14 June 2022

Movements in capital markets are increasingly being driven by two economic factors, inflation and interest rates, that are beyond the ability of individual investors to control. While a particular company’s prospects still matter, as evidenced by the impact of recent profits warnings in the retail sector, changes in portfolio values are more likely to reflect the latest news on rising prices, the reactions of central banks through interest rate policy, its likely effect on the economy and, ultimately, on corporate profits.

That news was particularly bad last week, which was enough to scuttle the recent rally entirely and send both stock and bond markets to new lows for the year. Firstly, the European Central Bank outlined plans to raise rates for the first time in over a decade. A hawkish tone had been anticipated since the disappointing inflation data of the previous week but, in the event, markets still managed to be rattled. To complicate matters, the ECB’s battle is not just with inflation, but with the markets themselves, as seen in the growing dislocation between the bond yields of Italy and its less credit-worthy neighbours, versus those of Germany and its more well-heeled neighbours. While still a long way from the levels of the Eurozone Crisis of 2011 and 2012, the gap is widening, and investors are fretting that there is no new plan in place to prevent this so-called “fragmentation”.

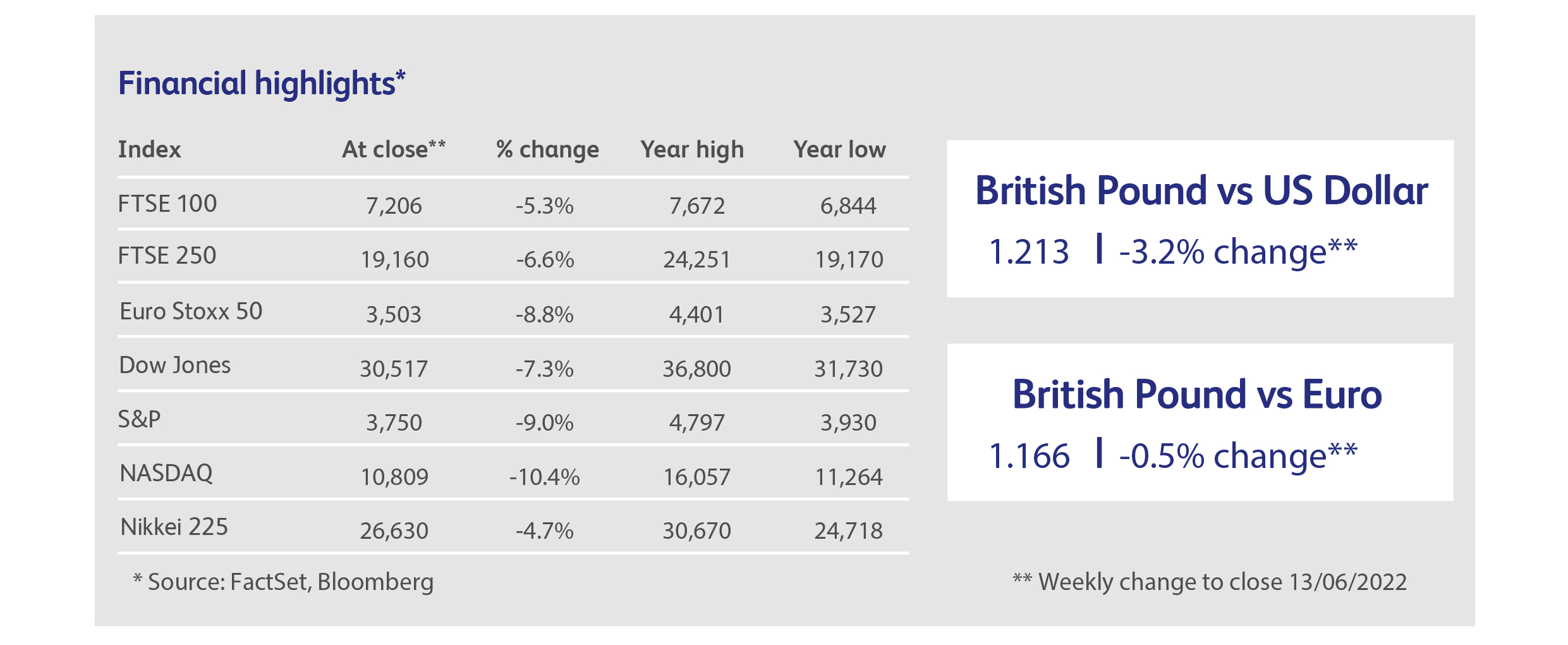

This news was followed by inflation data for the US that exceeded expectations, prompting a mini-panic that spread across global capital markets. Surprising accelerations in the rate of inflation have been the norm for the last six months; what was really shocking this time was the strength of the market reaction. The S&P 500, the world’s largest stock market by value, fell 9% in three days, and is now down more than 20% from its December peak, denoting the official occurrence of a bear market. Short-term US government bonds, traditionally a safe haven for investors, had their worst day since 1987. The US dollar on the other hand, a genuine safe haven, rose 3% against other major currencies.

It’s not clear why markets chose this inflation report to lose control: economists pointed out that so-called “core” inflation, which excludes the more volatile prices of food and fuel, actually fell for the third month in a row. But investors were not impressed by such niceties and, in any case, people still have to buy food and fuel. The over-riding concern seems to be that central bankers have fallen behind in the fight against inflation, and will have to raise rates more and for longer, inflicting more damage on the economy. This will only increase the hyper-sensitivity of markets to these factors, and it could well be the case that a trough in asset prices will only be reached if inflation is seen to have peaked.

Attention now turns to the US central bank’s meeting this week, the timing of which, coming so soon after last week’s mini-panic, imparts an unusual significance. Chairman Powell has the ability to destabilise markets further by upping his anti-inflation rhetoric, or he can throw investors a bone by focusing on core inflation measures and the positive trends that are apparent there.

US discount retailer Target Corp produced its second profit warning inside a month, as the company makes drastic price-cuts to shift unsold stock. The company also blamed unusually high transportation and fuel costs. Strangely, the further reduction in expected operating margins had little impact on the share price, whereas the original profit warning in May had caused a 30% decline.

The strategic decision to target the “metaverse” has plunged Meta Platforms, formerly Facebook, into a darker reality all of its own. This week the company ceased development of its high-tech, wrist-activated smartwatch, which had been in development for two years. This was perceived as a blow to the prospects for electromyography, the use of one’s body to issue instructions to digital devices, which is a key technological component in the development of the metaverse. Meanwhile, further information emerged about the resignation of the company’s Chief Operating Officer, Sheryl Sandberg, including an investigation into the usage of company resources on private projects, and comments that suggested she did not want to participate in the multi-year metaverse project.

Intel became the latest corporate behemoth to talk down the economy, when its Chief Financial Officer described economic conditions as “clearly” weaker at a conference last week, and warned of the negative impact on the semiconductor industry. Loose lips sink ships, and investors promptly marked down the values of the entire semiconductor sector. A profit warning by Intel, whose stock is now down 24% year-to-date, is widely expected.

The big, global oil companies may have been among this year’s most successful investments, but they come with a large dose of political risk. President Biden himself highlighted Exxon’s super-profits, when he described the company as having made “more money than God” in a speech last week. This ominous statement follows the UK government’s decision last month to levy a windfall tax on the country’s oil and gas sector.

Highlights

Calendar

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.