7 July 2020

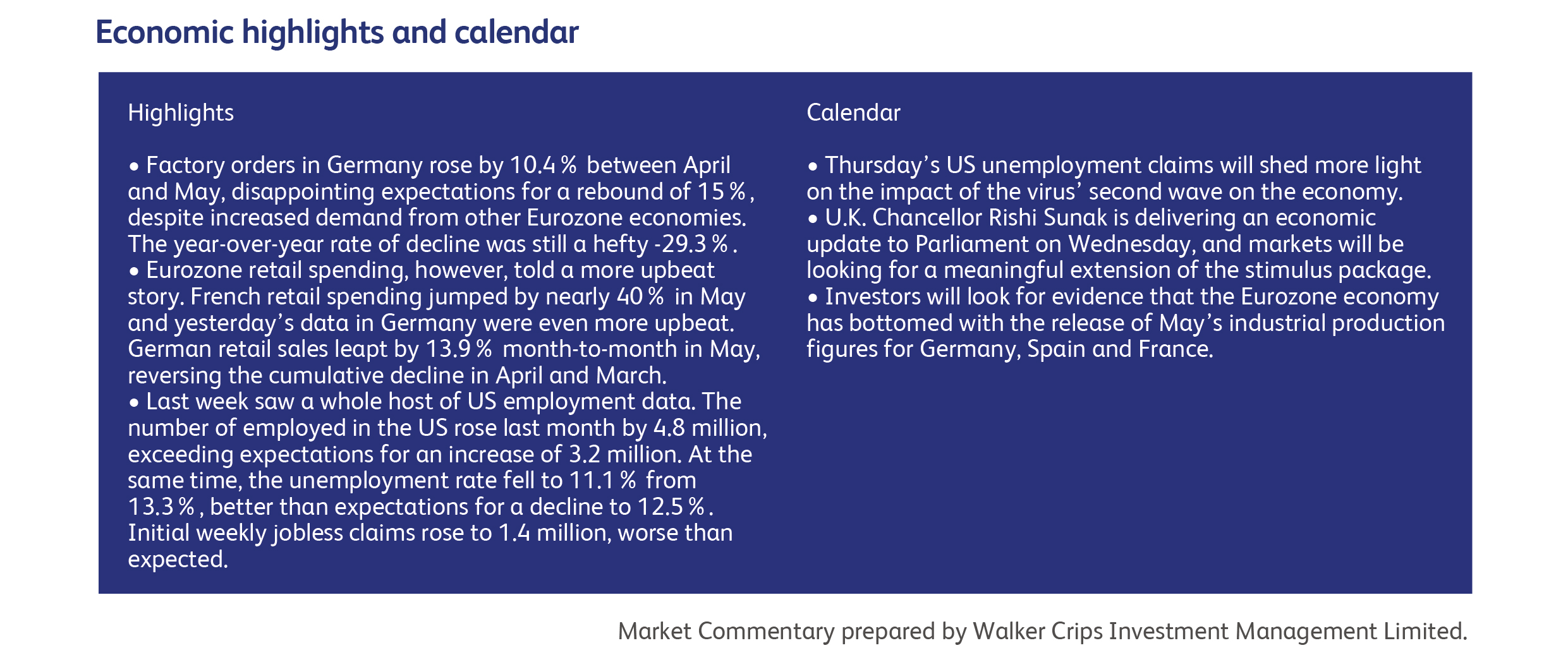

Another week in which the world’s largest economy went backwards in the fight against the pandemic but stockmarkets roared ahead, with the US leading the charge. The medical data continues to deteriorate across a large number of US states, and the reactions of local authorities and the public are now beginning to show up in the employment data. Many US indicators of employment, both in the official and the more real-time on-line data, suggest that broader economic activity has moved into a lower gear. The downward momentum in unemployment claims has steadied, remaining at an enormous 1.4 million per week (to put this in historic perspective, initial claims during a bad recession typically top out at around 600,000). The number of unemployed whose positions have been permanently eliminated has risen to 3.7 million suggesting that, once the economy has reopened, a severe recession will be evident. Activity in the unofficial US data, such as restaurant bookings from OpenTable and Apple Mobility, is flat or falling.

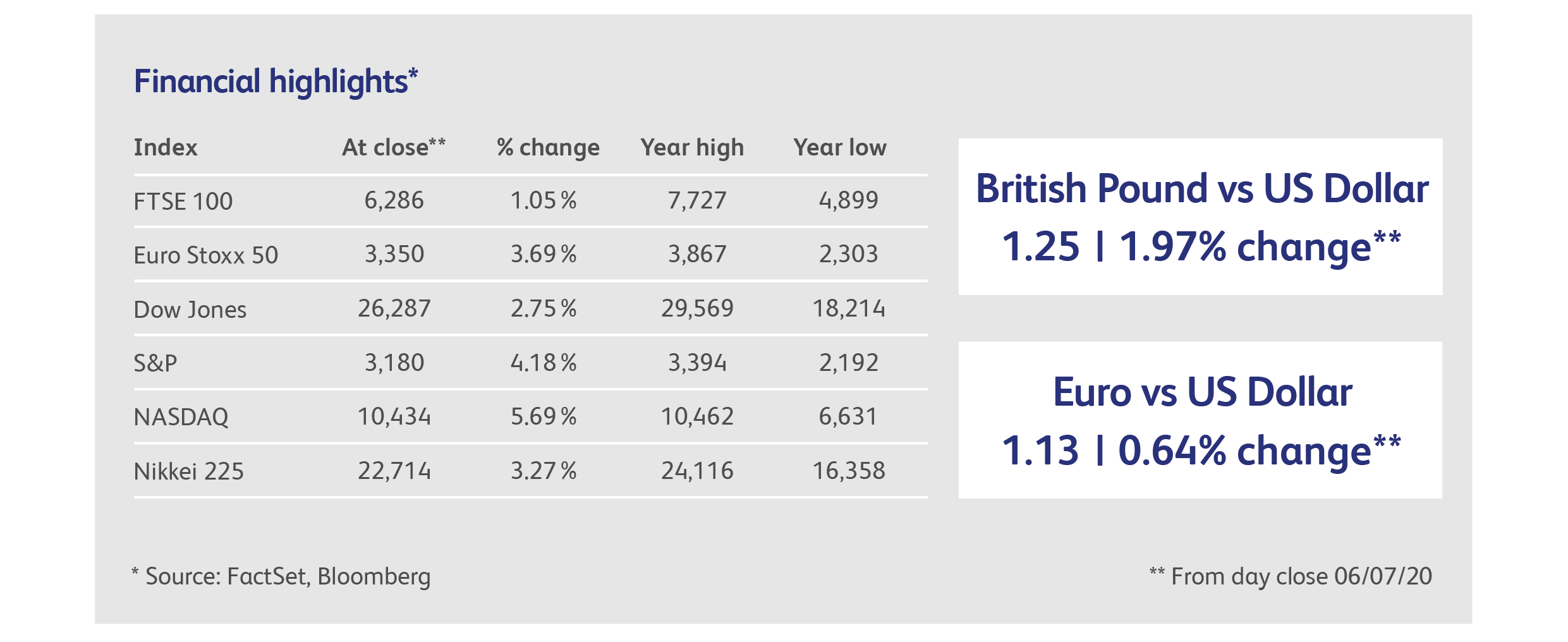

The UK stockmarket was the exception to the bonanza in equities, rising only 1%, perhaps because recent business and economic surveys in the UK have yet to confirm that a robust rebound is under way. Many firms remained prohibited from trading in June, especially in the food services and leisure sectors. The Office of National Statistics’ latest fortnightly Business Impact of Covid-19 survey, released in the last week, showed only a slight increase in the proportion of businesses that are trading: rising only to 86% in the first two weeks of June, from 84% previously. Similarly, the proportion of employees working as normal, either at home or at their usual place of work, increased only to 62%, from 59%. In addition, the Bank of England’s latest Decision Maker Panel survey, conducted between June 5 and 19, showed that firms estimate that Q2 sales would be 38% below the level they would have expected in the absence of Covid-19. Rail and air passenger numbers have yet to bounce meaningfully. Output in the education sector will not recover from its 46% February-to-April decline until schools reopen for all pupils, which is currently scheduled for September.

However, more positive trends emerged in Chinese data last week. China’s surveys of business activity bounced back better than expected in June, and the growth in profits for Chinese industrials firms in May rose 6% from last year, marking the first positive growth for large industrial firms this year. The contribution to profits was unevenly distributed between the winners, such as manufacturers of medical equipment, producers of the raw materials used in medical equipment, and suppliers of all things technological: computers, electronic devices and electronic components. The losers included vehicle manufacturers and makers of metal products generally. Overall, the outlook for China’s rebound is brightening: signs of a broadening improvement in demand are emerging, accompanying the substantial investment in infrastructure and property driven directly by government stimulus. Chinese investors were richly rewarded: the Shanghai Composite stockmarket index rose an extraordinary 12.6% from a week ago. Moreover, the two notable stockmarket forces that are apparent in the US are also present in China: a flurry of involvement by day-trading retail investors, and a government that seems to have prioritised a healthy bull market as a key objective of economic policy.

Information sources have reported Microsoft is looking at acquiring Warner Bros' game division to increase the game-making capabilities of its Xbox group. Current owner AT&T is considering the unit’s sale, which is behind popular franchises based on Batman, Game of Thrones and Harry Potter, to help pay down its $154 billion in debt.

Warren Buffett’s Berkshire Hathaway has agreed to buy the natural gas assets of Dominion Energy in a $10 billion deal. The deal represents Berkshire’s first major purchase since the coronavirus pandemic, but will still barely put a dent in the record $137 billion cash hoard the company has built up. As a consequence of the purchase, Berkshire Hathaway Energy will carry 18% of all interstate natural gas transmission in the United States, up from 8%.

The electric carmaker Tesla Inc. continued its meteoric rise as its share price rose 13% to a record high of $1,371.58 (close of business 06/07/20) per share on Monday. This extended the carmakers rally to over 40% in the previous five trading sessions and 228% year to date. Monday’s share price increase saw Tesla’s stock market value jump by $30 billion in a day, which is more than the entire value of Ford Motor Co. The recent share price performance has been driven by better than expected car deliveries in Q2.

The ride-hailing business Uber has agreed to buy the food-delivery business Postmates in an all stock deal worth $2.65 billion. The deal comes after Uber’s failed attempt to acquire GrubHub, which has subsequently been bought by Just Eat Takeaway. The deal sees the continuing consolidation trend in the food delivery market.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.