6 September 2022

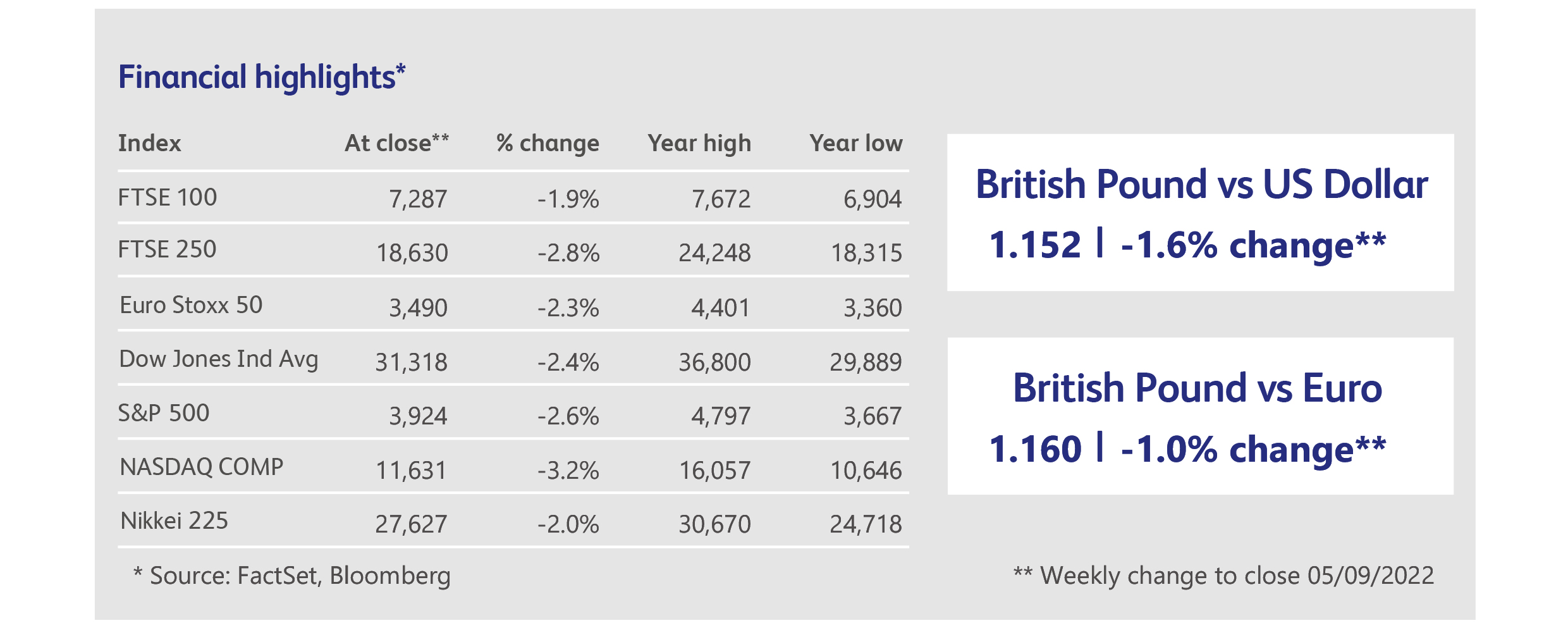

Capital markets continued their decline in the wake of the US Federal Reserve chairman’s speech of the previous week, with the pain spreading across a wide range of asset classes. US stock markets failed to muster any kind of rally but, at least, they are still well above the lows reached in June. European stock markets, on the other hand, are retesting their lows of the year, following news that Gazprom had ceased natural gas supplies to Germany entirely. This was not wholly unexpected, but it does add to the crisis in energy markets and to the threat of higher inflation for longer. The realisation that energy bills are going to spiral upwards yet again has governments in Europe rushing to abandon free markets and impose fixed price-regimes. The implied subsidies are enormous - £130 billion in the UK if Prime Minister Truss’ new plan gets the go-ahead, equivalent to about one third of total government spending on the pandemic. European governments meet at the end of the week to outline their latest thinking, but the current range of aid packages already amounts to EUR375 billion. With such large numbers at stake, windfall taxes on the utility sector are very much on the agenda.

Governments are caught between a rock and hard place: these programmes will alleviate hardship and support economic growth, but they also raise the risk of prolonging inflationary pressures that already extend far beyond the energy sector. That leaves central banks with an even tougher task, facing huge government stimulus spending at a time when they are trying to tame the beast created by pandemic stimulus spending. It’s not the first time that interest rate policy will be at odds with government policy: soon after the Credit Crunch, governments adopted austerity policies just as central bankers had made it possible to spend their way back to growth; now, ironically, it seems that governments are hooked on spending just as central bankers are trying to reign it in.

Tough talk by central bankers over the last week seems to have convinced bond markets that rates are going to go higher, and bonds took a beating with yields across-the-board nearing their highs of the year. The UK bond market deserves special mention, though not for the right reasons, as yields on British government bonds rocketed at the same time as the pound plunged, a toxic combination that reflects a mix of currency weakness, high energy costs (relative to other nations), soaring inflation plus recent deterioration in the economic data. Not the greatest hand ever dealt to a new prime minister.

To be fair, much of the pound’s weakness is due to the strength of the US dollar which, feeding off fear in markets, rose to a 30-year high against other major currencies. It’s hard to see how this trend can be broken while the Federal Reserve leads the charge on interest rates and European economies suffer from ever-worsening stagflation. Eventually, in theory, the strong dollar should deflate the cost of imports into the US, alleviating inflation pressures and enabling the Federal Reserve to relax its hawkish stance. This, in turn, should serve to weaken the dollar against other currencies. But this is still some time away. For now, markets are increasingly reliant on a resolution to the conflict in Ukraine in order to return to a more familiar equilibrium.

Shares in electric car manufacturer Polestar Automotive Holdings dropped 12% despite the company reporting revenues that nearly doubled in the first half of its financial year. The Swedish-based company is struggling with volatility in currencies and inflation in input costs, which have exacerbated operating losses and raised the prospect of a cash squeeze. Polestar is backed by Volvo and the Chinese car manufacturer Geely.

Seagate Technology Holdings, the world’s biggest manufacturer of computer hard drives, announced a second profit warning in as many months, as demand from consumers faltered and the company drastically reduced its forecast revenues for the current calendar quarter. The company’s comments echo recent reports by HP and Dell Technologies, though Seagate specifically highlighted Asia as a weak spot.

Despite the woes affecting consumers, they haven’t yet stopped drinking. In fact, Pernod Ricard’s results suggest alcohol consumption is increasing, as the company beat expectations for its financial year in both revenues and profits. The company’s sales, which primarily consist of whisky and vodka, grew 17% during the last year.

Despite all the political problems associated with Chinese firms listing in the US, some recent Chinese debutants have experienced bizarre, astronomically positive price moves on their first day of trading. The most recent was Addentax Group Corp, a textile printing company, which experienced an initial 13,000% rally after listing on the Nasdaq stock exchange. The rally took the company’s valuation to nearly $20 billion, before settling down to a valuation of $1 billion by the end of the day. On the company’s second day of trading the shares shed another two thirds of their value, and the valuation ended the week at a mere $300 million. Seven other Chinese launches in the US this year have experienced similar price anomalies.

Highlights

Calendar

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.