17 February 2026

Last week, the Bank of England's (BoE) Deputy Governor, Sarah Breeden, signalled that interest rate cuts could arrive within the next couple of meetings as inflation eases, with markets currently pricing in two 25 basis point reductions this year. Elsewhere, Monetary Policy Committee (MPC) member, Catherine Mann, links US trade wars to UK inflation via higher Chinese export prices. The long-term labour market downturn is stabilising, with candidate availability up and the decline in permanent hiring slowing to an 18-month low. Political uncertainty, fuelled by speculation over Prime Minister Starmer’s leadership, has dampened sentiment, leading investors to cut UK asset and debt exposure. As a result, almost 80% of business leaders are prioritising resilience over investment due to political and international trade pressures.

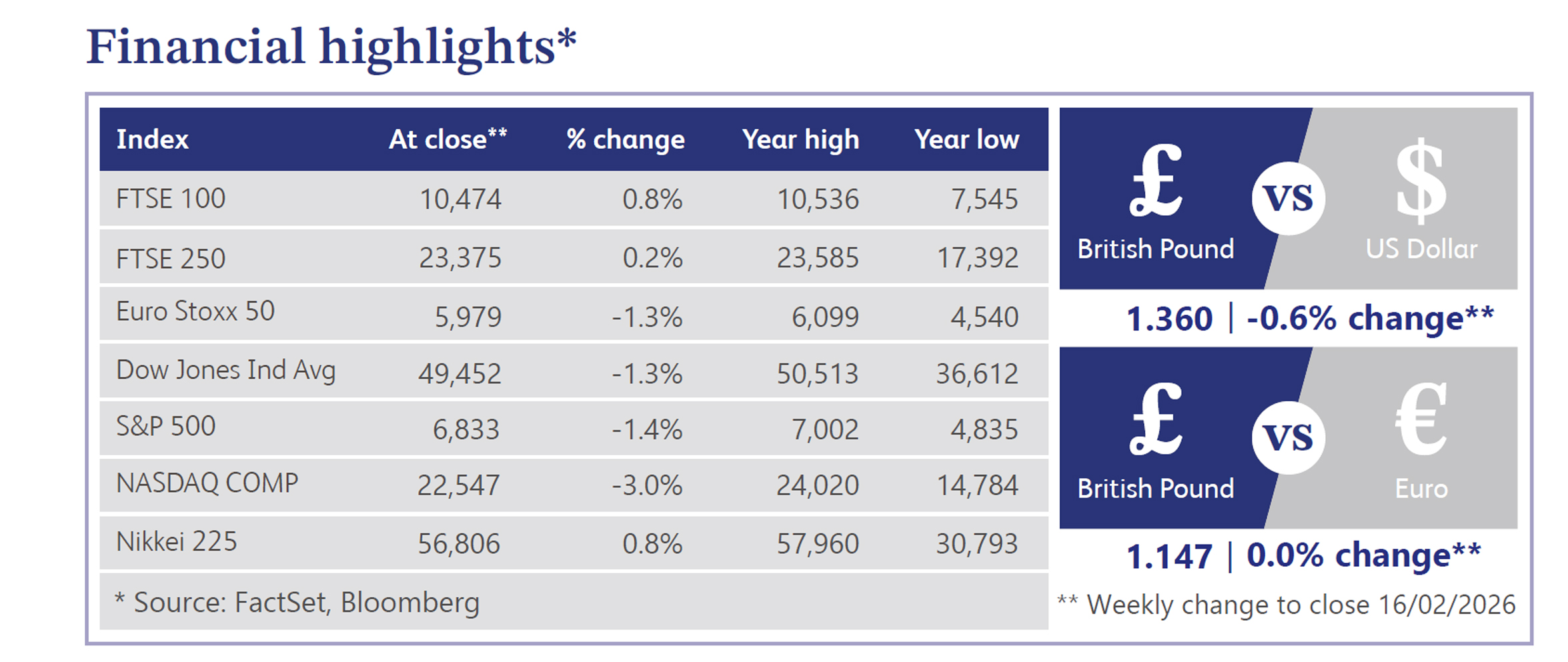

In equities, the FTSE 100 index finished the week up 0.74% to 10,446, bringing its year-to-date gain to 5.19%. Meanwhile, fiscal pressures are mounting; chancellor Rachel Reeves faces calls to clarify funding for a £6bn-a-year special educational needs (SEND) bill, which the Office for Budget Responsibility (OBR) flagged as a risk to the £22bn fiscal headroom set in November. While ministers will cover up to 90% of historic debts, economists warn unresolved liabilities could erode budget buffers, forcing spending cuts or tax rises. Seeking growth, Reeves has termed the EU the "biggest prize," urging a deeper trading relationship and a broader "made in Europe" concept. However, economists caution that the economic boost is likely small, while political risks remain high regarding regulatory oversight and free movement. In currency markets, sterling strengthened against the dollar to 1.3633.

Across the Atlantic, economic signals were mixed as January nonfarm payrolls posted a healthy beat at 130k and core Consumer Price Index (CPI) met consensus, though December retail sales missed expectations. US equities were lower: the Dow Jones Industrial Average declined 1.23%, the Nasdaq fell 2.10%, the small-cap Russell 2000 dropped 0.89%, and the S&P 500 lost 1.39%. Big tech was mostly lower, with Apple falling 8% and Google declining 5.3% amid scrutiny over AI returns, although the equal-weight S&P 500 hit a fresh record high. Macro sentiment focused on central bank policy, with markets pricing 59 basis points of cuts through year-end despite hawkish comments from Federal Reserve officials Hammack and Logan. Elsewhere, Treasuries rallied as the curve flattened, the Dollar Index fell 0.8%, and gold rose 1.3% to end back above $5,000/oz. WTI crude oil settled down 1% despite President Trump’s threat to send a second aircraft carrier to Iran. The Utilities sector exhibited the strongest performance, in contrast to the banking sector, which registered the weakest results.

The property market shows recovery from a soft patch, evidenced by the Royal Institution of Chartered Surveyors (RICS) January price indicator improving to a net balance of -10% (better than the -11% consensus and the prior -14%). This is the least negative reading since June, up from the October 2025 low of -19%. Housing Minister Matthew Pennycook indicated house price growth will slow as Labour's plan to build 1.5 million new homes is expected to decrease prices by 2% for every 1% increase in supply.

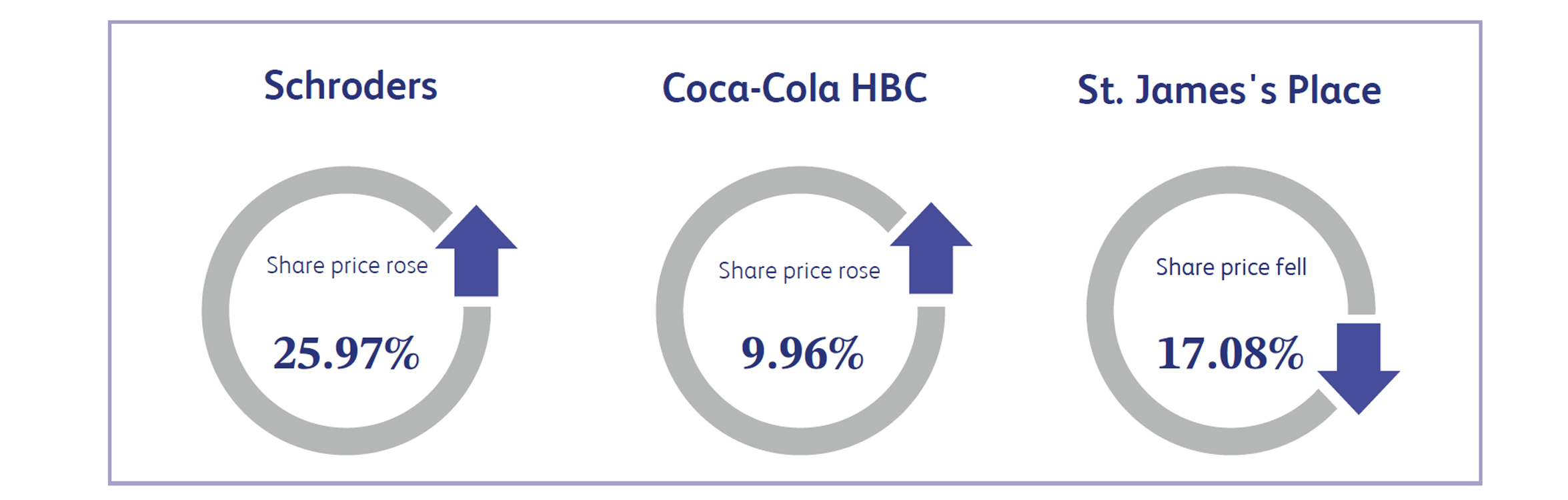

Schroders, the global investment and wealth management company, surged 25.97% after agreeing to a £9.9 billion takeover by US asset manager Nuveen. The deal, which represents a significant premium to its recent trading price, underscores the deep value international buyers see in UK heritage firms despite the broader "shunning" of the London market. This move to take the historic firm private further validates the trend of de-equitisation in the UK, as foreign capital capitalises on depressed valuations to acquire high-quality active managers, effectively removing another major name from the public exchange.

Coca-Cola HBC, a strategic bottling partner of The Coca-Cola Company serving 29 countries across Europe and Africa, rallied 9.96% as investors cheered a surprisingly robust margin outlook. The company benefited from a combination of easing raw material costs and resilient demand in its developing markets, which helped offset softer consumer sentiment in established territories. This performance reinforced the stock’s defensive appeal, with analysts noting that its pricing power and operational efficiency offer a reliable shelter for capital amidst broader market volatility.

St. James's Place, the UK’s largest wealth manager providing face-to-face financial advice, tumbled 17.08% amid existential fears that artificial intelligence could upend its traditional business model. The sell-off was triggered by the launch of "Hazel," a new AI-powered tax planning tool by US fintech Altruist, which investors worry could commoditise the complex, fee-based advice that forms the bedrock of SJP's revenues. This "AI panic" swept through the sector, with the market swiftly repricing the risk that automated, low-cost digital agents could disintermediate human advisers faster than previously anticipated.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management's own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.