11 February 2026

This article is the first in a short series from James Richards, Investment Director at Walker Crips Investment Management, sharing his investment philosophy and the principles that underpin how he manages client portfolios. In these pieces, James explores some commonly held beliefs about investing and explains why long-term outcomes often depend less on fashionable ideas and more on disciplined investment thinking and practical financial planning.

A key consideration for many investors is income, but people do not really mean income, they mean a source of cash flow. A favoured term for the younger generations now seems to be “passive income” where one is able to live off the yield on their investments (be that stocks, property or royalties), without having to eat into the capital (or “earn” income through employment). Whilst the phrase might be new, the concept certainly is not, with many of our investors in the fortunate position of receiving handsome regular dividends from long-held UK blue chip stocks. The UK market has a long history of paying good dividends to shareholders, particularly compared to our compatriots across the pond who tend to reinvest profits or give back via share buybacks.

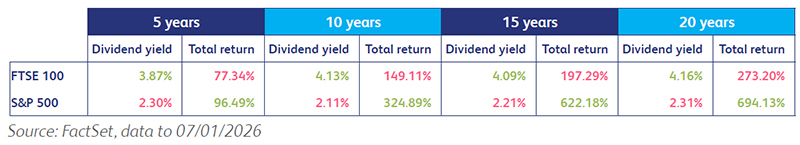

History shows that reinvesting profits (in profitable, growing businesses) internally is the most efficient way to grow and help the compounding effect. This is shown in the table below where the US market (S&P 500) has repeatedly out-returned the UK market (FTSE 100) even though the UK’s dividend yield is significantly greater than the US. What I am trying to say is that just because a company pays a good yield, does not mean it is a great investment.

UK Yields vs US Returns

Utility companies are good examples of this, often called ‘bond proxies’ because like a bond, they have limited capital growth, but a regular income. If that is what an investor wants, then they could get that from a bond, such as a Gilt (UK government bonds) or US Treasuries (US government debt), generally for less risk.

So, bond proxy type companies are not necessarily wrong, but if one is willing to take equity-like risk by holding company shares, why not pick ones that benefit from compound growth with profits reinvested in the business to make more profits? This should in theory lead to both greater capital and dividend growth.

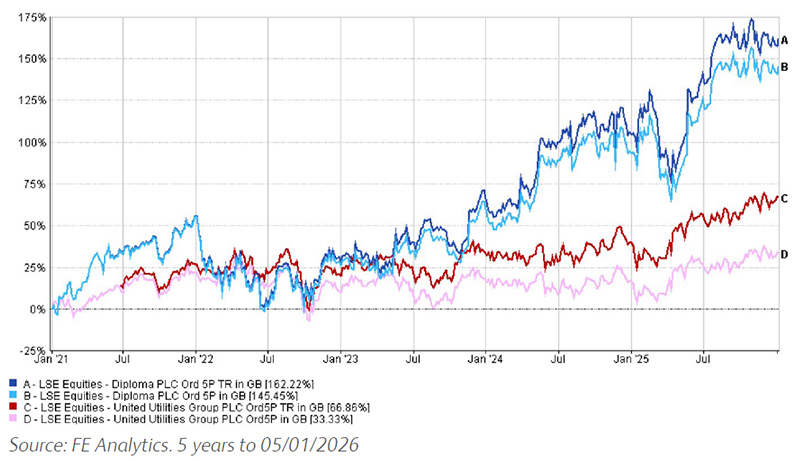

In the chart below, we see the price return of United Utilities (LSE: UU.), a UK provider of water services, over the past 5 years. Its shares have returned 33%, a somewhat pedestrian return for an equity, but when we look at the total return, which includes the 4.5% average annual dividend yield, we get to a return of double that at 66%. This is a classic example of a Bond Proxy stock. The chart also shows both the price and total return (dividends reinvested) of Diploma (LSE: DPLM), an industrial services company specialising in the distribution of value-add technical products such as controls and seals.

Whilst Diploma’s dividend yield is significantly less at 1.5%, and so the total return is predominately made up of the price return, in the chart below we see the benefit of a profitable business that is reinvesting profits internally rather than paying out dividends. Its 5-year total return is nearly three times that of United Utilities at 162%.

High dividends do not always yield higher returns

This idea of clients needing cash not strictly income, we believe holds through time, but is presently enhanced in the UK – at least whilst current legislation lasts – as capital gains are generally taxed at a lower rate to income and dividends and so it can be more tax efficient to trim some capital from a growing investment for one’s income needs than go for a high dividend stock and pay income tax on the yield. This is less of an issue in tax-wrapped vehicles such as ISAs and pensions, but the philosophy remains: investors typically require cash from a portfolio to fund spending, not necessarily an income stream in the traditional sense.

James Richards Chartered FCSI

Investment Director

Compounding: In financial terms, compounding is the process where the returns on an investment (interest, dividends, or capital gains) are reinvested to generate their own returns over time. Often described as “interest on interest,” it transforms a linear growth pattern into an exponential one as the investment “snowballs”.

Dividend yield: A financial ratio that shows how much a company pays out in dividends each year relative to its stock price. It is expressed as a percentage.

Gilt: A bond issued by the UK government. They are generally considered lower-risk investments because they are backed by the government.

Total return: The overall return on an investment, combining both capital appreciation (the increase in share price) and any dividends or interest received.

This white paper is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.