1 June 2021

What will the "return-to-normal" look like, and will it even look normal? Not all the economic data recently has conformed to the expectation of a booming, once-in-a-century rebound unleashed by government spending, accumulated savings and the pent-up desire to consume. Instead, it’s been more a case of “two steps forward, one step back”.

China’s economy was the first to lose some momentum, as the central bank acted early to tighten interest rates and the cost of financing. The Chinese government, meanwhile, reined in borrowing by heavily-indebted local authorities to fund infrastructure projects. This fizzling is partly explained by the smaller amount of stimulus required in China – the spending was never as spectacular as in the western world, and the accumulated savings in China are estimated to be a mere fraction of those available to consumers in the West.

The US has been a bigger surprise, with several hiccups in the recent economic data despite March’s awe inspiring stimulus programme. Both manufacturing activity and demand for manufactured goods in the US have disappointed over the last couple of months, though it is difficult to disentangle the underlying trend from the February snow-storms, the ebb and flow of stimulus spending and the impact of the current shortage of semiconductors. The housing boom in the US, which had reached pre-Credit Crunch levels of frenzy, is grinding to a halt. Home-buying intentions have plummeted, possibly because the fading of the pandemic means that fewer people now want to trade cities for suburbs, while mortgage rates have risen and lending standards have tightened. Most shocking of all the recent data, though, was the announcement that the US economy had created only 266,000 jobs in April, compared with the 1 million that had been expected. It was the largest shortfall between expectation and reality that this data series had ever produced. A lot, therefore, hinges on the employment data for May, which is due to be announced on Friday.

Fears are also now arising that the UK economy is losing momentum. The easing of the lockdown in the service sector on May 17th has not yet triggered the expected rush of activity, with retailers disappointed by the lack of in store traffic, and consumer spending (according to the Bank of England) falling back below its pre-pandemic level. So far, economically, the reopening has turned out to be a tad disappointing.

What is to blame? It seems that the most likely culprit is – still – the virus. Recent surveys in the UK suggest that many people are not yet comfortable visiting shops and enjoying indoor services. According to YouGov's periodic Covid-19 survey, the proportion of people saying that they are "very" or "somewhat" scared that they will contract Covid-19 increased to 35% on May 19th, up from 33% on May 6th. More importantly for the economy, a hefty 56% of people said that they are avoiding crowded public places, not much lower than during the last six months. Households likely will remain anxious, given the rise of the Indian variant and the fact that cases are starting to rise again. The vaccines might provide a decent level of protection against the new variant, but “decent” is still not a risk that everyone wants to run.

The US enterprise data cloud company Cloudera Inc. is the subject of a takeover deal by private-equity firms KKR & Co. and Clayton Dubilier & Rice LLC. While the exact terms of the deal to take the company private aren't known, it does currently have a market capitalisation of nearly $4 billion. Cloudera was founded in 2008 by a group of engineers from Oracle Corp., Yahoo Inc., Facebook and Google. It was an early participant in the open-source software framework Hadoop, but has struggled to shift to the now-dominant public cloud where it faces fierce competition.

US food-service equipment maker Welbilt Inc. has received an all-cash $3.3 billion topping bid from Italy's Ali Group. Privately held Ali Group was founded in 1963 and also makes food-service equipment, operating globally. Ali Group said on Friday it made the offer to buy the company for $23 a share, and comes as Welbilt had already agreed to sell itself to Middleby in April in an all-stock deal worth $2.9 billion.

UK investment crowdfunding platform Crowdcube is set to launch a platform for retail investors to participate in initial public offerings and comes as government ministers review plans to reduce the institutional dominance of London listings. From this summer the Group will offer a service for public as well as private share sales. Founded by Darren Westlake and Luke Lang, Crowdcube helps to channel retail investment into early-stage companies, and has previously helped to raise money for businesses such as Monzo and Revolut.

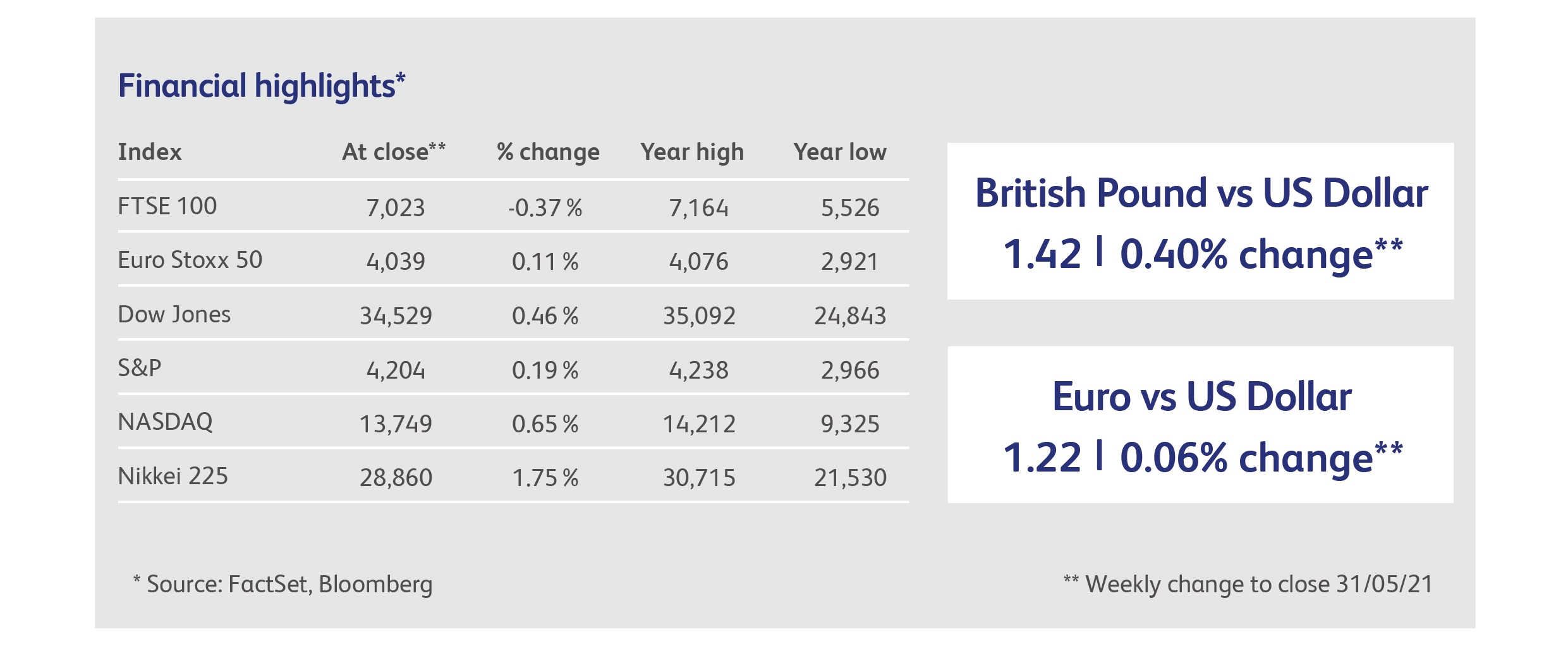

Highlights

Calendar

By far the most important data-point in an otherwise quiet week will be the US “non-farm payrolls” announced on Friday. This figure will reflect the number of jobs created, in May, in the US (outside the farm sector) and is a widely-watched gauge of the health of the US economy. Last month, the number was a catastrophic disappointment (the biggest miss versus expectations on record, with only 266,000 jobs created in the month of April versus the 1 million that had been expected), so markets will be relieved to see a strong rebound. Expectations have been reined in, however, as forecasters try to avoid another embarrassment: the average expectation is for only 650,000 new jobs to have been created.

An advance reading for inflation in the Eurozone, due today, is expected to show a rise to 1.9% in May, up from 1.6% in April

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.