29 March 2022

Stock markets continued to enjoy the post-Ukraine rally last week, with notable enthusiasm for all things American and, especially, American technology stocks. Also coming back into favour are some speculative favourites, including cryptocurrencies. Recent announcements of stock splits by American technology companies have been greeted with extremely outsized responses, despite the fact that they generate zero economic value to shareholders. Alphabet (Google) enjoyed a $130 billion boost to its market value on the day of the announcement, Amazon saw an $80 billion boost for its stock split and, most recently, Tesla an $84 billion boost. Perhaps this simply reflects the fact that American retail buyers still have plenty of firepower, as they have been a constant positive for markets since the start of the year, even continuing to pour money in throughout the Ukraine crisis. The other constant positive has been stock buybacks by American companies, which are running at all-time highs. Unfortunately for investors, while these factors may support valuations for a while, neither of them contributes to economic growth or the enlargement of corporate earnings. At least the earnings expectations for technology companies have ticked up recently while, for the broader US market, they have remained flat over the last six months.

The bond markets made waves again, with a growing chorus of commentators now predicting recession, based on the sell-off in short-term bonds relative to their longer-maturity brethren. The consensus seems to be growing among bond investors that central banks have gotten so far behind the curve in controlling inflation that they will be forced to put the brakes on economic growth in order to contain it. It’s worth noting that central banks have spent the last year pouring fuel on the inflationary fire: while US inflation rose from 2.3% to 7.9% over the last year, the Federal Reserve added a net $1 trillion to the US financial system. Over the past two weeks, even as the Fed raised rates by 0.25% and talked tough on inflation, it added a net $50 billion.

Of course, the European Central Bank has continued with its asset purchase programme, and this week saw a new arrival, with the Bank of Japan committing to buy unlimited amounts of Japanese government bonds for three days in a row in order to suppress Japanese government bond yields. Another important support to the inflation argument is politics: recent surveys in the US show that inflation is now a far bigger concern for voters than any other issue, including the pandemic. This is evidently a concern for governments globally, as plenty of European governments, and also the Japanese government, have put plans in place to subsidise consumers against rising energy prices.

It’s been a while since market commentators have had to write about the risk of Covid, apart from to say that the impact of Omicron in the developed world has been far less than expected, but the Chinese government took very rigorous action this week in locking down half of Shanghai, the country’s biggest city and one which represents nearly 4% of China’s economy. This will inevitably lead to an even bigger slowdown in the Chinese economy, more supply chain problems in the western world and more persistent inflation at the factory gate. But the Covid risk that is really not priced in to markets is of a more severe Covid mutation. According to the conventional wisdom, each Covid mutation is less severe than the last but medical evidence suggests this could simply reflect vaccinations, boosters and acquired immunity. The risk still exists, therefore, for a more severe variant to emerge.

Speculative fervour returned to the US technology sector when Nvidia, a manufacturer of computer chips used in gaming software, pledged to invest in the growth of its core business rather than in buying back its own shares. Nvidia shares jumped 8% on the news, adding to a 20% rally that had already occurred since the bottom of the market two weeks ago. The buying, which was mainly driven by American retail investors, spread beyond Nvidia to the broader technology sector, and the technology-heavy Nasdaq Composite Stock Index rose by 2% on the day. Analysts highlighted a recent uptick in earnings expectations for the tech sector, and suggested that investors are more interested in growth stocks than in interest rates.

Shares in Apple, the world’s biggest company by market value, rose by more than 2% after financial news service Bloomberg reported that the company is looking to sell iPhones via a subscription service. The proposal would make owning an iPhone similar in nature to owning a car via a lease agreement. Under the terms of the subscription, owners would be able to upgrade their devices from time to time. Apple shares have now risen for the last ten days in a row.

Shares in electric truck maker Nikola Corp jumped 10%, after the company announced that it had actually started manufacturing electric trucks at its factory in Arizona. The company described itself as being “laser-focused on delivering vehicles and generating revenue”. Nikola shares have risen by 49% since the market bottomed, but still languish more than 80% below their peak soon after listing in June, 2020. Nikola became briefly famous when its market value briefly exceeded that of Ford Motor Company, before its founder became the target of regulatory investigations.

Following hot on the heels of the UK’s regulatory onslaught last week, the biggest technology companies operating in Europe will face fines of up to 20% of global revenues if they infringe competition rules. Those rules include requirements for making messaging networks to connect to third party networks, letting users pick their own web browsers, and getting explicit consent from users to share their personal data. The new rules will only apply to technology platforms generating over EUR7.5 billion in annual revenue and with at least 45 million monthly users.

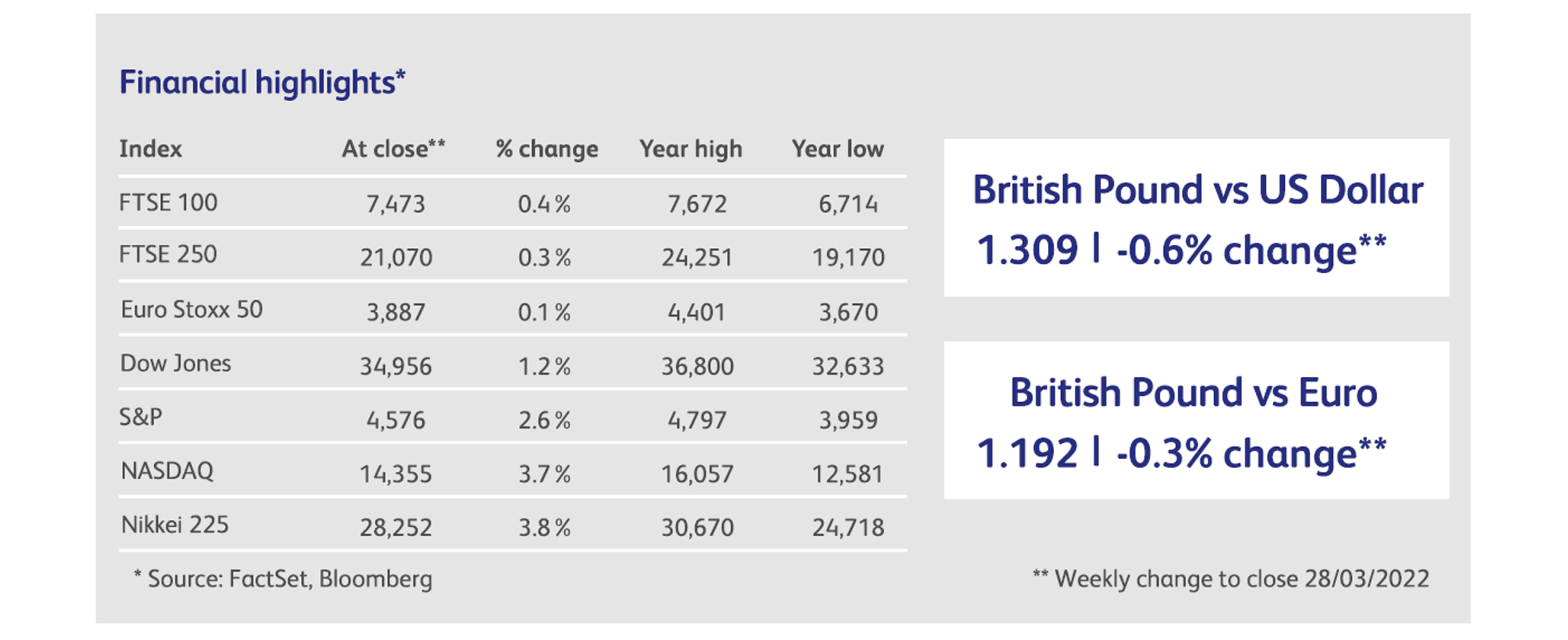

Highlights

Calendar

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.