12 October 2021

It was a dismal week for forecasts of economic growth as investors grappled with the new reality that, just as governments are reducing Covid-related support for households, their purchasing power is also being squeezed by the surge in inflation. There is a hint of stagflation in the air, and it doesn’t help that the post-lockdown rebound in consumer spending had already failed to meet expectations.

The US economy lost more of its lustre when the widely-watched monthly employment data showed that a mere 194,000 jobs had been created in September, far below expectations for 500,000. Investors had been hoping for a better result, partly because the last several months’ jobs data had also underwhelmed expectations, and partly because the end of Covid-related enhanced unemployment benefits were expected to send unemployed workers rushing back to the workforce. It seems certain that the delta variant is still constraining employment, as the Covid-sensitive leisure and hospitality sector was one of the worst performers, but it also seems increasingly likely that inflation is weighing on consumer activity.

European growth also hit a roadblock, with data showing that industrial production in Germany had plunged by 4% between July and August, leaving output still 9% below its pre-virus level. Thanks to semiconductor shortages, a terrible result had been expected for the automobile industry - which was duly delivered - but the weakness was far more broad-based, prompting forecasters to downgrade their expectations for Eurozone GDP growth. The ongoing energy crunch is still a risk too, and threatens to further constrain production.

Growth in China is being dampened by the same energy crunch that is making the headlines in Europe, and the Chinese government instructed coal miners last week to expand production. Furthermore, price caps on energy were raised and limits on energy consumption by companies were abolished. This is likely to show up in increased industrial production, and will certainly help energy providers, but will also unleash inflation on China’s energy-absorbing industrial sector and consumers. As a result, the hoped-for rebound in spending by Chinese consumers looks certain to be delayed again.

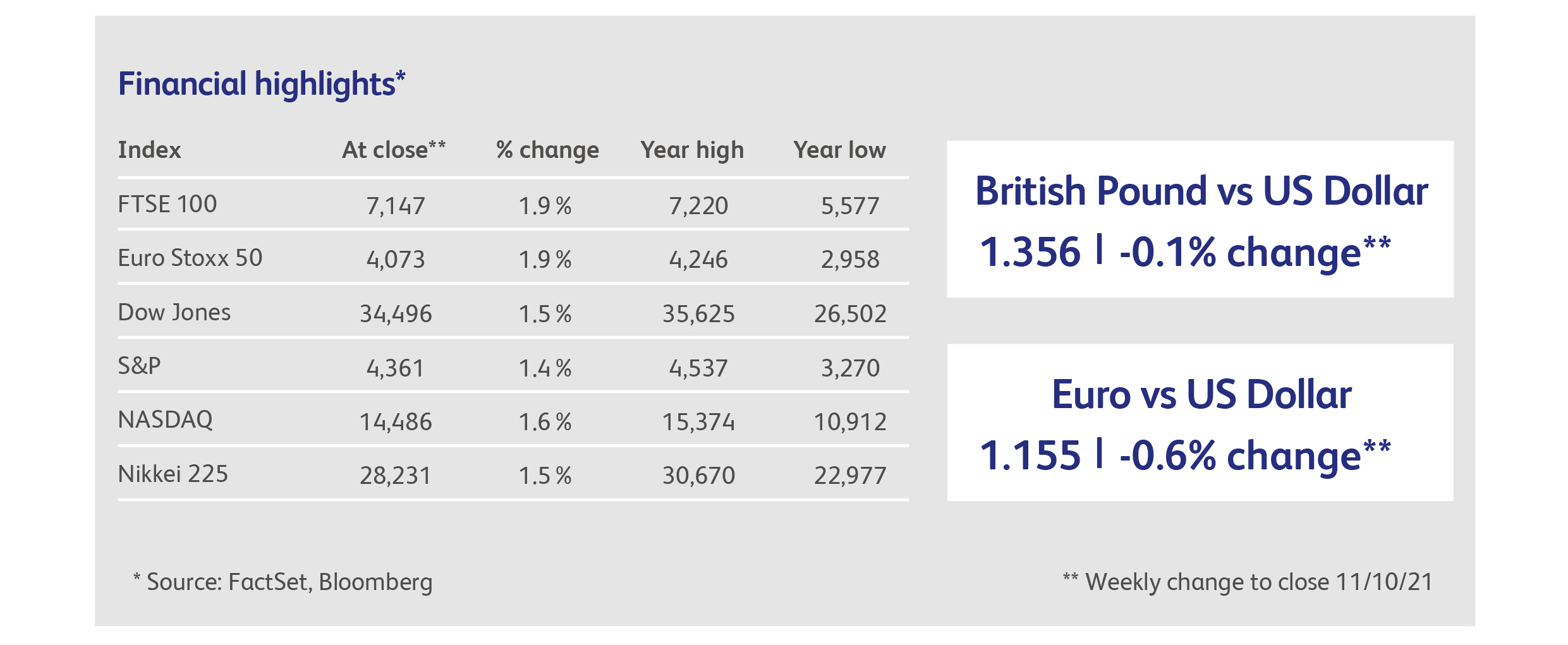

Stock markets recovered from last week’s wobble, but struggled to make headway and remain stuck at the lows of the last several months. The FTSE 100 index has been among the best performers, buoyed by weakness in sterling and a bias towards inflation beneficiaries, such as energy and natural resource companies. Japanese stock markets have been on a wild, roller-coaster ride, with the Nikkei 225 index surging by 13% in the run-up to the election of the new prime minister, and then plunging by almost as much, as Prime Minister Kishida’s policies promised less largesse and more fiscal rectitude than expected. This inauspicious start has already been branded the “Kishida Shock”.

Government bond markets took another battering, as investors continue to challenge the assumption of central bankers that inflation will be merely “transitory”. Corporate bonds were dragged down for the same reason, and it does not help that their minimal extra yield above government debt leaves little room for upside. Two officials at the Bank of England sent gilt yields higher when both publicly argued for higher rates to offset inflation. However, with the furlough programme having just ended and the post-pandemic recovery very much at risk, it remains to be seen whether the bank will follow through at its meeting in early November.

A Covid-induced exodus of factory workers from Vietnam’s industrial heartland, back to their homes in the provinces, is undermining supply chains that reach all round the world. The Vietnamese government estimates that 2 million workers may relocate in order to avoid strict lockdowns to counter an outbreak of the delta variant. Vietnam has become favoured as a low-cost producer primarily by the clothing industry. As a result, Nike has been forced to cut its sales forecasts, and analysts estimate that Skechers, Adidas and Under Armour all depend on Vietnam for at least a quarter of their production.

Following successful trials for Merck & Co’s anti-Covid pill, and with a host of other anti-viral treatments in development, sentiment has shifted against Covid vaccine manufacturers. Pfizer’s share price is down 15% since its peak in August, and Moderna’s is down 30% in the last two weeks alone. Expectations for the antiviral drugs are so high that some analysts are even forecasting a collapse in the market for rapid Covid-testing, with DiaSorin, Qiagen and Abbott Laboratories’ share prices all coming under pressure.

Following the explosion in natural gas prices, the prices of several other commodities crashed upwards last week, adding pressure to the inflationary pipeline. Cotton futures rose to their highest in nearly a decade as a result of adverse weather and shipping hold-ups. Aluminium, which is so energy-intensive to produce that it is sometimes referred to as “solid electricity”, jumped to its highest level since 2008; and iron ore prices have risen 50% in the past three weeks, mainly driven by expectations that Chinese steelmakers will resume operations after government-enforced production cuts.

The shortage of semiconductors has not proved to be an all-out bonanza for Taiwan Semiconductor Manufacturing, the world’s biggest chip-maker. It’s true that revenues for the last calendar quarter reached a record $14.8 billion, but this was merely in line with analysts’ expectations. Manufacturing lead times in the industry have expanded dramatically, reducing manufacturing volumes, and revenues have been impacted by weak sales of android phones, as well as the need to divert resources towards low-price chips for the automobile industry.

Highlights

German industrial production contracted by 4% in August as disruption to global supply chains continued to bite. For the same reason, Eurozone exports more generally are expected to struggle in the third calendar quarter.

Another dreadful jobs report from the US raised the issue of whether there is something more than the delta variant restraining employment growth. The US created 194,000 jobs in September, well below the forecast for 500,000. Adding to the disappointment, labour-force participation edged lower as people left the workforce.

The UK employment data for August suggest that the labour market was in reasonable shape ahead of the end of the furlough programme in September. Employment grew and, on some measures, is now above its pre-pandemic level, despite 1.1 million workers coming off furlough during the summer months.

Calendar

UK GDP is expected to have risen by 0.5% in August, a slightly faster rate than in July but well below the pace seen in prior months, and also below the Bank of England’s own forecasts. Car and energy output is likely to have rebounded but, within the service sector, declines in retail sales and Covid-related healthcare activities are expected to have offset the rebound in accommodation and food services.

Chinese inflation and trade data for September should confirm the message already sent by manufacturing surveys and regional trade data: of declining activity in both exports and imports, combined with rising prices.

Data for US retail sales and consumer sentiment will cast light on whether US consumers are still in the doldrums, following several months of lacklustre readings.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.