17 May 2022

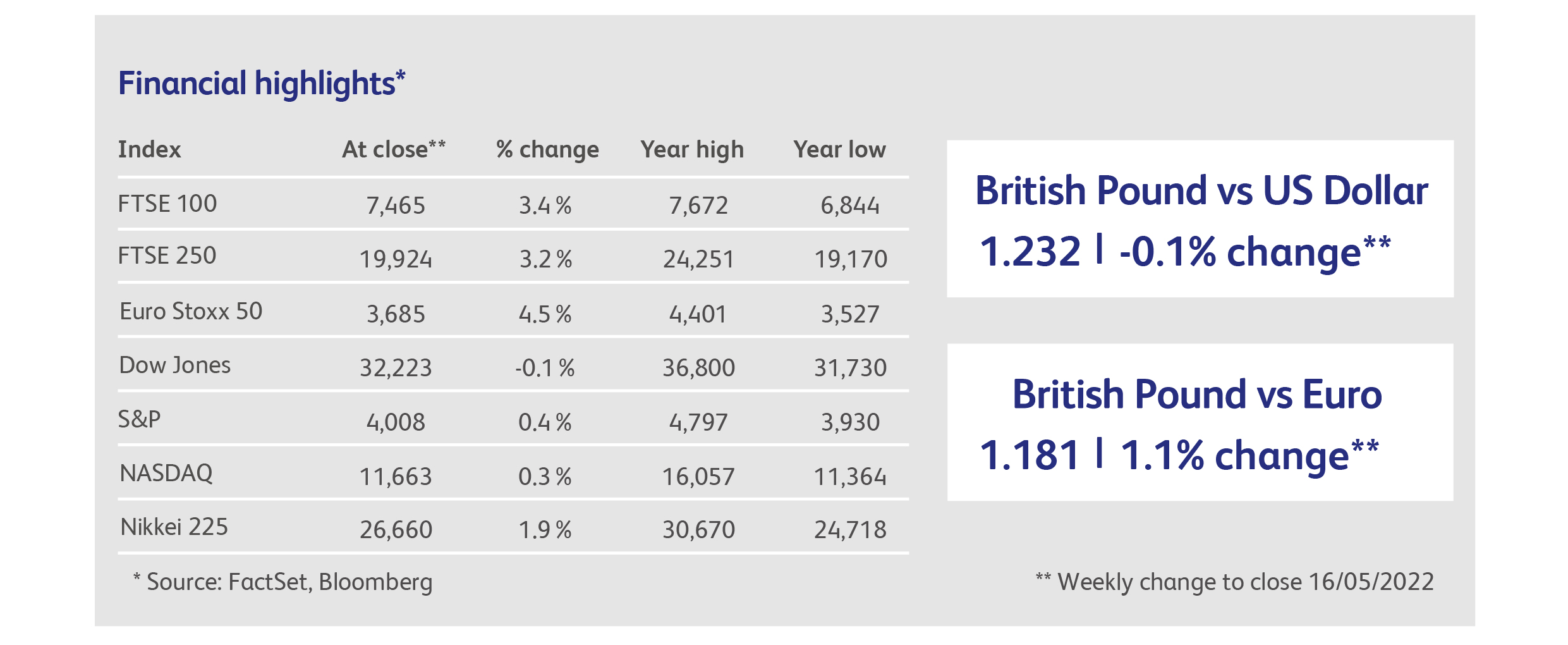

UK and continental European stockmarkets managed to bounce last week, but it was cold comfort after the declines of the last month or so. American markets could not follow suit, and weren’t helped by another shock from the monthly US inflation data. Nothing has yet appeared to alter the picture of persistent inflation and slowing economic growth. In recent weeks, economists have taken a hatchet to their US economic growth forecasts, having already done that for their European forecasts earlier in the year.

US investor sentiment won’t be helped by developments in the domestic housing market, where mortgage rates have gone ballistic in anticipation of multiple interest-rate hikes by the central bank. Mortgage rates have jumped by more than 2 percentage points since interest rate expectations turned up in September, driving up average monthly mortgage payments by about 50%. The prognosis for house prices is not good but, nevertheless, the hope is that an absence of available houses for sale will offset the impact. It’s a similar story in the UK, where mortgage rates have risen more sharply over the last six months than in any period since 2003. The surge in mortgage costs in both the US and UK probably has yet to peak.

Notwithstanding these issues, or the fact that US government bonds have taken a historic battering this year, the US dollar continues to push higher, and is up a massive 9% this year on average against other currencies. In fact, the US dollar has been a fairly reliable safe haven in times of market stress for the past 40 years, especially for sterling-based investors. With more fall-out expected from the Ukraine war in Europe, the UK rattling its sabre on Brexit again, and China’s economic slowdown ongoing, there seems little to stop the dollar’s rise. The dollar even seems to have supplanted gold as a favourite in times of trouble, with the latter dipping below $1,800 per ounce during the week, and now flat on the year in dollar terms. As China is the biggest buyer of gold, there was speculation that Covid-related restrictions there may have temporarily dampened demand.

The Chinese stockmarket has enjoyed a bounce recently following assurances from the government that support for the economy would be forthcoming, plus the prospect that anti-Covid lockdowns will eventually come to an end. The upside potential is significant: the Hang Seng China Enterprises Index, which comprises Chinese companies listed on the Hong Kong stockmarket, is currently at levels last reached in 2006, which also happens to be below the level it touched in 1993. However, investors hoping for an end to China’s zero-tolerance approach to Covid, as well as the consequences for supply chains and inflation in the western world, will have been disappointed when the government withdrew as host of the 2023 Asia football cup. Given that this competition is more than a year away, the withdrawal suggests that the government will actually be doubling-down on its zero-Covid policy.

Those investors who avoided cryptocurrencies had an occasion to pat themselves on the back last week after a major so-called “stablecoin” lost its peg to the US dollar and crashed in value, wiping out its sister cryptocurrency and $45 billion of investors’ money. The collapse of TerraUSD sent shockwaves throughout the cryptocurrency world, wiping hundreds of billions of dollars off other crypto asset values. Investors’ focus has now shifted to the biggest of the stablecoins, known as Tether, which is valued at about $70 billion. The debacle virtually ensures that US government regulation will soon be expanded to cover the crypto industry.

Apple has lost its crown as the world’s most valuable company after another hit to its share price, which fell 7% over the last week and is now down 20% from its highs of early April. That decline partly explains the lacklustre performance of the S&P 500 stockmarket index over recent weeks, because Apple is its largest component. The new world leader by stockmarket value is Saudi Aramco, the Saudi Arabian state-owned oil company, which posted a profit of $40 billion for the first calendar quarter, and whose share price has now grown by 46% since the company’s listing in December 2019.

Twitter’s share price crashed again after bidder Elon Musk again raised the possibility that he might renew his offer at a lower price. Musk, who is also the founder of Tesla, has lost enthusiasm for the deal ever since announcing it, and spent the last week questioning Twitter’s calculation of fake users. Twitter’s stock price is now 31% below the price of the consortium’s offer. Meanwhile, in a blow to economic forecasters, Musk has expanded his talent-set to include economic prognostication, telling a conference that the American economy is “probably” in a recession that will last for perhaps 12-18 months.

China’s fourth largest property developer, Sunac China Holdings, missed a payment on its dollar-denominated bonds and faces the prospect of default and restructuring. The company’s dollar bonds, which traded as high as 80 cents on the dollar a few months ago, fell below 30 cents. Sunac is the biggest Chinese property developer to miss a payment this year, and has about $8 billion in dollar debt outstanding.

Goldman Sachs belied its reputation for hard-nosed capitalism when it introduced unlimited holiday allowances for its most senior staff, as well as an extra two days off a year for junior staff. All US staff will now be required to take three weeks off a year, according to the financial news service Bloomberg. Unlimited holiday allowances are already a common feature at technology companies, apparently, and the move reflects the increasingly competitive market for attracting and retaining talent.

Highlights

Calendar

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.