21 December 2021

Hopes for a quiet end to the year for equity markets were upended by an accumulation of negatives that put an end to the post-Omicron resurgence. The culprits included Omicron itself, central banks plus a senator from West Virginia. The week started on a sour note when Sinovac, the Chinese Covid vaccine, was found to be relatively ineffective against Omicron – a result that has been reinforced by subsequent tests. This makes it very unlikely that China would be able to alter its zero-tolerance approach to Covid even if it wanted to, and increases the likelihood of Chinese factory closures, further global supply chain blockages and persistent inflation. Only the previous day, producer-price inflation in the US had risen to a record high for the eighth month in a row.

Omicron is spreading so quickly that expectations for economic growth are in a constant state of flux – but the trend is clearly downwards. In the best case, consumers’ risk-aversion slows economic growth, but only temporarily and without causing a recession. Other, worse scenarios involve renewed lockdowns and negative growth. The most recent round of business activity surveys revealed unexpectedly depressed levels of activity in the service sector in the US, EU and the UK.

Markets have weathered waves of Covid before, but that was when the mix of monetary policy, fiscal stimulus and advances in vaccine technology was more benign. The situation is quite different now, with central bankers changing their tune. The US Federal Reserve could have chosen to wait and see how Omicron develops at its meeting last week but, instead, it abandoned its description of inflation as “transitory” in favour of “elevated”, and the various governors that make up its monetary policy committee unanimously shifted their expectations for interest rates upwards. In a sign of the times, equity markets initially rose on the news, somewhat bizarrely given this signalled that the Fed is now back to taking away the punchbowl, rather than supplying the punch.

The European Central Bank also chose to emphasise inflationary pressures at its meeting, nearly doubling its inflation forecasts to levels far above those priced in by capital markets. Two thirds of this upgrade was based on the assumption of higher energy inflation, and it’s notable that European energy prices have surged again since then. At the same time, the ECB dropped its economic growth forecast for 2022, mainly in response to the current Covid-induced slowdown. The bank made it very clear that it will be winding down its asset purchase programme, so there was little comfort for investors here. Seasonal cheer was in even shorter supply at the Bank of England’s meeting, which produced a surprise rise in base rates, from 0.1% to 0.25%. This is another clear change in tack, as the bank chose to ignore early evidence suggesting marked damage to the service sector from rising Covid cases.

The message to investors is clear: the days of rapid and aggressive policy support for the pandemic from central banks are over. But what about fiscal support – surely governments will be forced to offer financial support to companies again and, in particular, to those sectors worst affected? So far this has been lacking and, in a potentially symbolic moment last week, democratic Senator Manchin of West Virginia effectively scuppered the President’s long-awaited $1.75 trillion fiscal stimulus.

We wish our readers well for the festive season and will be back on January 11th, 2022.

US investors looking to buy the dip are being drawn to Emerging Market equities, which are down 16% from their February highs, largely driven by declines in Chinese stocks. According to data from Bloomberg, US-listed trackers of Emerging Market indices just enjoyed their third consecutive week of inflows. Last week’s inflows were the biggest since April.

Airlines have become increasingly vocal in their warnings about the risks to travellers from new 5G telecommunications networks. Airlines and aviation officials claim that the 5G services, which are due to start in the US in early January, could interfere with equipment on planes and helicopters that tracks altitude, potentially preventing landings. The telecommunications industry denies the claims.

Airbnb and rival Expedia Group have got together to share information on threats to users’ safety, as well as other types of negative user experiences. The joint effort is intended to prevent offenders from being banned by one website, only to pop up on the other. The move follows reports of compensation paid out to users who have suffered harm after using the platforms.

Nike results for its latest quarter demonstrated the benefits of sales from its own website, as the direct business grew 9% during the quarter, and now accounts for about 40% of total revenues. Profit margins were boosted by robust demand and lean supply, which meant fewer markdowns, and strong revenue growth in the American business offset a plunge in China.

European natural gas prices hit new records several times during the week. Price pressures have been exacerbated by another shortage of supplies from Russia, while demand has been boosted by freezing temperatures. European natural gas prices have now risen more than 600% during the year, and are the principal driver of inflation across the region.

BNP Paribas’ $16 billion windfall from the sale of its US banking operations will be used for share buybacks and acquisitions. Possible targets include the European insurance sector, custody services or even a merger with another large European bank.

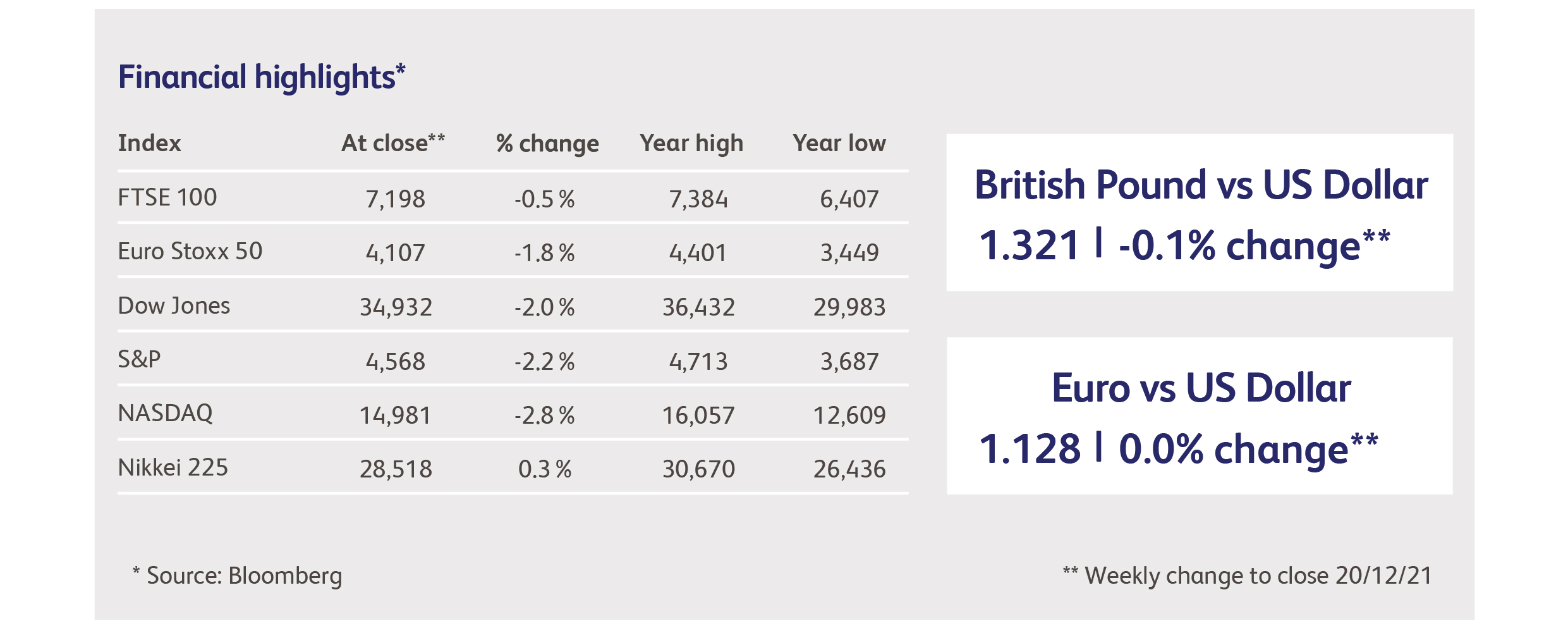

Highlights

Calendar

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.