10 May 2022

The past week saw the US Federal Reserve (Fed) do exactly as markets expected as it increased its benchmark interest rate by 50 basis points (to a range of 0.75% - 1.0%), constituting the biggest single increase in US borrowing costs since the year 2000.

The Fed also announced plans to reduce its gargantuan $9 trillion balance sheet. In June, July and August, The Central Bank plans to reduce its stock of Treasury Securities and Mortgage Backed Securities by a combined total of $47.5 billion per month, then from September onward by a combined total of $95 billion per month.

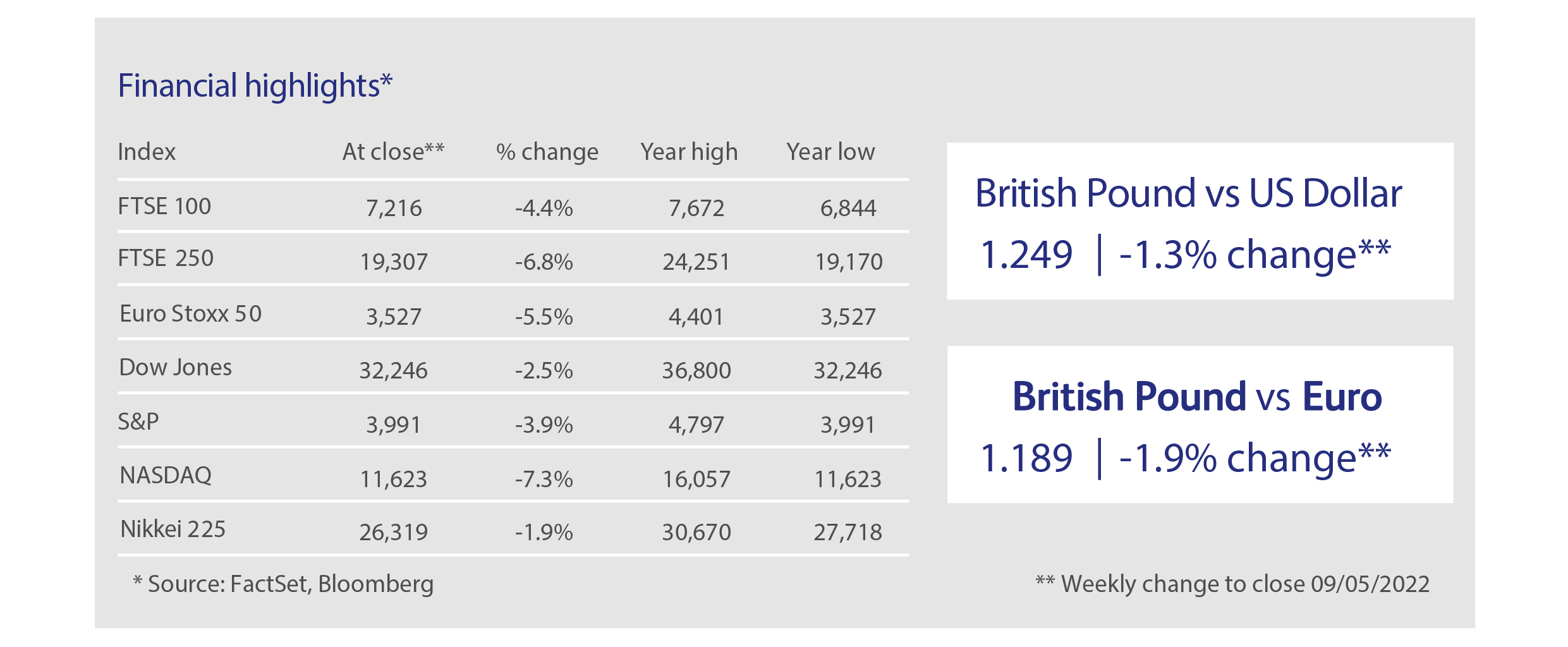

All of this may have been widely expected but it still did not stop volatility from continuing to engulf developed stock markets across the globe. After posting positive performance in the lead up to the interest rate announcement (and even posting a 3.0% gain on the day of the announcement), the bellwether S&P 500 index fell some 3.4% the following trading day and finished the week at its lowest level of the year. Its negative weekly performance marked the first time in over a decade that it has recorded negative performance for five consecutive weeks. The VIX Index (a measure of expected stock market volatility) correspondingly and unsurprisingly traded near its highest level of the year.

Meanwhile, in China the ‘zero-Covid’ policy means that Shanghai is entering its second month of full lockdown and Beijing is now also in partial lockdown with restaurants and gyms plus other public venues remaining closed at present. The strict action by the Chinese authorities has already had a clear negative effect on economic activity in Shanghai and indeed China as a whole. For example, data from Fitch for April suggests that traffic congestion, subway passenger volume and other high-frequency indicators were at their weakest since the outbreak of the pandemic in early 2020.

The Chinese government, including the People’s Bank of China, has pledged to step in to support economic growth with measures including the bringing forward of the construction of certain infrastructure projects. Whilst there is no reason to doubt that the Chinese government has both the desire and crucially the means to make good on their pledges, it is the potential knock-on effect to the global economy and its supply chains that is perhaps more difficult to quantify at the moment or indeed fix with a sticking plaster.

Economic growth forecasts for China are already being pared back and the risk of knock-on effects throughout the rest of the world are real. Against a backdrop of interest rates being increased across the developed world and growth slowing in China, there is a growing fear of a global recession at some point along the line. It remains to be seen for how long and how strictly the Chinese authorities will pursue their ‘zero-Covid’ policy. So for now at least, the main question at the top of many agendas remains whether and at what pace developed world economies can withstand the effects of monetary policy being tightened.

Uber appears to be winning the battle of the online taxi companies against Lyft, after the two competitors experienced a wildly different first few months of 2022. Both companies have been hit by a shortage of drivers caused by the pandemic, just as demand is rebounding, but Uber seems to have found new drivers without having to offer new incentives. Uber’s first quarter revenues rose 136% from the same (lockdown-affected) period last year, and management delivered a rosy outlook. Shares in Lyft plunged along with profits after the company confessed that it will continue to spend millions of dollars on incentives trying to lure drivers back into driving. Furthermore, the number of active riders, and the revenue per rider, both declined.

The shares of e-commerce company Shopify continued to struggle, falling to their lowest levels since April 2020 as the company reported first quarter profits that fell short of consensus market expectations. The Company’s President has been keen to try to highlight the longer-term growth opportunities for the business as it repositions to try to also help retailers with physical in-store point-of-sale services. Despite the poor share price performance, Bloomberg consensus expectations are for sales to grow 28% in 2022 to almost $6 billion.

Airbnb reported its first ever quarter of positive adjusted EBITDA as its first quarter results exceeded consensus analyst expectations. With demand for travel increasing, the company saw over 100 million nights and experiences booked for the first time during a single quarter. Despite giving an initial boost to the share price in after hours trading, Airbnb shares still ended the week down some 21.9% amidst the wider market sell off.

Sports clothing manufacturer Under Armour saw its shares fall some 33.7% over the week as it announced that it expects revenue growth of between 5 – 7% for the current fiscal year. This pales in comparison to the 27% growth achieved in the previous fiscal year, with supply chain issues caused by China's Covid-19 measures cited as a specific reason for subdued revenue growth.

Highlights

Calendar

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.