08 March 2022

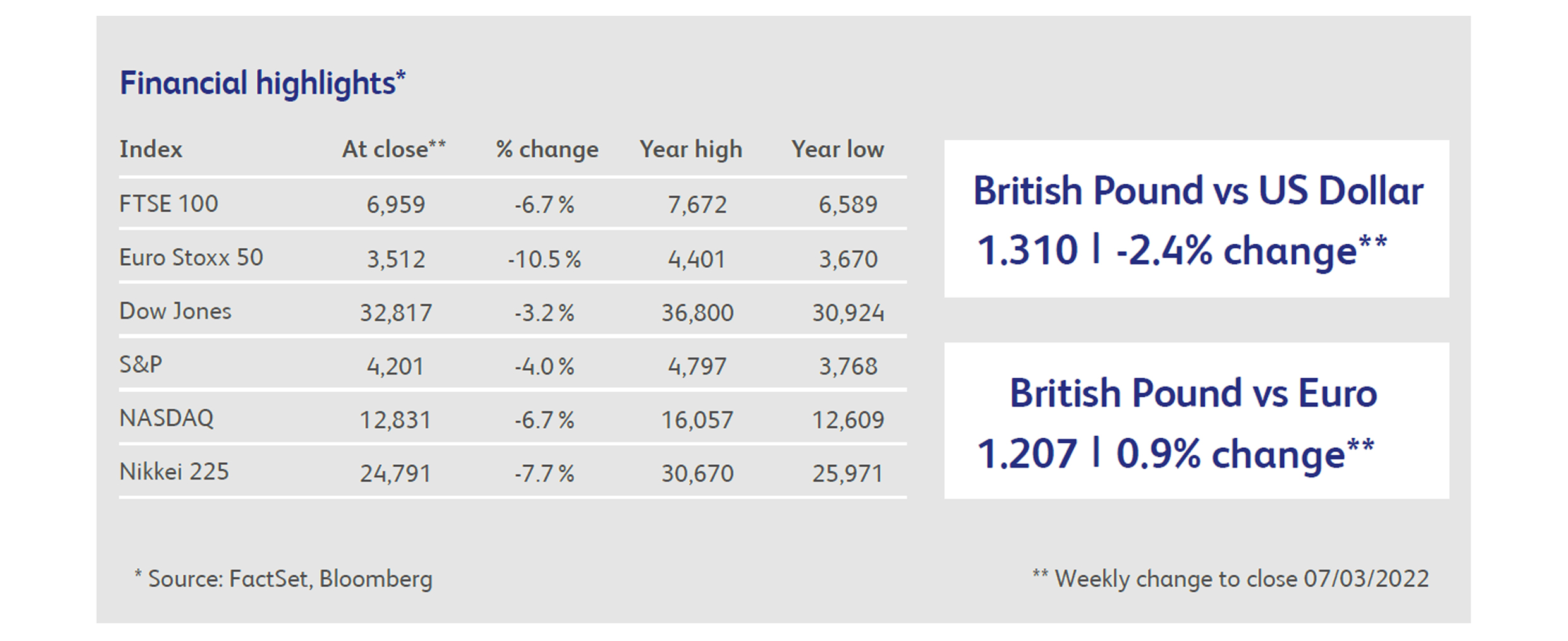

Stock markets had their worst week since the depths of the pandemic, with European equity indices particularly hard hit. The blue-chip Euro Stoxx 50 index fell over 10% during the week, and entered official bear-market territory (meaning that a decline of at least 20% from peak to trough has now taken place). It is also now below the levels reached during a brief rally in 2015. US equities have been relatively resilient and, despite declining by 3-4%, ended the week above their year-to-date lows. Being more geographically removed, it seems that US equities are less perturbed by the direct consequences of the invasion itself, but are nevertheless responding negatively to the threat of higher near-term inflation.

Are stock markets right to be reacting so violently, or are these moves a reflection of a deeper, structural malaise, with the war merely a catalyst for an unwinding of excessive speculation that built up during the pandemic? Economic opinion is divided on the effects of the war, with the International Monetary Fund warning that it will have a "severe impact" on global growth, caused mainly by the impact of food and energy inflation on poorer households. Others, however, point to the limited role of Russia and Ukraine in global trade. Taking Germany as an example, Russia is the recipient of only 2.3% of total exports, and the figure is even lower for Italy and France. Only 0.9% of the UK’s exports go to Russia, but the UK-orientated FTSE 250 has fallen by 12% since the conflict got going in earnest.

The impact of inflation is another matter, however, with higher commodity and energy prices likely to raise the trajectory of inflation and prolong its longevity. This is undesirable, because higher inflation raises the cost of living, and will lead to a reduction in economic growth. But what matters is the amount of any reduction in growth; so far, forecasts have been reduced by a mere fraction of a percent, mainly because the developed world’s economies are still rebounding from last year's lockdowns.

So, is it the end of the world, geopolitically speaking? One of the differences between this and previous Russian invasions has been the escalation in sanctions by the West, which have dramatically increased the cost of the war and of any subsequent occupation. Indeed, a number of political analysts are now highlighting the miscalculations that Putin has made, both militarily and financially, and confidently predict the end of his tenure. Assuming Putin is not mentally unhinged, he will surely have to accept that the project is no longer economically feasible, even if it can maintain military momentum. All else being equal, therefore, the new and unforeseen mega-sanctions have increased the chance of eventual de-escalation.

Nevertheless, de-escalation may take time to play out and, for now, stock markets are in panic mode. It's likely that such extreme behaviour is partly caused by markets themselves, with too many positions having been built with borrowed money over the past two years. This would hardly be surprising given the multitude of speculative excesses that had become apparent. Having spent most of the last two years blithely ignoring any and all risks, some investors may have no choice now but to focus only on risk.

Germany’s Dax stock market index fell 11% during the week, harking back to the initial shock of the pandemic. Among the biggest losers was Volkswagen, down 21% on the week after is decided to halt production at its factories in Russia, and to stop vehicle exports to Russia with immediate effect.

Shell landed itself with a public relations problem, and its share price fell 10% in a day, after taking a cut-price delivery of crude oil from Russia which prompted Ukraine’s Minister for Foreign Affairs to ask the company whether their Russian oil smelt like “Ukrainian blood?” The company argued that the purchase was justified by Russia’s significance to global oil supplies, and admitted to seeking government guidance on further supply issues.

Commodities had their best week since 1974 with gold heading back towards its post-pandemic high, European gas futures surging to a new record and oil passing $120 a barrel. Wheat hit its highest level since 2008, and the United Nation’s Food and Agriculture price index rose to a record high. Nickel prices soared by 20%, aluminium prices rose to a new record and copper closed in on its all-time high.

Away from the conflict, the Asian online taxi and delivery giant Grab Holdings fell 40% in a day after it reported that quarterly losses had doubled from last year, while revenues shrank by 44%. The shares have now fallen more than 70% since listing in the US via a Special Purpose Acquisition Company (“SPAC”) in 2020.

Highlights

Calendar

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.