7 May 2024

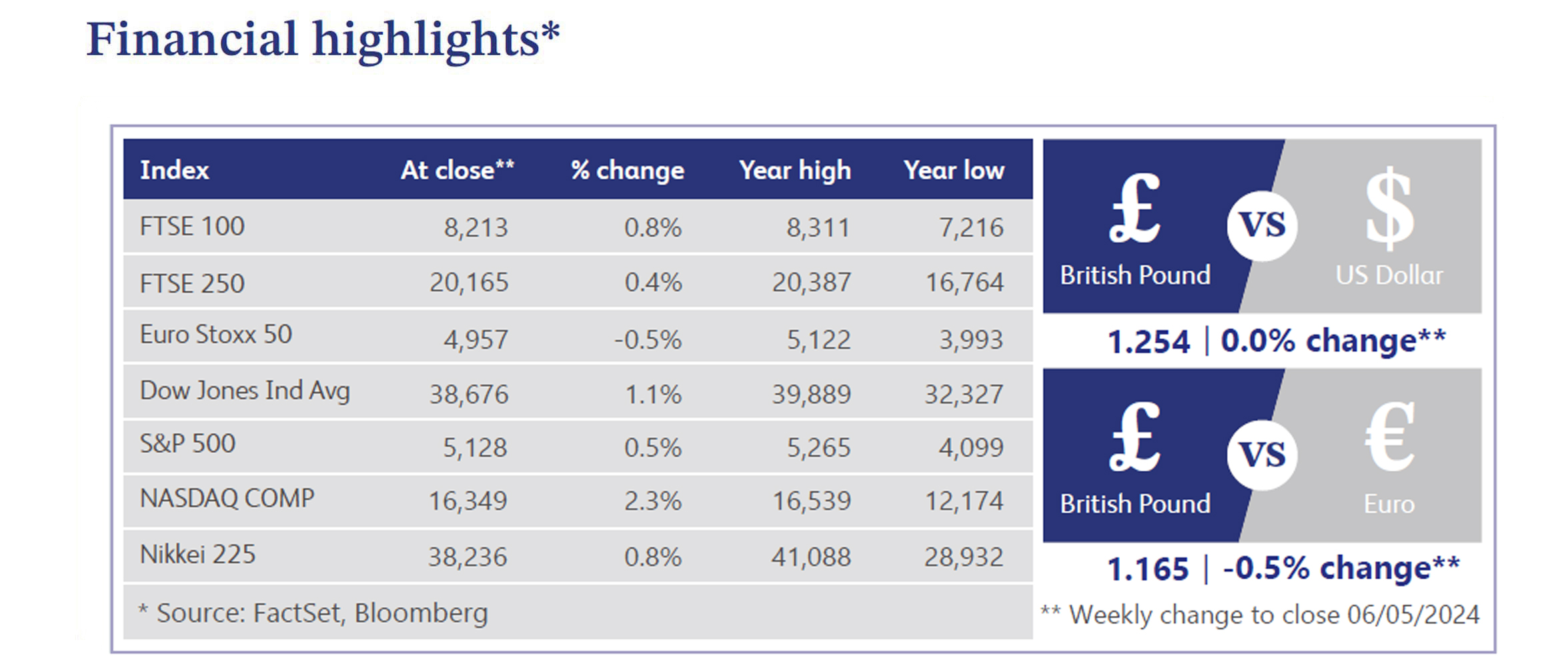

In anticipation of the Federal Reserve’s ("Fed") upcoming policy decision, the FTSE 100 and gilt yields saw modest increases. This decision is expected to influence the Bank of England's ("BOE") interest rate strategy. Currently, UK markets have dialled back interest rate expectations, predicting only 0.38% in cuts this year, with the first adjustment anticipated in the fourth quarter. This cautious stance comes despite the slowest rise in UK shop prices since December 2021, as reported by the British Retail Consortium. This reflects a notable deceleration in non-food price inflation and easing food costs.

On the global stage, US markets have shown resilience. After a period of decline, the S&P 500 and Nasdaq posted gains for the second consecutive week. Contributions from sectors such as big tech, paper, steel products, hospitals and China tech led to the rise. The week's gains in equities were largely fuelled by dovish signals from the Fed and encouraging economic data. April’s payroll report bolstered the soft landing narrative contributing to the uplift in equity performance. Data has also been published which suggests there is a balance between labour markets and advancing artificial intelligence technologies emerging. Despite these bullish indicators, the April ISM (Institute of Supply Management) Services report highlighted the ongoing concerns over stagflation and high inflation. The report showed that non-manufacturing firms’ business activity fell into contraction for the first time since December 2022, and there was an uptick in the Prices Paid index to the highest level since January.

Economic perspectives from the Organisation for Economic Cooperation and Development underscore fiscal pressures within the UK, forecasting sluggish growth and highlighting challenges posed by high taxation and public expenditure. These insights coincide with criticism from former BOE Governor, Mervyn King, who attributes the UK's inflation woes to a lack of diverse economic viewpoints and delayed responses from the central bank. Meanwhile, the costly legacy of the BOE's pandemic-era quantitative easing continues to burden taxpayers, with anticipated losses from bond purchases during the crisis projected to exceed £115 billion.

A report from EY-Parthenon showed nearly 19% of London-listed companies issued profit warnings over the past year, signalling persistent challenges in the business landscape. However, the frequency of these warnings slightly decreased from 77 in the last quarter of 2023 to 70 in the first quarter of 2024. The main reasons given, including contract delays and cancellations, highlight ongoing economic uncertainty. Consumer discretionary sectors have been particularly affected, where one in three warnings originated. Despite this, London's attractiveness for foreign direct investment has rebounded, reclaiming its top spot in Europe and signalling a resurgence in its global competitive edge.

There is optimism in the UK housing market as property asking prices have grown to near record highs. This trend is caused by robust mortgage approval rates, which are now at their highest since September 2022. Conversely, the rental market in London shows signs of price stabilisation, even as rental growth continues.

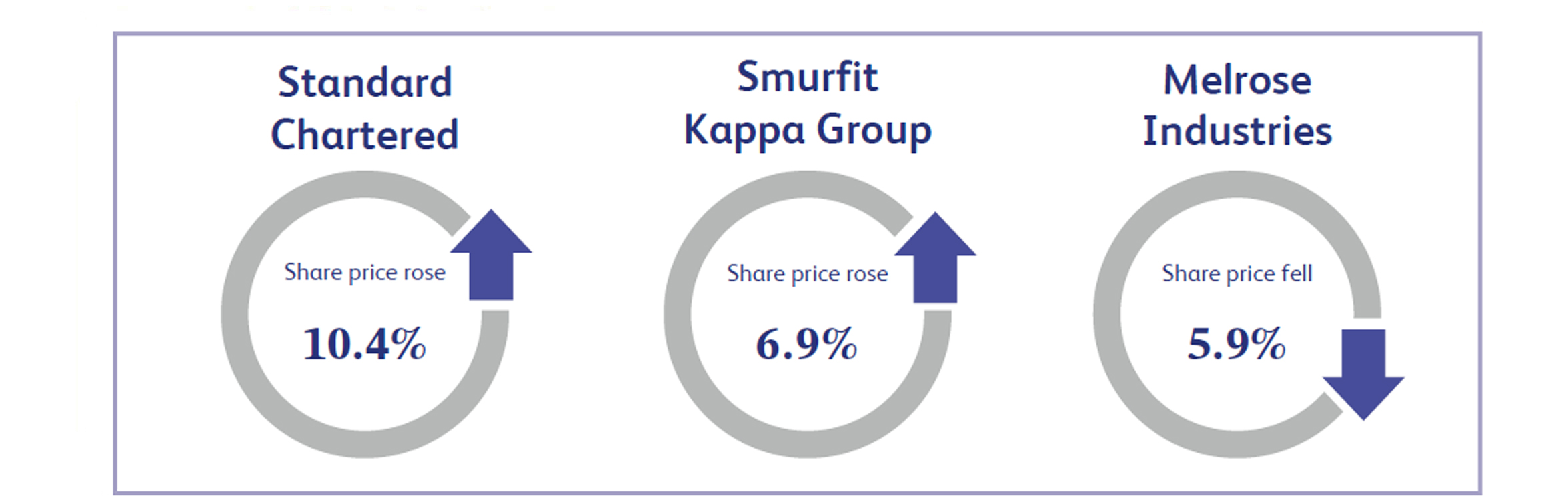

Standard Chartered, the international banking company, saw its share price increase by approximately 10.4% last week as the company reported its first quarter results. The company reported a strong set of results including underlying operating income of approximately $5.2 billion, beating analyst expectations of $4.7 billion. The company also announced a profit before tax figure of $1.9 billion, compared to last year’s figure of $1.8 billion. The company presented a strong outlook, increasing operating income guidance to be at the top end of their 5% to 7% range alongside continuing to increase the full year dividend over time.

Smurfit Kappa Group, a provider of paper-based packaging based in Ireland, announced its first quarter results last week which saw the company’s share price close the week approximately 6.9% higher. The company reported better than expected first quarter results which likely led to an increase in analyst estimates. The company reported revenue of €2.7 billion, a decline from last year’s figure of €2.9 billion. However, the company also reported earnings before interest, tax, depreciation and amortisation (EBITDA) of €487 million which beat JP Morgan’s estimate of €445 million. Despite figures not being as strong as the previous year, the company appears to have performed better than analysts expected.

Melrose Industries, the British manufacturing company, experienced a share price decline of approximately 5.9% last week as the company reported its first quarter results. The company reported that revenue increased by 8%, compared to the same period last year. Melrose’s engine division has shown strong progress with revenues increasing 21%. The company also reported that adjusted operating profit was up substantially when compared to the previous year. Melrose also confirmed that its full year guidance remains unchanged, including an expected 33% year-on-year increase in adjusted operating profit to £560 million.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.