20 January 2026

Last week the Bank of England ("BoE") released data showing unexpected resilience in November’s gross domestic product ("GDP"), which expanded by 0.3%, surpassing the 0.1% forecast and ending a two-month decline. The growth was driven by a rebound in both services and manufacturing, aided by Jaguar Land Rover’s recovery following a cyberattack, despite ongoing structural risks. At the same time, BoE Governor Andrew Bailey defended the importance of economic institutions and open trade, urging resistance to populist attacks and warning that undermining bodies such as the International Monetary Fund ("IMF") weakens their ability to highlight economic risks. Meanwhile, the Office for National Statistics ("ONS") may delay its new labour market survey by six months, potentially until May 2027, due to technical difficulties. Adding to concerns, the Institute for Public Policy Research ("IPPR") highlighted vulnerabilities in the UK economy, noting that supply chain disruptions linked to China could cost £1.5 billion annually for solar projects and jeopardise 90,000 electric vehicle jobs unless the government implements a 'securonomics' framework.

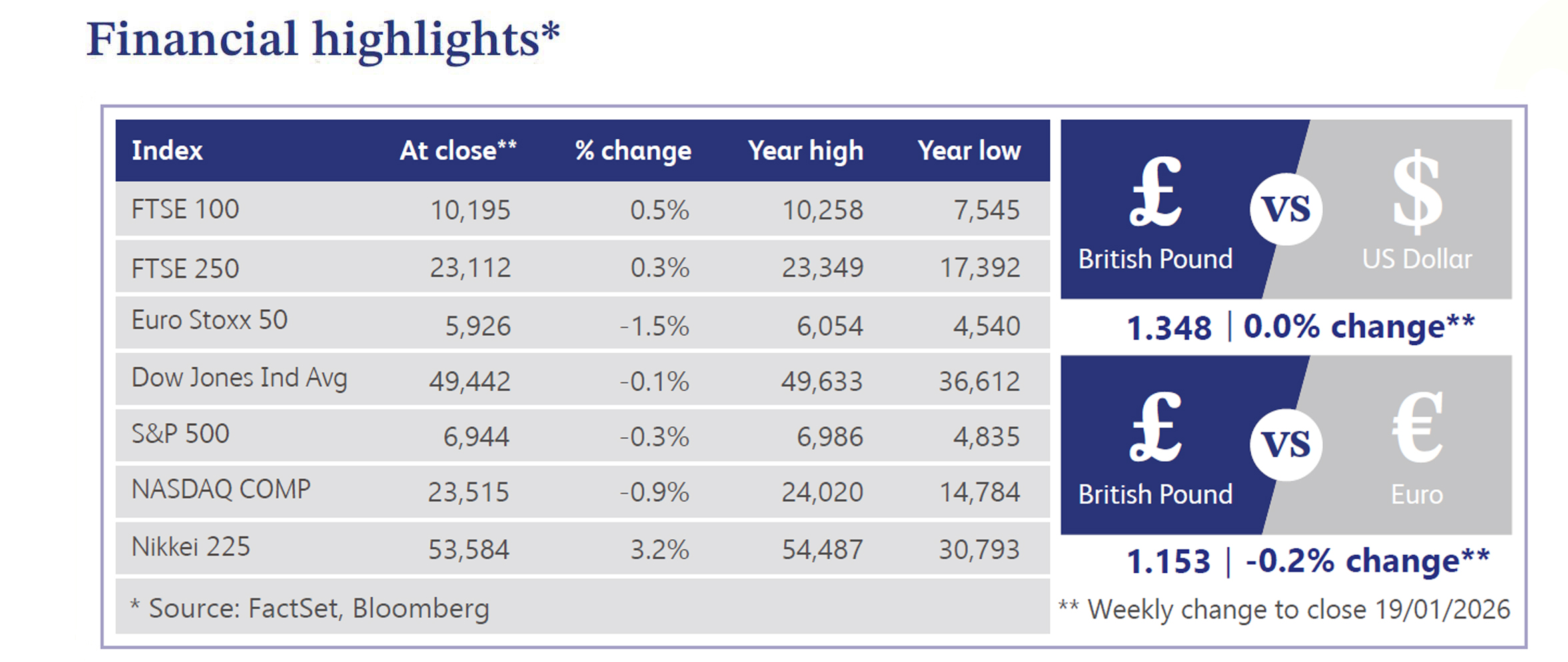

In equities, the FTSE 100 index closed the week at 10,195, continuing its strong start to 2026 with a year-to-date gain of 3.06%. Strength came from the asset management and biotechnology sectors, with Polar Capital Holdings and Ninety One rising 6.1% and 5.4% respectively following positive assets under management updates, while Genus surged 8.4% on a robust trading outlook. Conversely, the mining sector faced headwinds, with Rio Tinto shares falling 1.7% amid speculation over potential carve-outs should a merger with Glencore proceed. In currency markets, sterling strengthened against the US dollar, gaining 0.19% to trade at 1.3406 dollars per pound.

Across the Atlantic, the Bureau of Labour Statistics ("BLS") reported that core Consumer Price Index ("CPI") inflation rose 2.6% year-on-year in December, marking the slowest pace since March 2021. Meanwhile, consumer spending data from the Census Bureau exceeded expectations, with retail sales increasing 0.6% in November, rebounding from a slight decline in October and surpassing forecasts of 0.4%. Despite the supportive data, US equities were mostly lower, with the Dow, S&P 500 and Nasdaq closing in negative territory, although the Russell 2000 index rose 2.04%. The S&P 500 fell 0.3%, weighed down by major technology stocks, including Amazon, which declined 3.6%, and Meta, which dropped 5.0%, while Nvidia managed a modest gain of 0.7%. Investor sentiment was dampened by policy uncertainty and renewed concerns over Federal Reserve independence, with markets pricing in just 48 basis points of rate cuts for 2026. Treasury yields rose as the curve flattened, the US Dollar Index edged 0.2% higher, and gold rallied 2.0%. Geopolitical tensions centred on Iran, while the White House’s 'Main Street over Wall Street' policy push added further pressure on the banking sector.

UK housing sentiment has improved due to BoE easing and post-Budget clarity. Although activity remains subdued, the downturn is losing momentum as supply stabilises and price pressures ease. The longer-term outlook is positive, with sales and price growth expected over the next year, the most optimistic view since late 2024. In contrast, the rental market has softened, with tenant demand falling sharply to early pandemic levels.

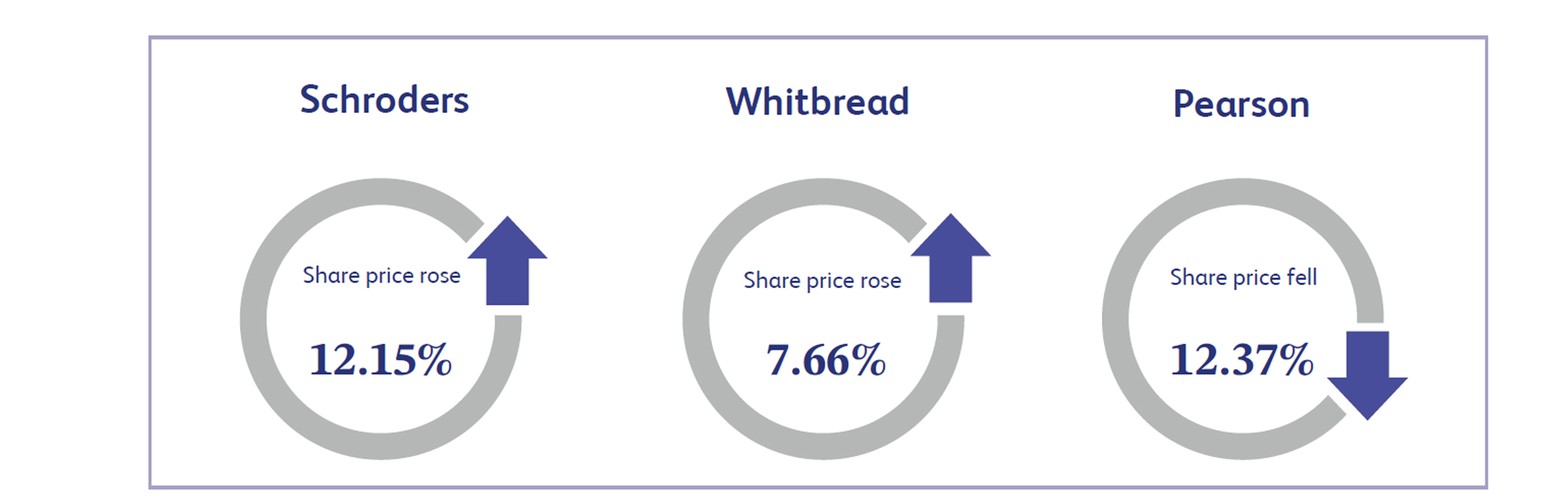

Schroders, the global asset and wealth management group, was the standout performer last week, as its shares climbed 12.15%. The company’s shares surged as investors regained confidence in a structural recovery across global equity markets and the asset management sector. Analysts praised Schroders’ diversified business model and strong growth in assets under management, positioning the firm as a prime beneficiary of solid equity inflows and the broadening market rally observed in early 2026. Nevertheless, momentum was tempered by lingering caution over cost inflation, which remains a key challenge in converting rising asset levels into expanding operating margins.

Whitbread, the UK’s leading hospitality group, also performed well last week, with shares in the company gaining 7.66%. Shares were supported by reports of a potential £300 million government bailout for the pub sector and resilient leisure demand. Analysts highlighted Whitbread’s dominant market position through Premier Inn and its ability to maintain robust occupancy levels, making it well-placed to benefit from a stabilising consumer environment in 2026. The upside, however, remained constrained by ongoing concerns over operating cost inflation, particularly wages and energy, which continue to pose a challenge to converting top-line revenue into higher margins.

Pearson, the global education and publishing giant, performed poorly over the week, falling 12.37%. The decline followed the loss of a major US student assessment contract in New Jersey, which overshadowed an otherwise steady operational update. Analysts expressed concern over the lack of explicit guidance for 2026, suggesting that budget cuts and competition from artificial intelligence are weighing on the firm’s competitive position. The fall was partially mitigated by management reiterating confidence in medium-term targets and robust free cash flow.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management's own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.