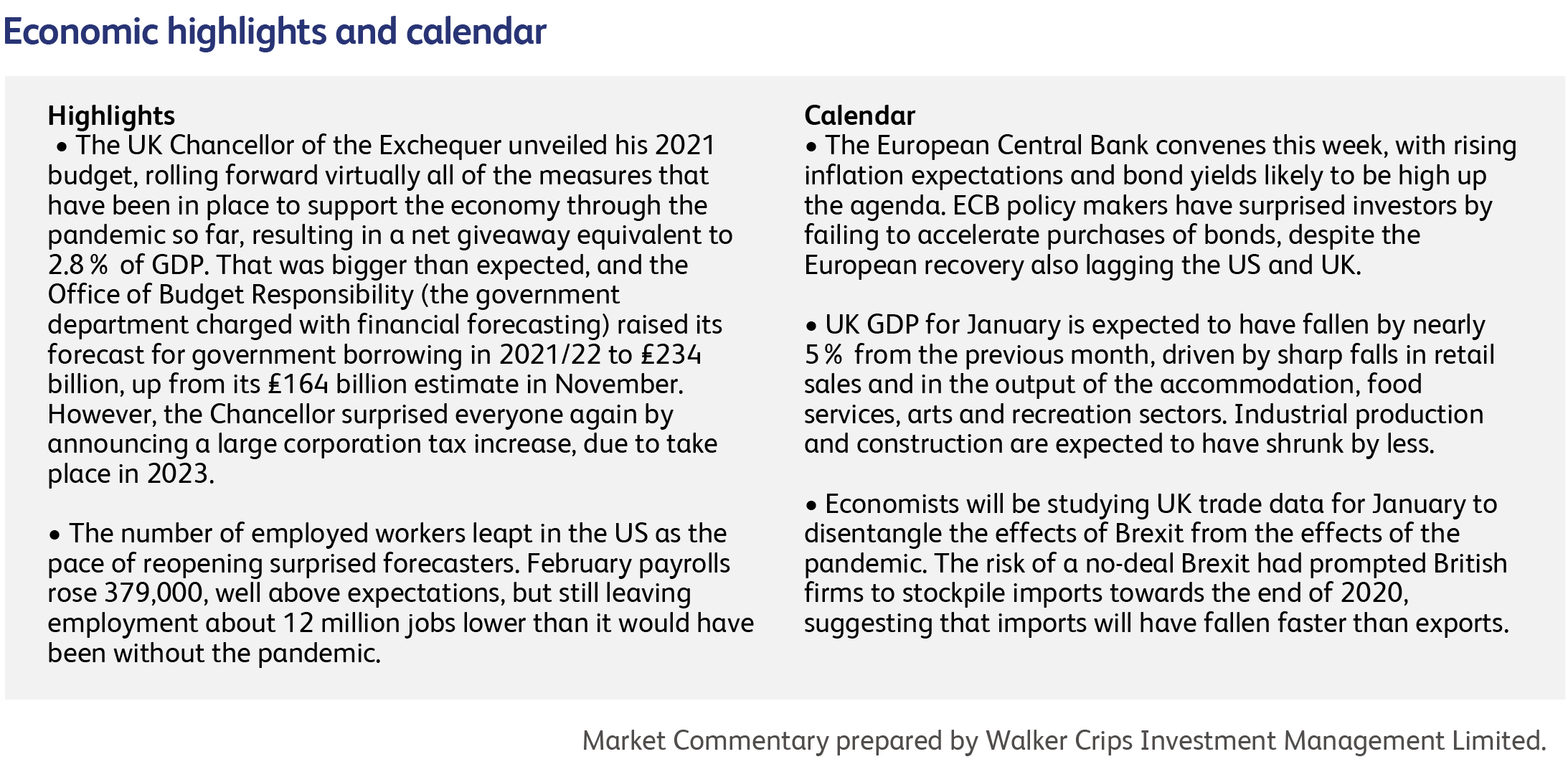

In the short-term term, no-one doubts the arrival of inflation. Rapid economic normalisation, pent-up demand, a huge accumulation of savings and ongoing fiscal stimulus will see to that. Among the more shocking forecasts, for example, Eurozone inflation is expected to leap from less than 1% to over 4% in the next couple of months. The impact of oil prices alone is a significant contributor, having doubled over the last 12 months.

Longer-term, there are also reasons to think that inflation might have some staying power. The huge increase in government and corporate debt caused by the pandemic will make any rise in interest rates very painful indeed. The more interest that governments pay on their debt, the less they are able to spend on services, welfare, infrastructure and so on. Unlike the Credit Crunch, moreover, when central banks offered governments the chance to spend and governments chose austerity, this time they are working closely together. Central banks will, therefore, be under a great deal of political pressure to keep rates low and allow inflation to build. Having supported capital markets - especially government bond markets - for so long, central banks may also fear the fallout that could occur if they were to actively combat inflation by shrinking the supply of money.

Another long-term inflationary trend is the reversal of globalisation. Over the last three decades, the rise of China as a low-cost manufacturing hub contributed to global deflation in the prices of goods and products. This was important because, as a result, higher inflation in the service sector was offset by deflation in the prices of manufactured goods, and overall inflation in the developed world stayed low. Globalisation’s impact is set to fade, partly because China’s workforce is no longer expanding or getting cheaper, and partly because governments themselves appear to have turned against the benefits of offshoring. This latter trend was most evident in the Trump administration’s tariffs, and in the recent geopolitical “cold war” that has developed between several countries and China. In the US in particular, China-bashing is politically popular across the political spectrum and President Biden is not reversing Trump’s anti-China policies. A feature of the changing politics on both sides of the Atlantic of the past several years has been the desire to restore domestic manufacturing jobs, and to level up areas that have been damaged by the effect of globalisation. These policies come at a cost to consumers.

Unlike most central banks, the Bank of Japan’s quantitative easing policy extends to purchasing Japanese shares. Such has been the bank’s appetite for equities that it has become country's largest holder of domestic stocks, and has been accused by critics of having pushed up prices in the Japanese stockmarket. That distortion extended to the bank’s own shares last week (the Bank of Japan is one of a few central banks in the world whose shares can be purchased on the stockmarket), which rose as much as 75%. Unfortunately for buyers, the shares carry no rights to dividends and the Bank of Japan’s mandate does not extend to making a profit.

Greensill Capital, the specialist financial services company founded by Lex Greensill, filed for insolvency protection yesterday after regulators took over its banking unit, and Credit Suisse Group AG froze investment funds linked to Greensill. These events were triggered after they lost coverage from credit insurers that provided default protection on their clients. Greensill focused on supply chain finance and would sell the loans to companies such as Credit Suisse and GAM Holdings AG, who would put them into money market funds, and sell to investors. SoftBank Group Corp.'s Vision Fund was an investor in the company, and the collapse is a blow to the Japanese investor.

The French luxury footwear brand Christian Louboutin is selling a 24% stake to an investment firm controlled by the Agnelli family, in a deal that values the company at €2.3 billion. Exor NV, controlled by the Agnelli family, will pay €541 million for the stake and comes as part of their push into the luxury goods market. Designer Christian Louboutin founded the brand, known for its red soled high-price stilettos, in Paris in 1991 with a small salon and now has 150 boutiques around the world.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.