01 March 2022

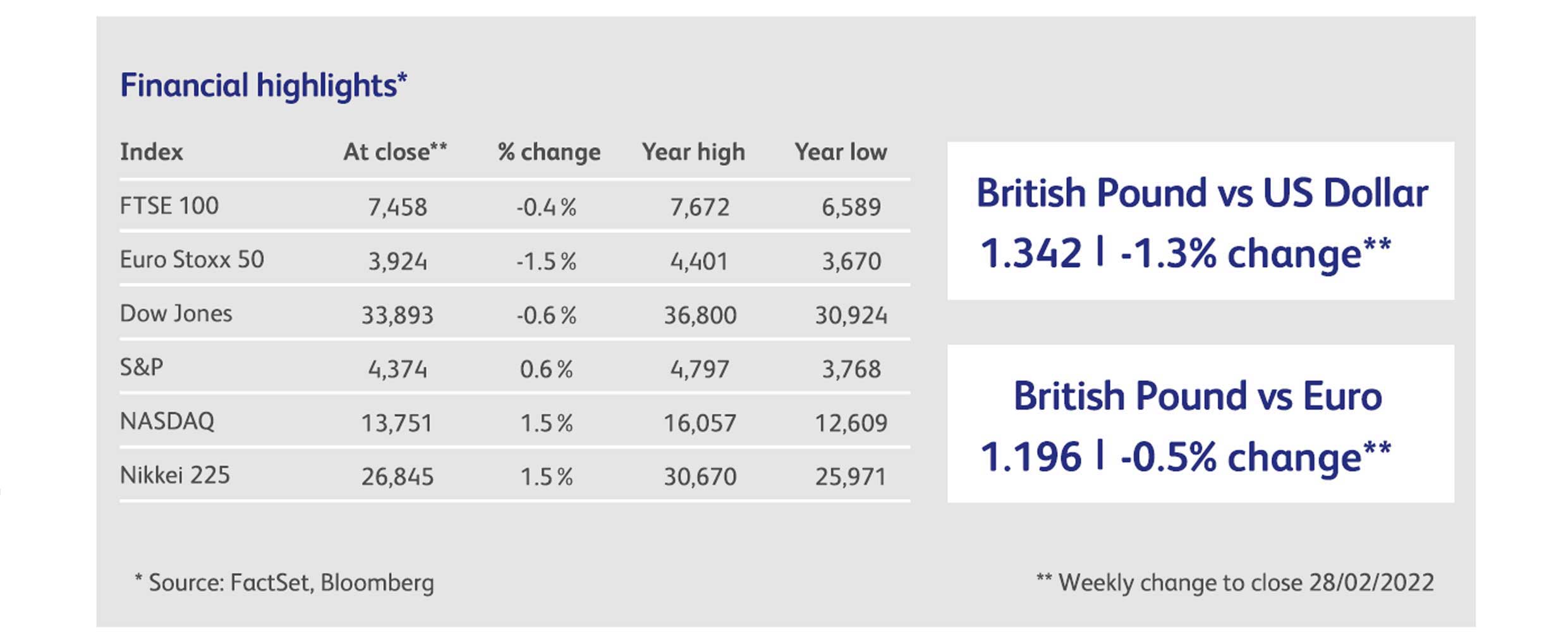

Stock markets recovered some poise during the week, but only after having fallen to new lows for the year to date in most regions. The extent of poor performance was roughly proportional to the geographical proximity to Ukraine, with the Euro Stoxx 50 blue-chip index falling 5% early in the week, before recovering to end the week down only 1.5%. The FTSE 100, which had been largely immune to inflation, interest rates or war, suffered its worst day since the start of the pandemic, declining nearly 4%. But it subsequently rallied by nearly the same amount, to end the week down only half a percent. These rallies were all the more remarkable for occurring while the sanctions applied by the West grew to unheard-of proportions, even targeting Russia’s access to the payment system that holds all the world’s banks together. With Russian assets in a Chernobyl-sized meltdown, it’s no wonder Putin was tempted to play the nuclear card, but even this could not derail the rally.

The decision by European countries, notably Germany, to increase military expenditure predictably sent defence-related stocks soaring. This was a boon to a host of British companies, and the mid-sized FTSE 250 had its best day of the year relative to other indices, rising by a percent when others were down. This may be a sound policy geopolitically, because it is unlikely that modern Russia would be any more able to outspend the West in an arms race than Soviet-era Russia. However, it comes at a time when government balance sheets are already stretched. It may ultimately be positive for stock markets if investors associate it with increased government expenditure; not so if it slows growth by redeploying expenditure destined for consumers to military purposes. One thing is certain, however: this historic decision brings forward the day of judgement, when governments’ pandemic borrowing must start to be paid back. To date, a discussion of this has been most evident in its absence.

Meanwhile, expectations for economic growth in the developed world have already been losing steam. Rising inflation, combined with the slowing of government and central bank stimulus, is squeezing households. Consumer confidence has plunged across the developed economies over the last few months but, so far, consumer spending has held up. Will households continue to dip into the excess savings accumulated during the pandemic? Is it possible that consumers hunker down in the face of rising inflation, or that these savings are confined mainly to the wealthiest cohorts of the population, who won’t have much impact on economic growth? Or will they just be spent on increasingly expensive housing? Expectations for US economic growth in 2022 are now at their lowest in a year, and the situation in the UK is even more acute due to the coming increase in national insurance contributions. UK households are likely to see their annual income, after adjusting for inflation, fall by the most since 1977, and possibly since the second world war. Average economic growth expectations for the UK have fallen by a percent since September.

The problem for economists is how to factor in the erosion of wealth and the reduction in government stimulus, while simultaneously allowing for a rapid rebound in economic growth from prior periods that were affected by lockdowns, as well as factoring in the potential impact of huge amounts of savings sitting on the side-lines. Needless to say, investors face a wide range of outcomes.

In his much-anticipated annual letter to shareholders, Warren Buffett lamented his cash-heavy balance sheet, highlighting the dearth of acquisition opportunities. He did rave about Berkshire Hathaway’s position in Apple, however, calling Apple’s CEO “brilliant”, and praising Apple’s massive share buyback programme. Over recent years Berkshire Hathaway has embraced the concept of stock repurchases, and the company announced that it bought back $27 billion of its own shares last year. No mention was made of succession planning, though favourite Greg Abel did write the section of the report on sustainability. Berkshire Hathaway shares are up 7.5% this year.

As part of its response to the Russian invasion of Ukraine, the US government has given asset managers until the 25th May to liquidate their holdings of bonds and equities in sanctioned Russian entities. Failing that, the holdings will be frozen. The asset managers in question, the biggest of which are BlackRock and Vanguard Group, must choose how to comply with the sanctions, which are at odds with their obligations to track equity indexes and bond benchmarks.

The private equity giant, Blackstone, had a good year, raising a record amount of money from investors and approaching $1 trillion assets under management. Blackstone’s CEO had an even better year: following on from his $611 million income in 2020, his income for 2021 topped $1 billion, comprising dividends from his 19% stake in the company plus a $160 million bonus. Blackstone shares have risen by 80% in the past year.

Alibaba has officially run out of growth, after the CEO announced that the company would be focusing on retaining users rather than growing them. Such strategic decisions are rare in the technology world, where accumulating user numbers is everything. It reflects the extremely difficult political environment in China, where the government has been waging a regulatory war on tech firms for the past year. Alibaba shares were down nearly 10% on the week, and are now below levels that were attained in 2014.

Highlights

Calendar

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.