Banner.jpg)

2 August 2022

It was another week in which stock and bond markets rose, overcoming worrisome news about inflation’s impact on the economy. The case for bonds is straightforward: the robustness with which central bankers are hiking rates has persuaded bond investors that they can bring inflation under control, even if it means causing a recession. Recessions are not necessarily bad for bonds and, after a historically big sell-off, valuations are much more attractive. The case for stock markets is not so simple: higher bond valuations do make equities more attractive by comparison, but equities have still to run the gauntlet of further inflation and interest rate rises, their combined impact on consumer spending and, more importantly, on corporate profits. It was remarkable that equities managed to continue their rally of the past month because the week’s data failed to offer much support in these respects.

The US Federal Reserve’s decision to raise rates by 0.75% had been telegraphed broadly in advance, and was widely expected. More striking was the Fed’s decision to abandon its policy of providing guidance to markets on likely rate rises, instead preferring to react to the data as it sees fit. The gloves are off, in other words, in the fight against inflation, and investors can expect considerably more volatility around central bank decision-making. The European Central Bank recently advocated the same approach, so this is a synchronised message from central bankers that taming inflation is more important than placating markets. Stock markets somehow interpreted this news as being less hawkish than expected, and the American S&P 500 stockmarket index ended the day up an impressive 3%. The following day, GDP data showed that the US economy was already in recession, having suffered two consecutive quarters of a shrinking economy. But investor sentiment was undimmed and the S&P 500 rose another percent. To end the week, crucial data on US wage growth showed that it had accelerated back to its highs of the past year, something that will definitely catch the Fed’s attention. The S&P 500 rose again.

Friday also brought terrible inflation data from the Eurozone, with price rises accelerating in food, alcohol, tobacco, the service sector and non-energy related goods. The only relief was in energy prices, but these have still to navigate the shenanigans surrounding the Nord Stream gas pipeline. A month ago, this inflation data would have sent assets into a tailspin but, remarkably, the Euro Stoxx 50 stock market index rose over a percent on the day.

In the background, meanwhile, the drumbeat of earnings reports from US companies for the second calendar quarter, which coincides with the half-year for many European companies, suggested that profits had held up relatively well versus expectations. The energy and banking sectors were particular bright spots. However, expectations generally had already been lowered ahead of the earnings announcements, and are now coming down fast for the third calendar quarter. On one hand, it’s a bullish sign that markets can override so many potential negatives: it’s always said that markets must “climb the wall of worry” in order to rise from the bottom. On the other hand, as negative data-points accumulate there is the potential for a void to open up between investor sentiment and the economic reality.

The technology sector has delivered a diverse range of outcomes in its earnings reports for the second calendar quarter. Leading the pack was Apple, the world’s most valuable company, whose revenues and profits narrowly beat the expectations of analysts. Apple’s iPhone and iPad divisions performed better than expected, but weakness was apparent in the iMac and “wearables” businesses. Supply chain problems were not as bad as originally feared. Following a rough start to the year, Apple is re-establishing its position as a safe haven in the technology sector.

Amazon’s business model seems to be similarly unassailable, with the company projecting growth in revenues of a brisk 17% in the current calendar quarter. Amazon was able to avoid a slowdown in turnover which has been affecting its rivals, and also implemented an increase in the cost of Amazon prime membership without losing revenues. The company also made progress in addressing excessive warehouse and transportation costs.

Samsung Electronics was unable to reproduce Apple’s success, despite being the world’s biggest manufacturer of smartphones. Revenue in its semiconductor division was the problem, though, up by 24% on the prior period, but still managing to miss analysts’ estimates by 22%. The boom in sales of semiconductors has ended in a bust, with manufacturers suffering a hangover from excess inventory accumulated during the pandemic. The semiconductor sector more broadly took another hit when Qualcomm and Intel both issued profit warnings.

At the other end of the tech spectrum, Meta Platforms, owner of Facebook and Instagram, reported its first ever decline in revenues, due to shrinking sales of advertising, a direct result of the slowdown in consumer spending. The e-commerce specialist Shopify managed to grow its revenues by 16%, but signalled an end to its more rapid, pandemic-fuelled expansion. The company is now preparing for a world in which e-commerce spending reverts to its pre-pandemic norms.

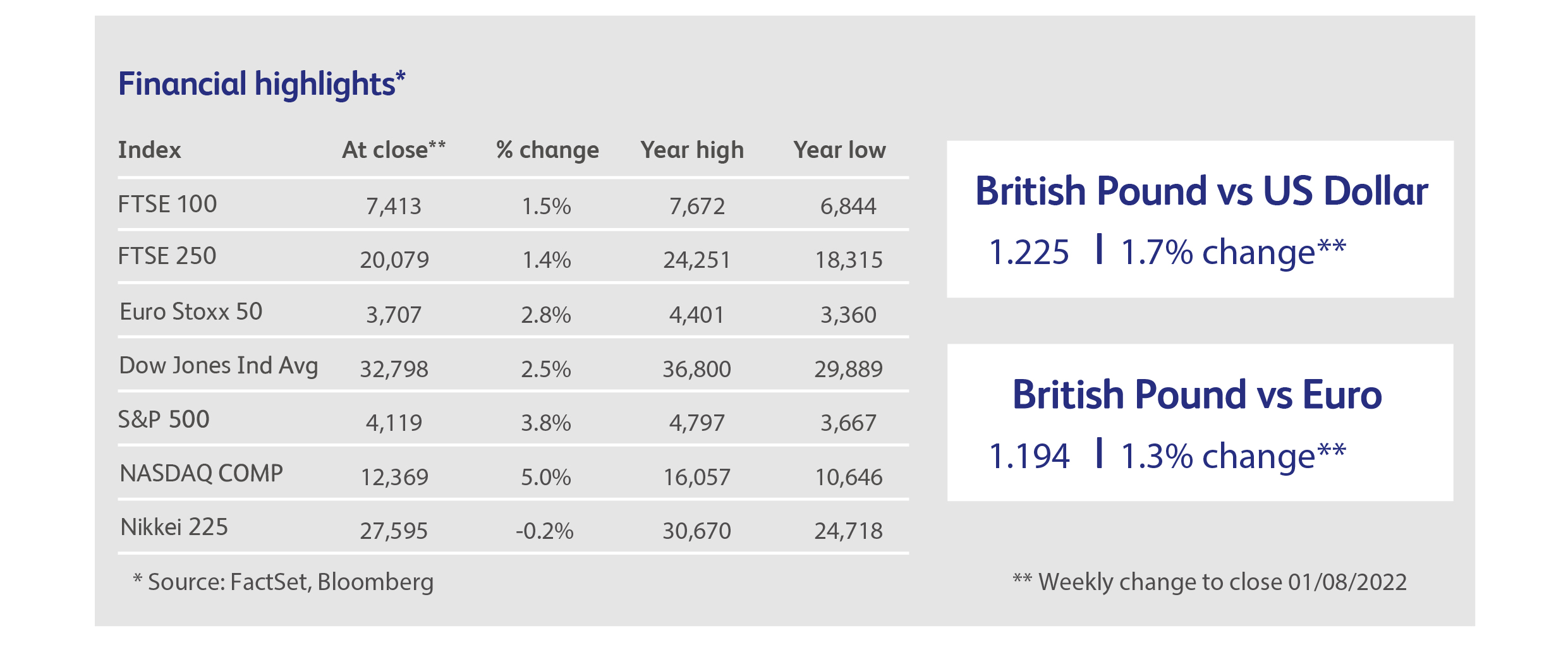

Highlights

Calendar

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.