21 September 2021

Markets wobbled again as the pain threshold for bad news was crossed for the second week in a row. Ugly risks in China continued to accumulate, with another government crackdown on the private sector, this time aimed at Casino operators in Macau. In addition, the impending bankruptcy of the giant, debt-laden Chinese property company Evergrande has been dominating the financial news (see Stock focus below). Some estimates put Evergrande’s debt at equivalent to 2-3% of Chinese GDP. In Europe, the inflation debate took a more hawkish turn as an unexpected rise in UK inflation to 3.2% in August, versus expectations for 2.9%, equalled the largest monthly jump in inflation since records began in 1997. On the European mainland, meanwhile, having already won a commitment to wind down the European Central Bank’s asset purchase programme last week, the ECB’s inflation hawks were emboldened to speak out again, this time criticising the bank’s own inflation forecasts for being too low.

More revelations of US Federal Reserve governors’ trading activities threatened to sour investors’ confidence in central banks at a time when the credibility of central bankers is critical to investor sentiment. In the previous week, the media had focused on the trading activities of two Fed governors, who subsequently promised to liquidate all their personal assets. Last week, further Fed officials were implicated, including Fed Chairman Jerome Powell. The financial news service CNBC claimed that, among the Fed’s $5 billion in municipal bond purchases last year, were bonds owned by Powell. Powell has ordered a review of the Fed’s internal rules around investments by governors and the political pressure is on for a zero-tolerance, everything-must-be-sold approach. It would be uncomfortable if, while trying to wind down their asset purchases without pulling the rug out from under the markets, central bankers were simultaneously selling out.

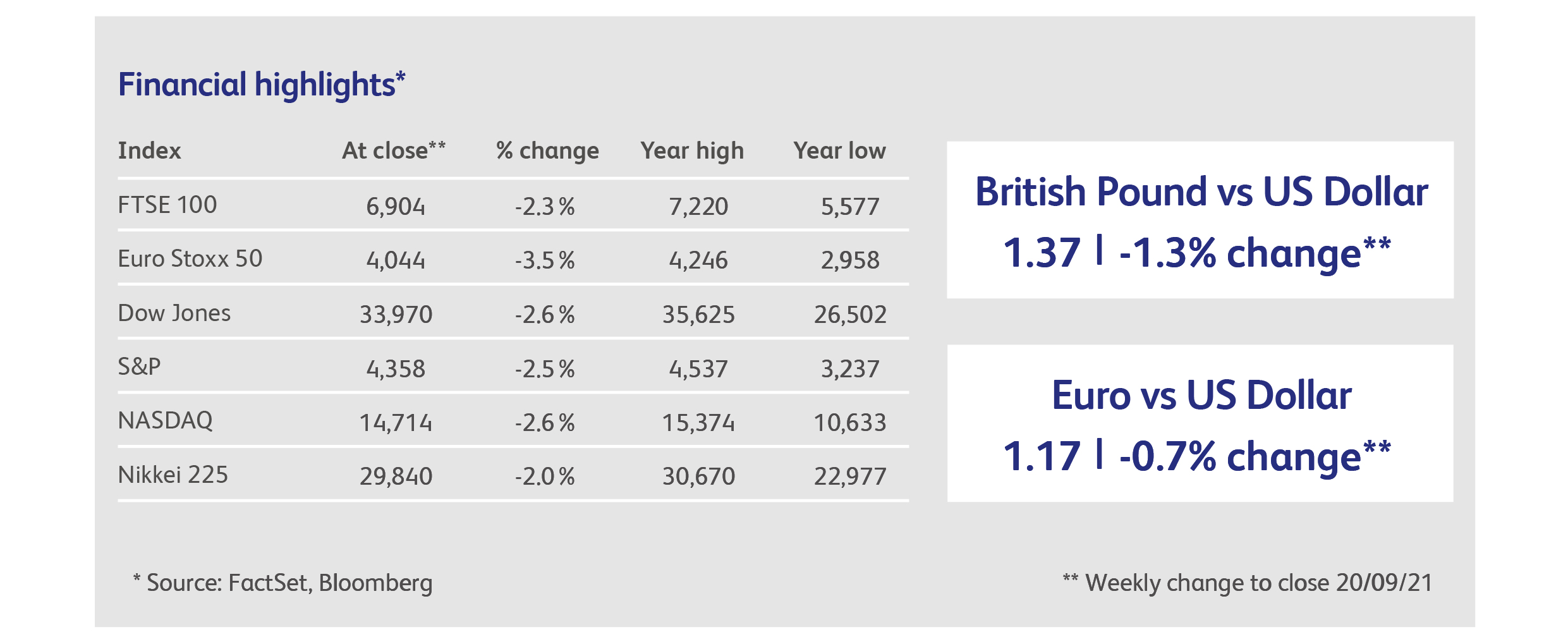

There were few hiding places for investors: equity indices were off by 2-3% across the board, falling to levels not seen since April or May. This occurred despite near-record inflows into stock markets: according to Bank of America, investors poured $46 billion, the most since March, into US equity funds. Despite their supposed safe-haven status, government bonds and gold sold off for most of the week. The US dollar helped offset some of the pain, rising about 1% on a trade-weighted basis, and by 1.5% against sterling.

Optimists point to a mountain of savings on the sidelines as potential support for markets, but this depends on investors wanting to buy assets at ever-higher prices. Isn’t that what investors are supposed to not do? Throwing money at assets might make the price go higher, but it does not change the value. Value depends on the long-run prospects for economic growth and company profits and, crucially, on whether future cash flows to investors will be enough to pay their bills. For current market levels to be justified, economies must break out of their post-Credit Crunch economic stagnation. That’s a lot to ask, given that indebtedness and demographics are still a huge drag. In addition, there are now the policy risks that accompany populist government. These are epitomised by trade tariffs, trade barriers and the trade war against China, a strategy conceived by President Trump but which President Biden has perpetuated. And that brings us back, full circle, to ugly risks in China…

Chinese debt markets are at risk of a tsunami, as the giant property developer Evergrande nears default on its $300 billion of outstanding debt. Shares of other real estate firms have plunged, while the yield on an index of dollar-denominated junk bonds has climbed to about 14%, the highest in nearly a decade. The moment of truth will arrive on Thursday, when a payment of $83 million is due on a five-year US dollar bond.

Quite a few remote shorelines will be impacted by the Evergrande tsunami. UK-based fund management house Ashmore Group, which specialises in emerging market debt, is reckoned to be holding $400 million of Evergrande debt. Ashmore shares are down 9% over the last month. Other significant exposures (through their fund management divisions) include BlackRock, UBS Group and HSBC Holdings.

China remains at the epicentre of global risk, with another authoritarian crackdown, this time targeting casino operators in Macau. The pain was not confined to Chinese companies this time, with the share prices of US casino operators Wynn Resorts and Las Vegas Sands Corp also tumbling. These companies generate about half their revenue from Macau, which is the world’s largest gambling hub. The UK investment trust, Macau Property Opportunities Fund, lost 14% of its value during the week.

Apple’s party has been gate-crashed by another tech company, Slack Technologies. Since Apple began using the internal message board service for employees in 2019, Slack has become a key mechanism for Apple employees from different divisions, who had historically been kept apart, to communicate with each other. The result has been a barrage of abuse, as employees criticise the company’s hiring choices, political stances, remote-working arrangements, equal pay, plus a host of personal grudges.

Highlights

Calendar

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.