9 June 2020

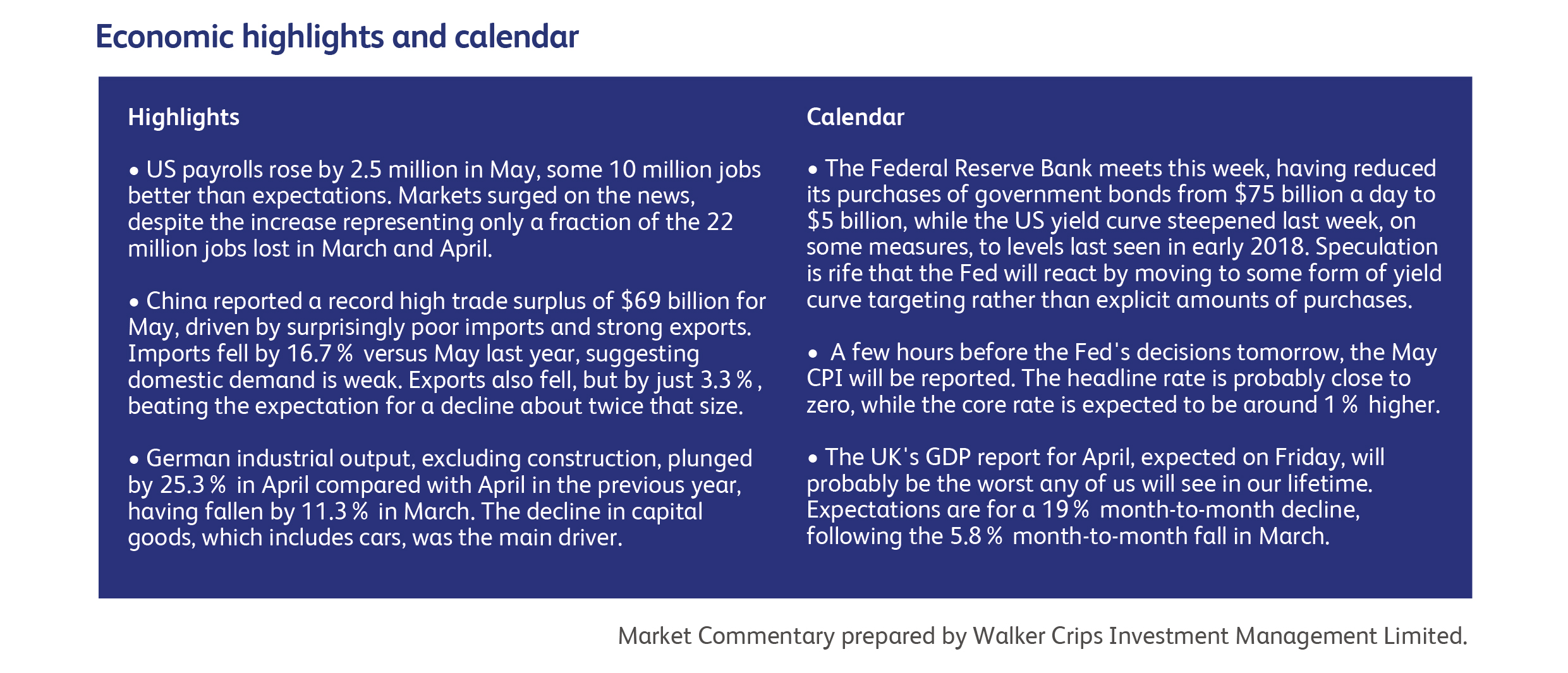

The pandemic is no longer a risk - at least you would think so from the behaviour of stockmarkets last week, which surged around the world. Those with a technology bias, such as the Nasdaq, the S&P 500, the South Korean KOSPI, have either reached new all-time highs or are closing in on them. But the euphoria is not confined to technology stocks: Germany’s industry-heavy Dax touched levels it last reached in January and, even in Brazil, where the pandemic is rife and the government has stopped publishing data, the BOVESPA stockmarket index reach levels touched only nine months ago. Incidentally, the Brazilian and Mexican currencies have recently been among the strongest in the world against the US dollar, soaring by 18% and 10% respectively since the middle of May, despite these countries being the new epicentre of the pandemic. Emerging market bonds have seen their premiums recover more than half of the crisis-induced run-up, despite their economies being the hardest hit by the collapse in commodity prices and economic activity.

A crucial question for investors is whether the markets will continue to ignore pandemic-related risk if a second wave of the virus hits. Anti-racism and anti-police marches occurred in 700 US towns and cities last week, plus major cities around the world, without much evidence of social distancing or the wearing of masks. Some southern US states are already seeing second waves, due in part to citizens and Green Card holders coming back to the US from border cities in Mexico, seeking treatment. In a sign of things to come, the Governor of Arkansas has paused the state’s reopening. The next month is surely going to test - definitively - whether the virus has retained its infectiousness.

It was another week of ever-greater fiscal and monetary stimulus. China enacted a wide range of measures, most notably the establishment of a special purpose vehicle by the central bank and ministry of finance to direct 440 billion yuan ($62 billion) of funds to regional banks so that they can provide new loans or roll over maturing loans to small businesses. The central bank also expects the repayment of 3.7 trillion yuan ($520 billion) of loans to be deferred under this program. A further 2 trillion yuan (US$281.2 billion), comprising 1 trillion yuan from the central government budget and 1 trillion yuan in special off-budget treasury bonds, was made available to local governments to provide them with working capital. The authorities in Beijing announced an innovative plan to distribute coupons worth 12 billion yuan ($1.7 billion) to spur consumption at participating restaurants and retailers.

The EU slashed its growth forecasts, and now expects annual GDP to fall by 8.7% in 2020 and to rebound by 5.2% in 2021 and by 3.3% in 2022. Moreover, the balance of risks around the baseline projection was described as being tilted to the downside. If correct, the Euro Area economy will recover the output lost as a result of the pandemic only towards the end of 2022. However, the European Central Bank did not disappoint investors at its governing council meeting, extending its emergency bond purchase scheme to mid-2021 and increasing it by EUR600 billion to EUR1.35 trillion. Within the EU, Germany announced a EUR130 billion fiscal package, about 4% of GDP.

BP announced it is to cut its global workforce of approximately 70,000 by 10,000. They've said the majority of the cuts will happen this year and will primarily affect office-based roles, in particular senior levels where a one-third reduction is expected.

According to a Bloomberg report, AstraZeneca informally approached Gilead Sciences last month to gauge its interest in a merger. Gilead Sciences is an American biopharmaceutical company, with a market capitalisation of approximately $96 billion. If the deal did go ahead it would set a new record for pharmaceutical M&A, eclipsing the acquisition of Celgene by Bristol Myers Squibb for $74 billion last year.

British American Tobacco released its first half of the year trading update today. In it they say business has been performing well amid the pandemic, but they downgraded their adjusted revenue growth expectations for the full year. They anticipate a full year headwind of around 3% in adjusted earnings from the coronavirus pandemic.

Bellway, the UK residential property developer, released a trading update today where it was revealed they sold 1,000 fewer homes between August (2019) and May (2020), than the previous August (2018) to May (2019) period. Financial guidance from the company remains suspended given the ongoing uncertainty. However, they did say construction activity has restarted on around 230 sites that are in the latter stages of production.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.