29 November 2022

Markets continued to demonstrate resilience last week despite an accumulation of problems in China which threatened to undermine sentiment. Along the way, investors were cheered by European business activity surveys that were significantly better than expected, leading to comments by some optimistic investment strategists that any recession is likely to be relatively shallow. This view may be coloured by the 20% rebound in markets from their recent lows, however, and a cohort of dismal economists were quick to emphasise that business activity is still shrinking. Though inflation appears to have peaked in the US, and is expected to have already peaked in Europe, it’s too early to say that consumers will start to spend again. For a start, they may not have the financial resources: higher living expenses, even if they are rising at a less rapid rate, are still negative for economic growth. Given our meagre experience of inflation over the past few decades, it’s difficult to say how much consumers have already been impacted by inflation and how much of that impact is still to be reflected in their behaviour.

At least the glass is half-full or half-empty depending upon your point of view; this is better than the completely empty glass that markets were contemplating two months ago. US Federal Reserve Chairman Powell has been one of the main protagonists for the empty glass but, recently, a split appears to have become apparent between his singular focus on inflation, even to the extent of sacrificing the economy, and the softer views of his fellow Fed governors. Investors were encouraged by the minutes to the Fed’s last meeting, released last week, which provided further evidence of a backlash against rapid increases in interest rates. Participants noted the weakening in the labour market, consumer and business spending, commodity prices and rental costs, and a “substantial majority” judged that a slower pace of rate rises would soon be appropriate.

China currently presents the biggest threat to the rally. China’s daily Covid infections reached a record high during the week, prompting local authorities to re-impose lockdowns in major cities. This was a major blow, given that the recent 25% bounce in Chinese stock markets had been predicated on the idea that the era of ultra-strict lockdowns was over. It will also be a blow to the Chinese economy, to companies with significant Chinese exposure and to hopes for an end to supply chain-driven inflation. Also last week the Chinese government fined the Ant Group, a large financial technology firm, $1 billion. This is highly symbolic, as it was the authorities’ treatment of this firm, and the subsequent disappearance of its founder, one of China’s most successful entrepreneurs, that signalled a broad-based attack on the private sector by the Chinese government, leading eventually to a 60% decline in Chinese stock markets. But commentators were quick to paint the fine as a positive, merely a slap on the wrist that signifies the end of the government’s anti-technology campaign. A bit more attention was paid when fights broke out between workers and security guards at a huge Chinese factory that manufactures iPhones, as employees grew angry with the strict anti-Covid working conditions. By the weekend, however, this local strife had gone national, with protesters taking to the streets and some even demanding the removal of President Xi Jinping. Coming so soon after Xi’s anointing as eternal leader, this is embarrassing. Markets initially sold off as investors contemplated the inevitable backlash from the Chinese authorities but, as at the time of writing, optimism appears to have triumphed.

Shares in Apple, the world’s largest company by market value, remained resilient despite violent unrest at its biggest manufacturing plant in China. Workers at the plant in Zhengzhou, known as iPhone City, stampeded out of the building after almost a month of Covid lockdown restrictions, pushing past security guards and prompting local authorities to call in anti-riot police. The problems were restricted to just a few hundred workers out of the 200,000 strong labour force at the factory, but estimates suggest the impact on the production of iPhones will run into the millions.

Manchester United shares enjoyed the type of success on the market that has eluded the team on the pitch, surging by over 60% in two days to their highest level since 2018. The rally was initially prompted by the announcement of a strategic review which could lead to the sale of part, or all, of the company. Later in the week, the Saudi Arabian sports minister stated that its government would support bids for the company.

No-one could accuse the Walt Disney board of ageism, having reappointed 71-year old former chief executive Bob Iger to the CEO role. Inconsistency is another matter, however, as the board had unanimously extended his predecessor’s contract only five months ago. An analyst following Disney described it as one of the worst leadership transitions in history. Nevertheless, the market loved it, sending the stock up 7% and adding over $100 billion to the company’s market value. The change may not resolve the problem of the heavily loss-making Disney+ streaming service, because Iger was a strong supporter of the project during his previous tenure.

The oil industry has been unusually exposed to global political events over the past year, and this trend continued last week when the price of oil fell to its lowest level in a year. The culprits were the European Union, which is proposing to cap the price of Russian oil, and China, where it became apparent that the relaxation of China’s zero-tolerance Covid policy is still some way off.

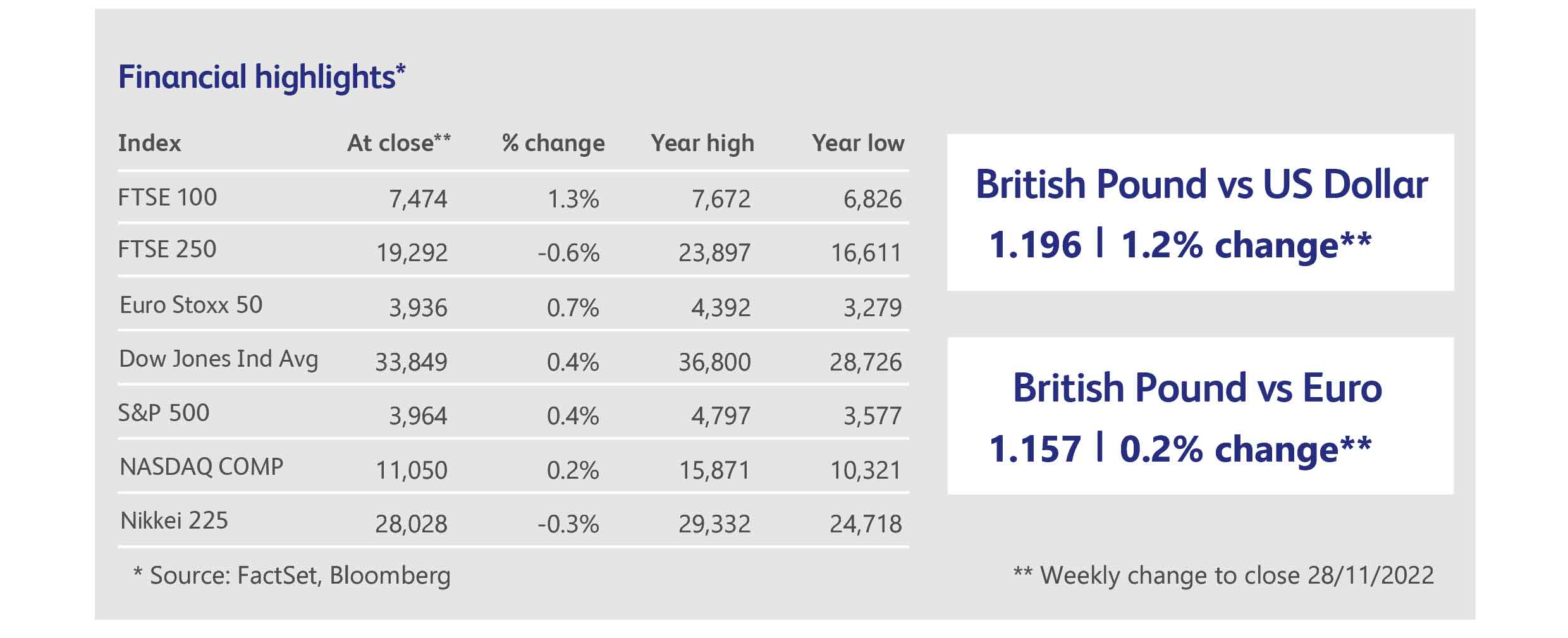

Highlights

Calendar

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.