23 March 2021

It’s doubtful that the experience of recent economic cycles has much to tell us about the one about to begin. Part of the problem derives from the unique rapidity and size of the economic dislocations, as well as the huge size of the economic support programmes, prompted by the lockdowns. Further uncertainty is caused by the extreme measures taken by central banks with respect to interest rates and asset purchase programmes. Together, these factors ensure that the paths to be taken by economies, and capital markets, over the next 12 months are effectively unknowable.

Capital markets have proved their resilience to the economic ups and downs of the past year, having progressed upwards relatively smoothly, despite the enormous economic setbacks caused by the second and third waves of the virus. However, the fear is that their upward momentum is more a function of cheap debt and easy monetary policies than any fundamental economic considerations. If correct, capital markets are more likely to be exposed to changes in monetary policy than any other factors. One can only imagine the trepidation with which central bankers approach changes to policies, but that is exactly what would have traditionally been required of them once economic normality returns.

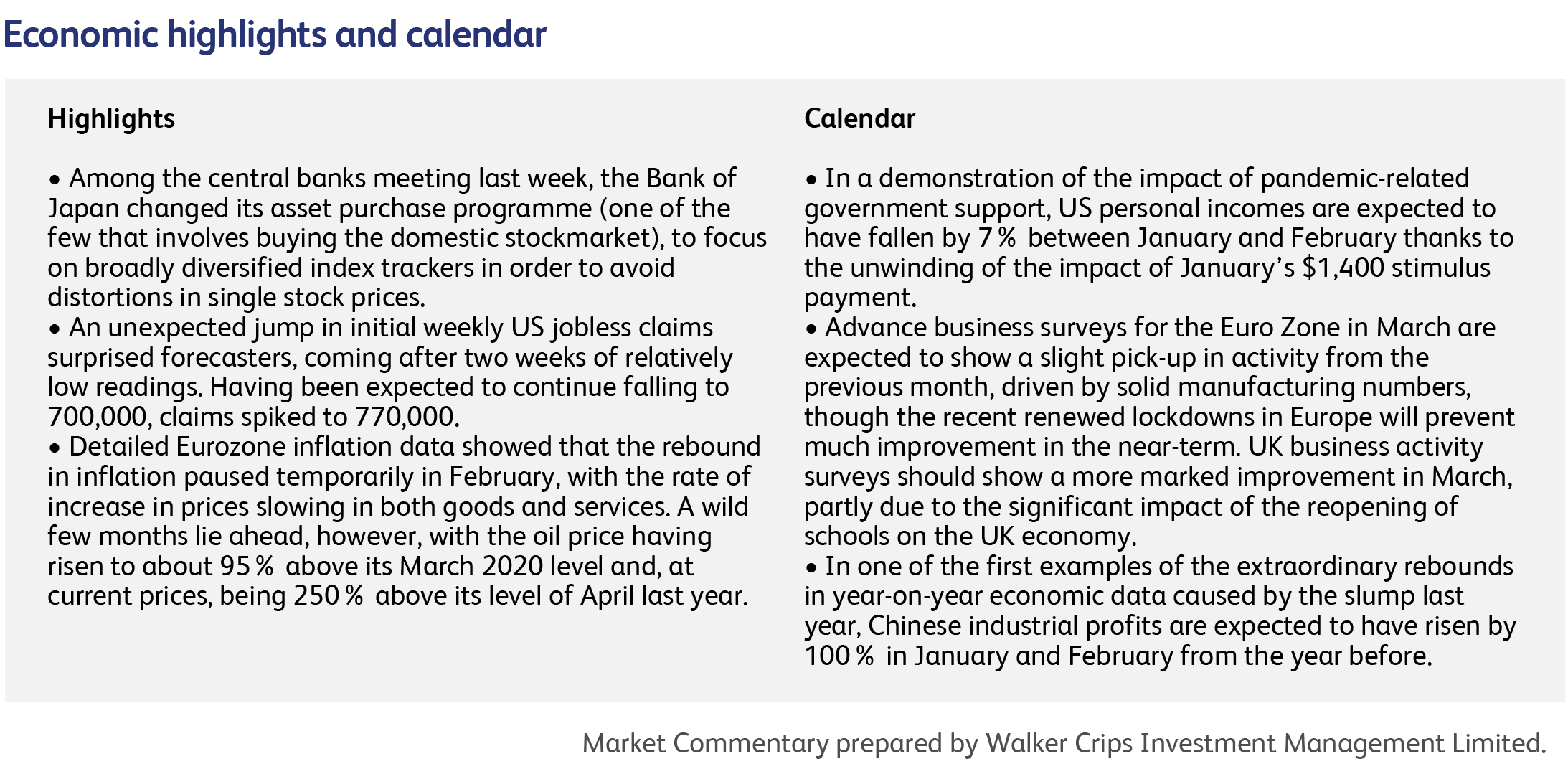

Central bankers are going to have to master the art of constructive ambiguity: acknowledging the strength of the economic recovery but dismissing it at the same time as being fraught with downside risk. Only then can they justify the continuance of the asset purchase programmes that maintain market stability. This balancing act will become more difficult as the year-on-year comparisons of economic data become stratospherically positive in the second calendar quarter, driven by the uniquely low levels of activity in the base period used for comparison.

Some of this ambiguity was on show last week, with the Bank of England’s more upbeat assessment of the UK economy. The Monetary Policy Committee noted that the pace of reopening was swifter than it had anticipated last month, and that fiscal support on the UK (and the US, it noted) had exceeded its expectations. The Governor even blurted out on a radio show that he now expects GDP to recover to its pre-Covid peak in the fourth calendar quarter of the year, one quarter earlier than predicted a month ago. But none of this caused the bank to revise its economic forecasts! Moreover, any judgements regarding the economic outlook, its asset purchases and its policy guidance were deferred to its next meeting in May.

In the US, Federal Reserve Chairman Powell has described the Fed’s job as being to provide support until the recovery is complete, a big departure from the traditionally forward-looking approach of monetary policy. The Biden administration, meanwhile, is considering as much as $3 trillion worth of spending in a new stimulus programme that will follow the recent $1.9 trillion pandemic-relief bill (equivalent to 8.8% of GDP). Central bankers risk their credibility if they try to keep too many balls in the air at the same time. Already in the US, investors are expecting the central bank to increase rates several times by the end of 2023 despite the policymakers at the FederalReserve promising no such thing.

Volkswagen’s share price surged last week on hopes that it can replace Tesla as the global leader in electric vehicle manufacture, pushing the shares close to all-time highs and ensuring that Volkswagen became Germany’s most valuable public company. The share price later dropped back but is still up over 50% for the year to date. At about $150 billion, Volkswagen’s’ market value is dwarfed by Tesla, at $600 billion.

Microsoft Corporation’s share price has risen parabolically during the pandemic and sits near an all-time high, despite a cyberattack on Microsoft Exchange servers that could be used by hackers to initiate “ransomware” attacks on computer networks - where files are encrypted and held ransom in exchange for a payment. A patch issued by Microsoft three weeks ago failed to remove the threat. Microsoft has accused Chinese state-sponsored hackers of being responsible.

One of the world's leading auto chip makers, Renesas Electronics Corp., has had its production capabilities compromised after a fire at a factory owned by a subsidiary in Japan damaged large swathes of equipment. Renesas said heat from an electrical problem inside a single piece of equipment caused the fire, and contaminated clean rooms needed to make semiconductors. Mr Shibata, Renesas's chief executive, said on Sunday the impact on global chip supplies would be significant, and the company estimates revenue losses will be approximately $160 million a month. It comes at a time when car makers have already been struggling with a shortage of semiconductors, caused in part from a surprisingly strong bounce back after the coronavirus pandemic his last year.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.