30 November 2021

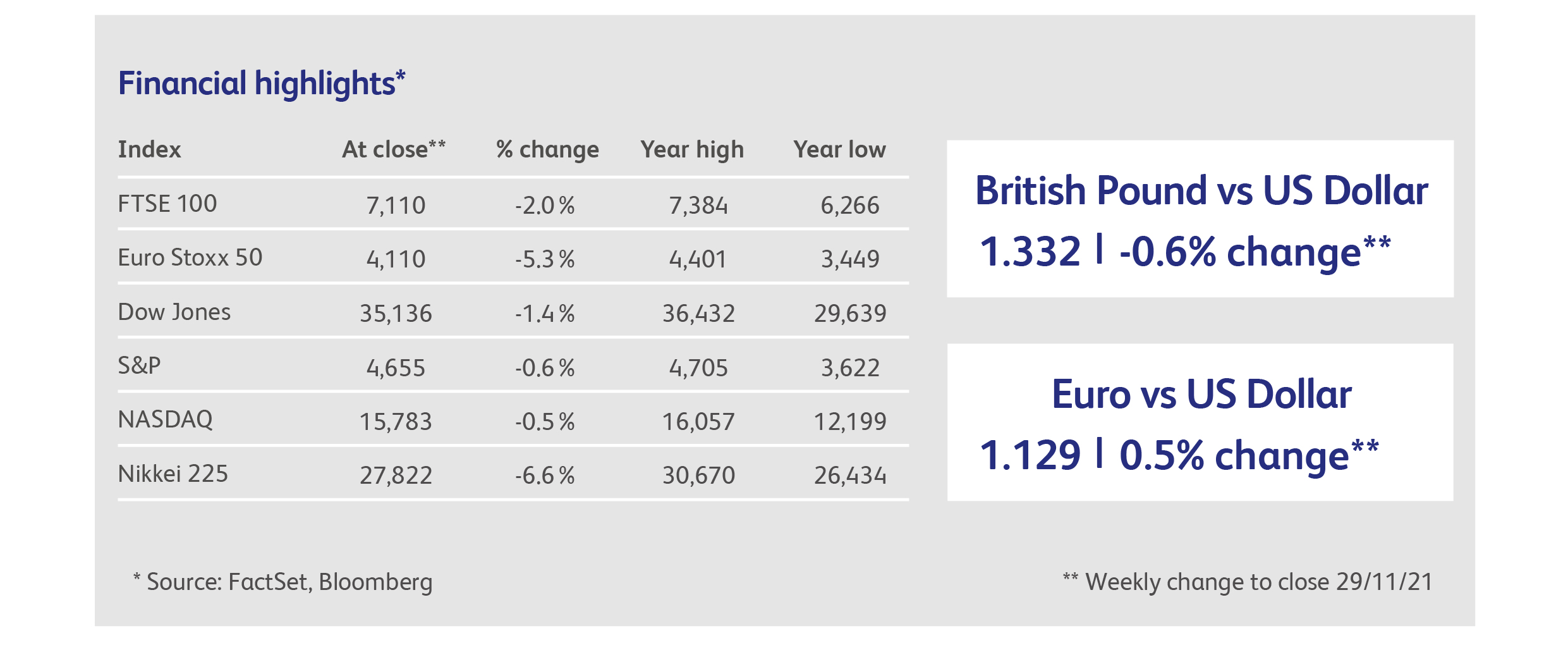

Stock market volumes were already thin when news emerged of the Omicron variant, on account of the Thanksgiving holiday in America, exacerbating the sell-off and causing the worst daily decline in more than a year. The European blue-chip Euro Stoxx 50 index fell back to earth with a thud, falling 4% in a day, though the real wonder was how it had kept rising at all given recent European Covid statistics. Having enjoyed a 10% run-up in recent weeks, this index is now back at the levels seen in June. It was a similar story with most stock market indices globally, which gave up several months of gains in a day. The Nikkei continued on its remarkable roller coaster ride, dropping 6% to levels last seen in January. Over the past few months, it has enjoyed a 14% rally, followed by a 9% fall, followed by an 8% rally and now this latest decline, as hopes for the new government’s stimulus programme have fought it out with disappointing economic data. The technology-heavy Nasdaq Composite index again bucked the trend, and had made back most of its losses by the end of the week, as investors anticipated another pandemic bonanza for online businesses.

The Vix index, a measure of stock market volatility, recorded its fourth-largest daily increase since 1990. But the repercussions went far wider than equities, with oil prices falling 13%, their 9th largest ever one-day decline. Cryptocurrencies demonstrated again that they are too large to be divorced from the rest of the market, falling roughly 10% across the board; fans, though, will be cheered by the fact that a cryptocurrency called Omicron rallied 900% - purely because its name happens to be Omicron. Government bonds resumed safe haven status after a torrid few weeks and, notably, have not given back any of their gains even as equities have rallied.

Even allowing for the poor liquidity over Thanksgiving, the market reaction seems extreme given that it’s too soon to say whether the new variant will be more infectious than Delta, or evade natural immune responses better, or cause more serious disease. Perhaps the most important news of the week was the reaction of governments, which were far quicker to ban travel from high-risk destinations than they had been for Delta. There was a hint of zero-tolerance about this, which could have scared investors banking on a continuation of the current, more economically friendly approach. The strategy of most western governments to allow the virus to propagate, as long as it does not overwhelm hospitals, could become viewed as misguided. Ominously, the Chinese government, which has been the strongest advocate of zero-tolerance since the pandemic began, trumpeted its approach as the best defence against the new variant, dashing hopes for a U-turn in Chinese policy.

So could this really be it for the equity bull market? Although the investment industry has spent the best part of the last year thinking up reasons to justify why equities are at current valuations, the most compelling explanation by far is the tsunami of money created by governments and central banks in fighting the pandemic. After all, the world’s stock markets are, in aggregate, about 40% above their pre-pandemic levels, so a new variant alone should not be enough to derail them. What really matters is the response of institutions and, especially, whether trillions of taxpayers’ dollars would be unleashed again, unfunded by current tax rates, and whether trillions of new dollars would be invested by central banks, created out of thin air.

Pfizer was quick to reassure markets that it could have a new vaccine against the Omicron variant up and running in a few months. Even in a worst-case scenario, the company believes that its current vaccine will provide some protection. Pfizer’s stock was up 7.5% to a new all-time high on the day after the Omicron news broke. Moderna’s CEO, on the other hand, spooked markets by highlighting the risk that Omicron can evade existing vaccines, and emphasising the practical difficulties of getting new vaccines into mass production. Moderna’s share price was up 30% on the day.

Google warned that malicious actors are hacking Google Cloud accounts and commandeering them to mine for cryptocurrencies. The company stated that 86% of recently compromised Google Cloud accounts were used solely for this purpose, which requires large amounts of computing power.

China may be about to use the nuclear option in its spat with Chinese technology companies listed in the US, after rumours emerged that Chinese regulators had asked the giant online taxi service Didi Global to de-list from US exchanges. Didi Global’s shares fell 7% on the news, before recovering somewhat, but are down 44% since the IPO in July.

Didi Global’s western rival Uber, meanwhile, was hit by municipal authorities in Brussels, who fined the company EUR300,000 and effectively shut down its operations in the city. The ban was hastily promised a reconsideration, however, after 2,000 angry Uber drivers blocked the main roads into the Belgian capital.

Analysts at Bank of America estimated that investors have poured nearly $900 billion into global equity funds so far this year, more than the combined total over the past 19 years. Exchange-traded funds captured 88% of these flows.

Highlights

Calendar

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.