15 February 2022

Things were looking up at the beginning of the week, with the previous week’s blockbuster US employment report having given stock markets a confidence boost. By mid-week, with a bounce well and truly underway, it looked like markets might even be making an attempt to reclaim their previous highs. The mood darkened, however, after the US inflation report on Thursday, which showed that inflation had once again outstripped most forecasters’ expectations and was running at its highest level for 40 years. Moreover, the report confirmed that inflation is now spreading from pandemic-affected goods to the broader service economy. Service sector prices had their biggest annual increase in 30 years. As expected, higher house prices are also now feeding into higher rental costs and, as housing is the biggest component of the inflation calculation, its impact is likely to be sustained.

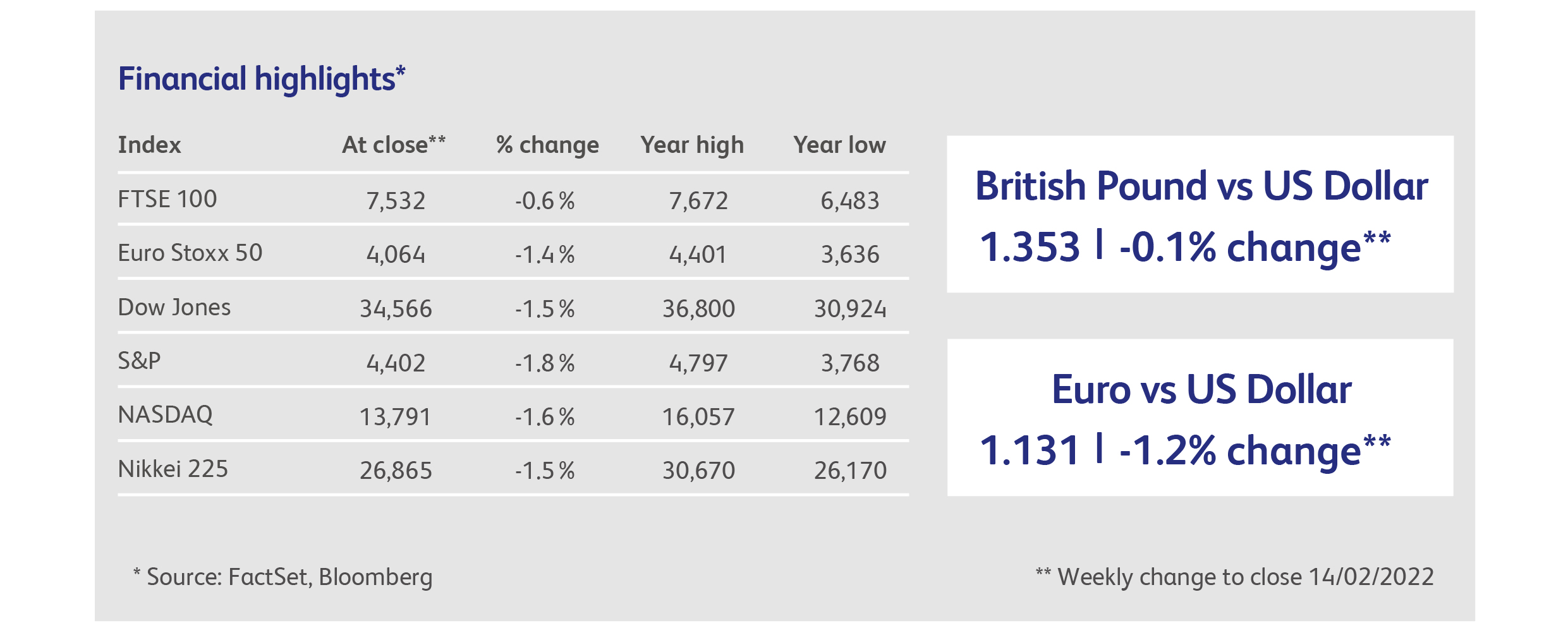

Initially, stock markets were even willing to shrug this news off, before a call for a half-percent rate rise by a Federal Reserve official cast gloom upon the market mood. No amount of denials by other Federal Reserve officials could undo the damage. Markets were further unnerved when US Consumer Confidence was reported to have cratered again, this time falling to its lowest level in a decade, and the party definitively turned to a hangover when, late on Friday, the US National Security Adviser warned that an invasion of Ukraine by Russia was imminent. Technology stocks once again led markets lower, and the FTSE 100 again was the most buoyant of the major indices, with investors appreciating its bias towards previously-unfashionable oil and tobacco companies.

At least equity markets are still a long way from outright panic. The real horror story, at least for market watchers, can currently be found in bond markets, where moves that can seem inconsequential in size - when compared to equities - represent huge changes in outlook. This was again in evidence during the week, when US government two-year bond yields suffered their worst day since 2009 on the back of the inflation report. Market expectations for rate rises are now far, far ahead of the guidance being given by central bankers. One or the other is going to be proved very wrong.

It’s not just the size of the market moves that are unsettling bond investors, but the rapidity with which bond markets have moved from steady eddies to screaming demons. Such regime changes in volatility are far more rare than big changes in rate expectations themselves. Moreover, the dislocation is not confined to shorter-term maturities: looking out over ten years or more, another rapid change has also been taking place in expectations for future interest rates, with longer maturities failing to follow short-term maturities upwards. Having already committed one policy blunder by underestimating the persistence of inflation, markets are increasingly expecting central banks to make another, the implication being that they will have to raise rates too violently, slamming the brakes on economic growth.

The contrasting fortunes of taxi-hailing rivals Uber Technologies and Lyft were on display last week. Uber was able to put Omicron clearly in the rear-view mirror, reporting the largest number of active users in its history and an 83% increase in revenues for the fourth calendar quarter. Uber’s new food delivery business also had its first profitable quarter. Nevertheless, the stock fell 10% on the day after the results were announced, and ended a volatile week down 5%. The smaller Lyft, on the other hand, was able to report higher revenues than expected but its number of active users fell short of analysts’ expectations. However, Lyft shares rose 10% on the day following the news and managed to end the week up 6%.

Shares in sports clothing company Under Armour fell 12%, the most in two years, after the company warned that supply chain disruptions would impact sales for the next six months. Even worse, increases in shipping costs are driving gross margins lower, as the company uses costly air freight to circumvent bottlenecks in shipping lanes. Finally, the company delayed giving its annual guidance by several months. The shares are now 14% below their pre-pandemic levels.

Walt Disney Co capped off a bad year for its share price by announcing online subscriber-growth far above analysts’ expectations and earnings that were nearly double expectations. The company’s theme parks also produced a strong performance, doubling revenues from the previous, lockdown-affected year and turning from loss to a $2.5 billion profit. Disney shares fell 3% the day after the results were announced and are hovering around pre-pandemic levels, despite the rapid growth of the company’s online streaming business.

The amount of bonds held by central banks is so large that, should they decide to release them back into the marketplace, there are real fears they could compete with governments’ own debt-raising capabilities. Rumour has it that the Bank of England, which is currently on course to begin running down its £875 billion holding of government bonds at some point this year, has entered into discussions with the government about the potential impact on debt issuance by the Treasury’s Debt Management Office. Given the supposed independence of the Bank of England, this could be a tricky discussion.

Highlights

Calendar

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.