25 October 2022

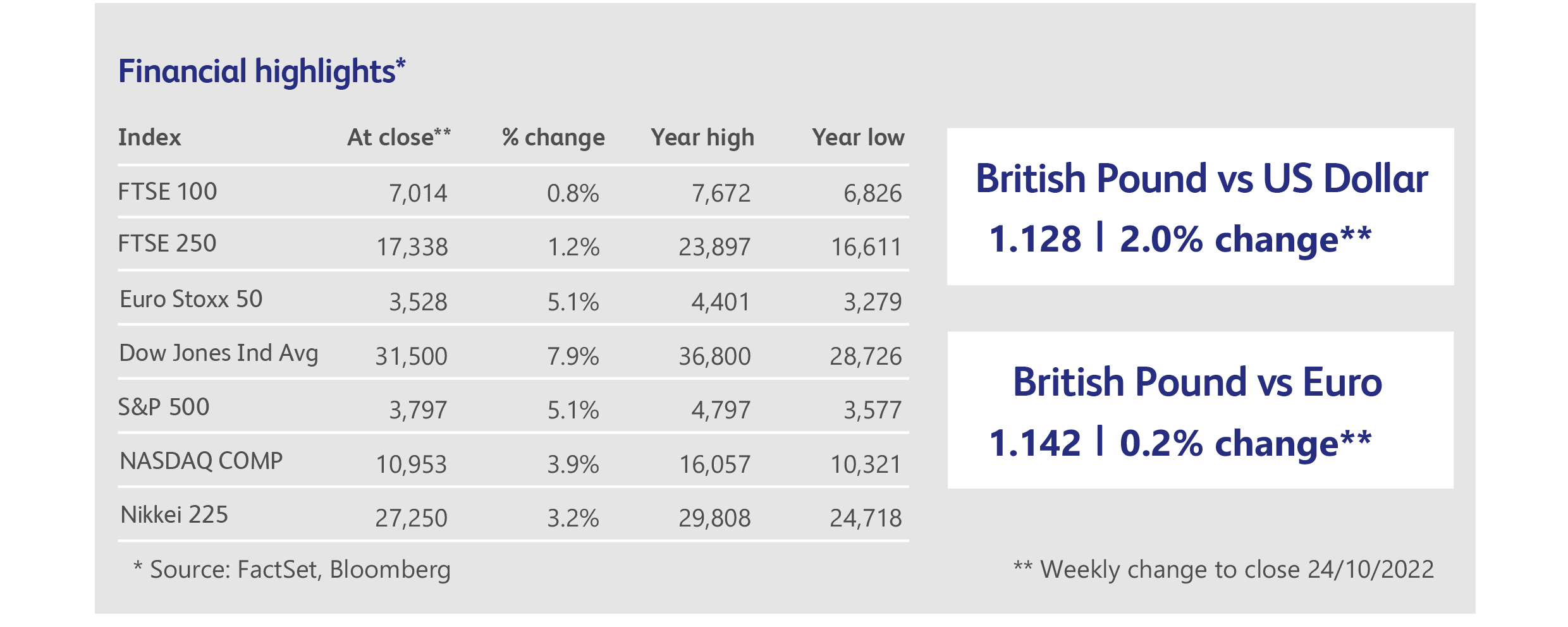

Stock markets managed to build on their rally of the previous week as the flow of news turned from unremittingly bad to merely “mixed”, and the steady drumbeat of company profit warnings was occasionally drowned out by some surprisingly upbeat reports. Stock markets were even able to shrug off another dismal performance by bond markets, helped by a relatively steady week for the US dollar.

The quarterly parade of earnings reports was the highlight of the week for investors, with notable disappointments in Tesla, Adidas, US banks in general, and the on-line advertising sector. Fortunately, expectations seem to have been reduced to such an extent that a lot of the bad news is already priced in. About three quarters of reporting companies have beaten expectations, though the extent of the outperformance is low by historical standards. Positive surprises were reported by several companies, including Netflix, United Airlines, LVMH and IBM (for more detail see the Stock Focus section).

Comments from officials at the US Federal Reserve, to the effect that rates would have to rise to “well above” 4% this year and then to stay at such high levels, threatened to derail the rally. Fortunately, these were more than countered by Friday’s Wall Street Journal article suggesting other Fed officials are not keen to continue hiking rates so aggressively at every meeting. As the week ended, sentiment in Europe was helped by falling natural gas prices after European leaders agreed joint action on a package of measures designed to constrain energy costs. Natural gas prices fell over 20% during the week and are now down 70% from their August peak. The news that Rishi Sunak’s leadership bid would be uncontested calmed British asset markets, and gilt yields fell significantly as buyers gained more confidence.

The publication of China’s latest batch of economic data had been suspended during the 20th Party Congress, giving rise to fears that it would either be disastrous, or subject to manipulation. In the event, China’s economy appeared to have enjoyed a post-lockdown bounce in the third calendar quarter, produced by a combination of growth in industrial production, construction and services. The property sector remained the main drag, but even this moderated from the rate of decline in the previous quarter. The positive data, however, were overshadowed by the consolidation of power announced at the Party Congress under President Xi Jinping, which dashed hopes for a rapid end to China’s rigorous anti-Covid policy. Xi’s loyal protégé, Li Qiang, will become second-in-command despite having little top-level experience and being blamed for Shanghai's disastrous lockdown earlier in the year. Li Qiang will be responsible for running the economy at a time of the slowest growth China has seen for decades — mainly caused by Xi’s refusal to ease the zero-Covid policy. Chinese stock markets reacted to the news by plunging across the board, with the Hong Kong-based Hang Seng Index falling below a level reached in 1997. The Chinese currency depreciated further against the US dollar and is now at the level last seen during the Credit Crunch. So far, the impact has been restricted to sales of Chinese assets by foreign investors, but the geopolitical implications run deep and, unfortunately for investors, China remains the world’s main engine of economic growth.

Netflix results provided a boost to investor sentiment when it reported a return to growth in all geographic regions, prompting a 14% rally in the company’s shares and a copycat rally in shares of all companies involved in movie streaming services. Revenue grew by nearly 6% for the third calendar quarter following several successful releases of new films and miniseries.

Luxury goods firm LVMH, which owns the Moet, Hennessy and Louis Vuitton brands, continued to defy the recessionary forces and reported sales that surged by 22% in the third calendar quarter. The company’s Chief Financial Officer argued that its clients are more exposed to stock market shocks than to economic slowdowns.

Economic bellwether American Express reported provisions for bad debts in the third calendar quarter that were significantly higher than the expectations of those analysts following the company, and the rate of credit write-offs jumped by 40%. The stock fell by 7% on the news, initially, before rallying back to close the day down less than 2%, perhaps because the company’s revenues benefited from the impact of inflation on purchase prices of goods and services. Revenues climbed 24% to an all-time high.

All eyes are on the earnings announcements for the technology sector due this week, which includes five of the biggest technology firms: Apple, Microsoft, Alphabet, Amazon and Meta Platforms (formerly Facebook). The group represents about one fifth of the US stock market, so any unexpected news has the potential to impact investor sentiment. According to estimates compiled by Bloomberg, investors are expecting a 22% decline in profits for this group in the third calendar quarter versus the same quarter last year.

Highlights

Calendar

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.