20 June 2023

Last week saw UK labour data surprise to the upside as the April unemployment rate gave a figure of 3.8%, lower than the consensus estimate of 4.0% and the prior reading of 3.9%. Wage growth also accelerated as weekly earnings excluding bonuses was announced at 7.2% versus an estimate of 6.9% and a prior reading of 6.7%. This data is likely to reinforce rate hike expectations at the Bank of England’s (“BoE”) next meeting later this week. Markets are now pricing interest rates to reach as high as 5.7% by February 2024 versus expectations of 5.5% prior to this new data. It should also be noted that some expectations are suggesting interest rates will reach as high as 6% before the end of the year.

UK manufacturing data also announced last week showed the economy registering a modest 0.2% expansion in May. This, despite earlier forecasts of a 0.3% contraction in April. The services sector has been the largest contributor to growth on a quarterly basis and is up 0.3%. The negative impact of industrial action over the preceding months should also be noted. The economy is now estimated to be 0.3% above its pre-Covid levels in February 2020. This demonstrates that the economy is holding up better than expected, but analysts are still warning of recession risks as a result of the increasing rate hike expectations.

The Governor of the BoE, Andrew Bailey, acknowledged that inflation is taking longer than originally hoped to come down and stated that a policy review would be implemented. The BoE have continuously expressed that they are committed to bringing inflation back down to its 2% target. Although, as inflation remains stickier than expected, discussions are taking place regarding the risk of overtightening which could potentially cause significant damage to the economy. More dovish members of the BoE are arguing the point that there is little that policy can do to impact inflation in the short term. The same members are also expressing thoughts that as conditions in the mortgage market tighten it may do some of the heavy lifting for the BoE in lowering inflation.

That being said, UK consumers are less pessimistic about inflation in the second quarter based on the May BoE/Ipsos Inflation Attitudes Survey. The survey showed expectations for prices to rise 3.5% over the following 12 months. This is down from a previous figure of 3.9% in February 2023 and a peak of 4.9% in August 2022.

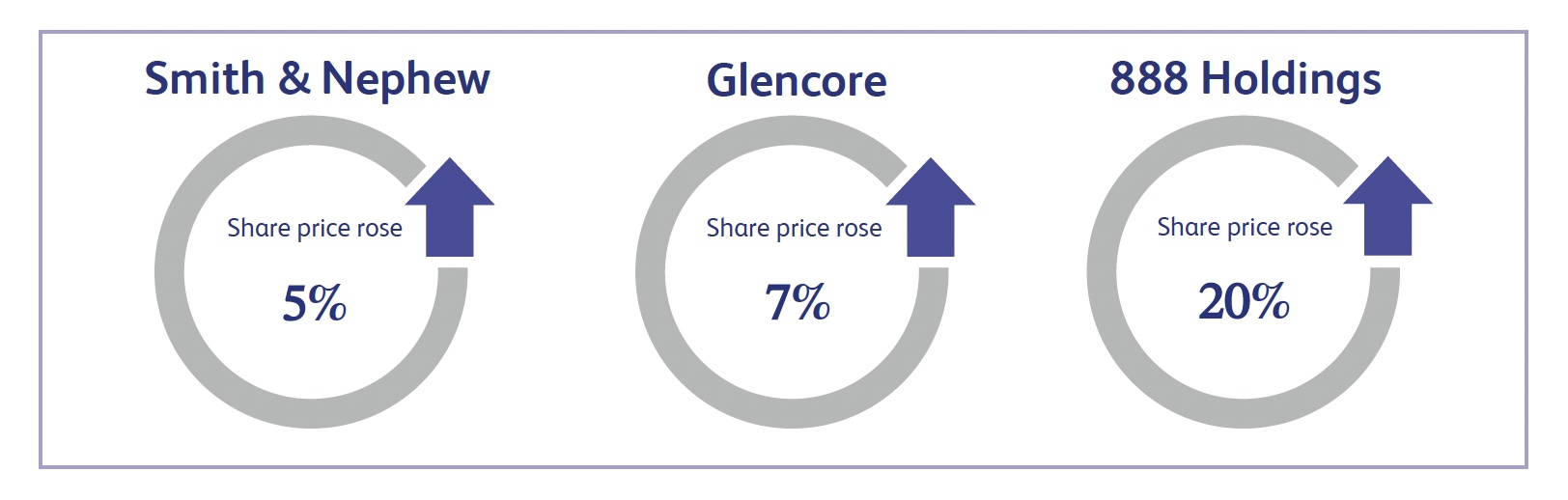

Smith & Nephew, the British multinational medical equipment manufacturer, saw its share price increase by approximately 5% last week. The increase in share price was triggered as a result of Smith & Nephew receiving Food and Drug Administration ("FDA") clearance for its AETOS Shoulder System. This is the latest solution in Smith & Nephew’s expanding Upper Extremity portfolio and is designed to maximise stability, preserve bone and maintain patient anatomy. The company also noted that total shoulder arthroplasty is one of the fastest growing segments in Orthopaedics with an estimated 250,000 procedures in the US by 2025.

Glencore, the multinational commodity trading and mining company, confirmed last week that it had submitted an alternative proposal to acquire Teck’s steelmaking coal business. Teck also confirmed that it was engaging with Glencore on the proposal. Glencore’s share price increased approximately 7% last week on the news. Glencore also announced that the company closed the sale of Cobar Mine, with Glencore receiving $775 million in cash and $100 million in shares.

888 Holdings, the owner of several popular gambling brands and websites, saw its share price increase approximately 20% last week. This was as a result of the company announcing the completion of the sale of its Latvian business alongside activist investors pushing for a management change. The stock has been under pressure due to several compliance failings and rising interest rates that have soured the £1.95 billion debt-heavy deal to acquire William Hill. Markets have therefore responded positively to the idea of new management in order to accelerate its existing strategy alongside finding new directions for growth.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.