15 March 2022

European stock markets recovered some poise during the week, rallying off their Ukraine-war lows, and moving more into line with their American peers. As concerns surrounding the conflict receded, however, fear of inflation increased, prompting bond markets to plumb new lows for the year. This latest move can be attributed partly to the war, which has unleashed a spike in commodity prices, and partly to the latest wave of Covid cases in China, which has prompted the authorities to lock down cities and, in one case, an entire province. These lockdowns threaten to exacerbate supply-chain blockages, boosting production-line inflation in China just after it had begun to decline. Ultimately, this could feed through into more persistent consumer price inflation in the Western world.

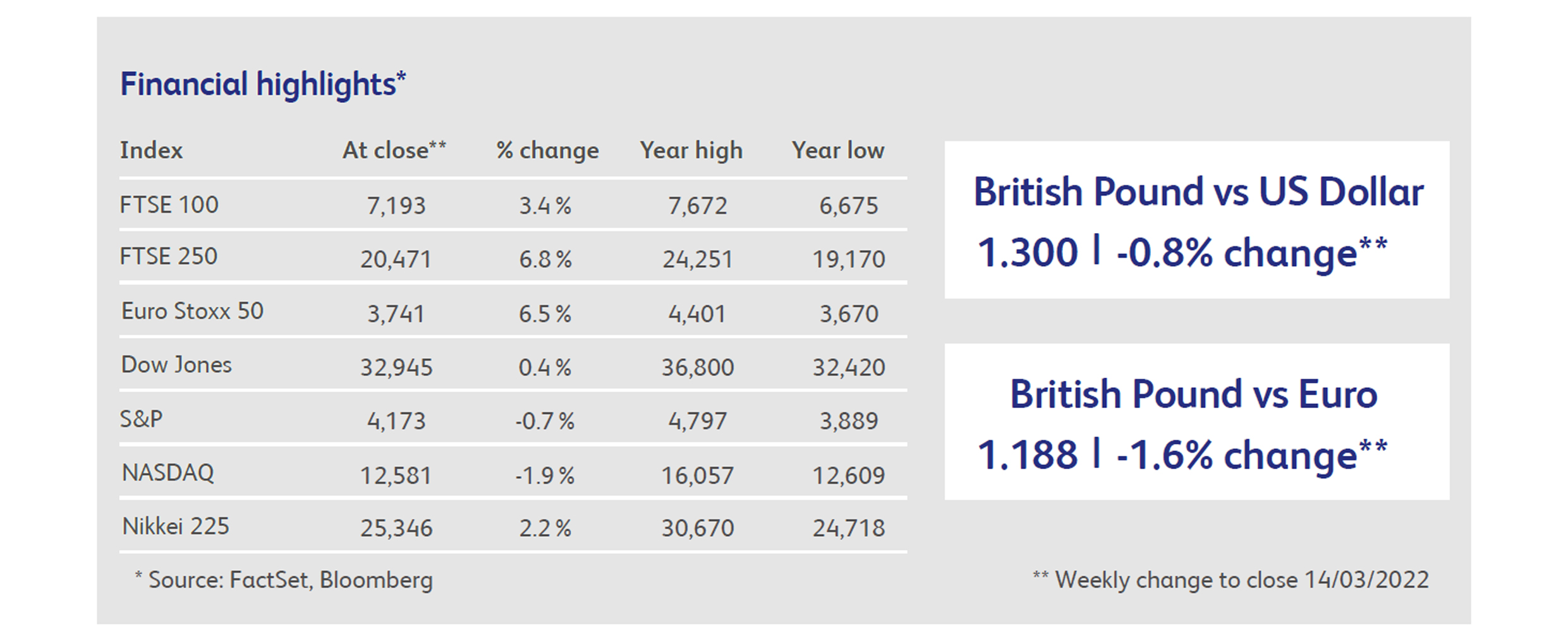

Absent the traditional safe haven of government bonds, investors have flocked to gold and the US dollar. Gold had a bad week though, falling 5%, but at least it is still up a healthy 4% since the conflict got going in earnest. The dollar has been the real winner, though, rallying robustly against other major currencies since the conflict started. The flip-side of this for UK investors has been the poor performance of the pound, which has fallen 4% against the dollar since the conflict started, and is now trading close to $1.30. It does not help that the UK is a large importer, including of energy, which was reflected in a widening trade deficit for January. But the UK also imports cars and holidays in large volumes, and these markets are likely to recover over coming months, suggesting that a further rapid expansion of the trade deficit is highly likely, keeping the pound under pressure.

The most newsworthy event in capital markets in the last week, however, was the Chinese stock market, which suffered several disasters in rapid succession. First up was the vast Norwegian sovereign wealth fund (which holds the wealth collected from the country's oil assets), announcing that it was eliminating its holding in a Chinese clothing firm, due to the risk of contributing to human rights violations in Xinjiang. This prompted investors to realise that the kind of sanctions being applied to Russia might come into play against China, and a broad sell-off ensued.

Chinese technology stocks then caught the bug and continued their year-long sell-off, with the Hang Seng Tech Index falling by 20% during the week. Regulatory pressure was the main problem, but this time emanating from the US, where the Securities and Exchange Commission threatened five Chinese firms with delisting due to inadequate audit procedures. A wave of Covid in the technology hub of Shenzhen and the province of Jilin did not help, and there are real fears that the lack of vaccinations and acquired immunity in China makes it ripe for a major Covid disaster of the kind that the rest of the world encountered early in the pandemic.

Finally, the broader Chinese stock market fell again after rumours spread that Russia asked for Chinese military support in Ukraine, and investors again weighed the risk of potential sanctions. This trail of wreckage has resulted in some eye-catching performance data: the Hang Seng China Enterprises Index, which measures the prices of Chinese companies listed in Hong Kong, is down 28% over the last month and 45% over the past year. The Nasdaq Golden Dragon Index, an index of Chinese companies listed in the US, is down 70% over the past year. Even the on-shore domestic equity markets, which are reported to have benefitted from government support, are trading below the levels reached in 2015.

Volatility in commodities markets is creating opportunities for speculators but headaches for industrial users. In an unusual move last week, the London Metals Exchange shut down its market for nickel, and also cancelled trades worth billions, after a 250% jump in the nickel price threatened to bankrupt some dealers and industrial users. The jump in nickel's price was caused by a massive short squeeze on Chinese nickel producer Tsingshan Holding Group. Traders were outraged by the move, arguing that the function of the exchange is to preserve liquidity. Industrial users, who just want to stay in business, applauded. London's nickel market has yet to reopen but, when it does, rules designed to prevent excessive price volatility will apply.

Pfizer is winning the battle to develop an anti-Covid pill, after its Paxlovid treatment cut the risk of hospitalisation or death by 90% in trials. In contrast, Merck & Co's pill was only 30% effective. However, Paxlovid pills can't arrive fast enough, with producers only expecting to be ready to supply their first deliveries in December. Analysts estimate that larger quantities won't be available until May 2023. Moreover, it's not known whether supplies of the 38 different ingredients will hold up under such massive demand.

Amazon's 20-for-one stock split evokes memories of the excesses of the internet boom and achieved the same kind of ultra-frothy reaction among investors, with the stock soaring 6% on the day following the announcement. In theory, stock splits don't add any real, economic value, but this one managed to add $80 billion to the company's market value. Amazon's move follows another 20-for-one stock split in the technology sector, announced by Alphabet (owner of Google) last month. Alphabet's market value had surged by $130 billion after its announcement.

China's latest Covid scare threatens to further disrupt supply chains that are already suffering from shortages of materials and shipping delays. Hon Hai Precision Industry, one of Apple's main suppliers, halted production at its sites in the Southern city of Shenzhen, which was locked down at the weekend. The news did not help Apple's share price, which has now fallen for five weeks in a row. Volkswagen and Toyota closed plants in the northern province of Jilin.

Highlights

Calendar

This publication is intended to be Walker Crips Investment Management's own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.