2 June 2020

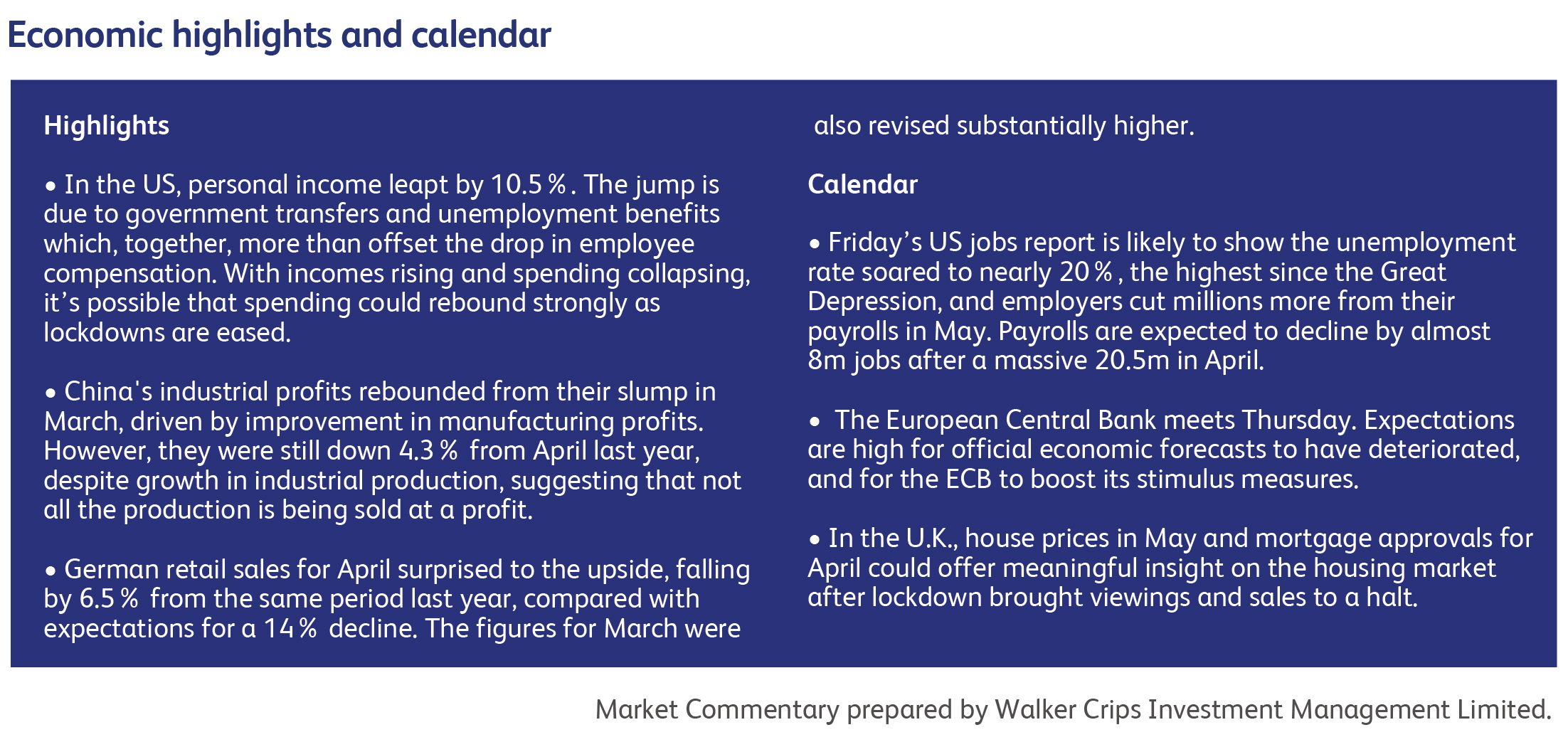

It was a week in which TV cameras were focused on riots in Hong Kong and America, but investors were, seemingly, focused on substantial increases in the already-extraordinary fiscal response to the pandemic. In the spirit of “we will do whatever it takes”, China’s largest-ever economic stimulus package was unveiled at the National People's Congress. It could amount to 10% of GDP in 2020. In Japan, plans were announced for another round of stimulus the same size as the first (JPY 117trn, or $1.1trn); combined, these Japanese actions will sum to a world-leading 43% of GDP.

The EU took a big step towards joint debt issuance with its proposed recovery fund, consisting of €500bn in grants, and €250bn in loans. While the details are still to be ratified, the fact that Germany (along with France) was driving the initiative suggests that fiscal discipline in the EU is now, like everywhere else, a thing of the past. More is in the works: the next big fiscal boost is likely to be the $3trn US stimulus bill, which would permit the continuation of enhanced unemployment benefits and stimulus payments to households beyond the end of July. The legislation has already passed Congress, this being an election year, the Senate is unlikely to stand in its way.

It seems like nothing can derail the world’s stockmarkets, which rose across-the-board. They barely register the antics of President Trump, who escalated the dispute with China over Hong Kong by removing Hong Kong’s privileged trading status. The UK waded into this quagmire by offering refuge to nearly 3m Hong Kong citizens and, presumably, awaits the inevitable backlash from Beijing. Trump thrashed around in other ways, too, terminating the US relationship with the World Health Organization (WHO) due to its Chinese links, and hastily rearranging a G7 summit after embarrassing snubs from invitees.

Logic suggests that further stimulus is needed because the scale of the economic damage is overwhelming the earlier programmes. In the US, 2.1m jobless claims were filed during the previous week, taking the Covid-19 shock to over 40 million, or a quarter of the labour force. On the GDP front, the Q1 contraction was revised from -4.8% to -5.0%. China’s manufacturing PMI survey slipped backwards in May, and momentum appears to be fading due to weak overseas demand. Job cuts have resumed in the manufacturing sector. In contrast, the services sector showed a mild improvement, boosted by the relaxation of travel curbs and the extended May Day holiday, as well as strong infrastructure development due to government stimulus. Japan formally ended its state of emergency, but not in time to bring relief to industrial production or retail sales, which plummeted in April. Italy’s GDP growth for the first quarter was revised sharply lower, to -5.3%, from -4.7% in the previous estimate. Italy's GDP may fall by as much as 13% in a worst-case scenario this year, according to the Bank of Italy.

Tesco’s chief financial officer Alan Stewart decided to retire. Stewart, who joined from Marks & Spencer five years ago, will step down from Tesco in April next year.

Dart Group completed the sale of its logistics and distributions business, Fowler Welch, to Culina Group for £98m. Fowler Welch provides food supply-chain services and serves retailers, processors, growers and importers through its distribution network. The Dart Group board said the deal would enable them to focus on the long-term strategy of growing its Leisure business – Jet2 and Jet2holidays.

AstraZeneca, the British-Swedish pharmaceutical and biopharmaceutical company, achieved expanded regulatory backing for two medications -Lynparza and Brilinta. Lynparza, which is being developed with US drugmaker Merck, received recommendation from a panel of the European health regulator for use as a follow-on treatment for a form of advanced pancreatic cancer. While the heart drug Brilinta, for use as a treatment to reduce the risk of a first heart attack or stroke in high-risk patients, received a US green light.

Eli Lilly, the US pharmaceutical company, began human tests of an antibody drug against Covid-19. In a milestone for drug companies aiming to combat the virus, researchers began testing what appears to be the first new medicine developed specifically against Covid-19.

Boeing announced they are to start job cuts that are expected to hit nearly 13,000 workers. The reductions, mostly in the US, had been expected since they revealed plans last month to slash their global workforce by 10%. The company has been struggling from a drop in demand for aircraft as travel plunges amid the pandemic.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.