12 August 2025

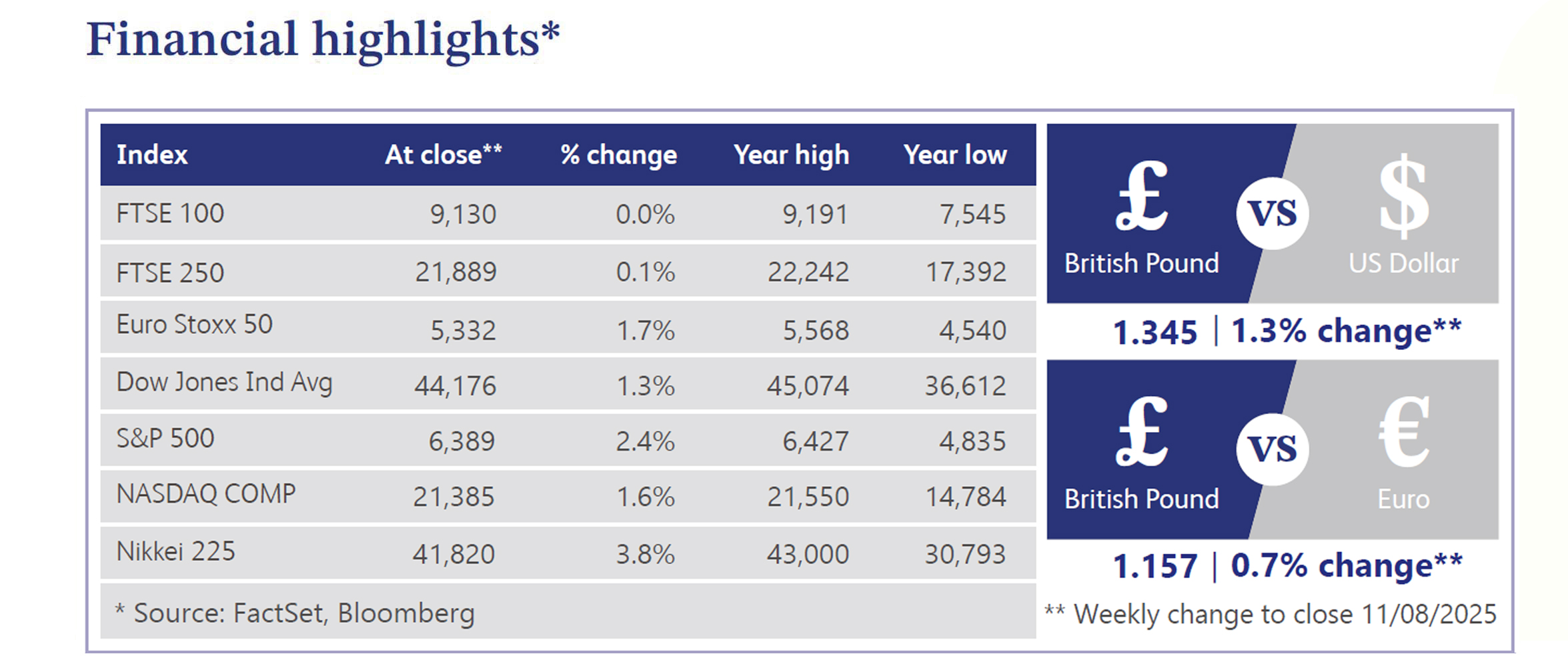

The UK ended last week with uncertainty surrounding the Bank of England’s (“BoE”) policy direction following a “hawkish” 0.25% cut to the interest rate, bringing it to 4%. The decision was narrowly split (5 votes to 4) and accompanied by higher near-term inflation forecasts and cautious guidance, leaving only a 50% chance of another rate cut this year. In September, the BoE may slow gilt sales, as quantitative tightening appears to have restricted conditions more than expected. Economic data pointed to underlying fragility, with Purchasing Managers’ Index (“PMI”) readings revised upward but still signalling a slowdown. Construction activity contracted sharply, retail footfall slipped and elevated borrowing costs continued to restrain investment. Economists expect multiple rate cuts in 2026 as the BoE balances growth support with inflation control.

The UK political and economic narrative continued to revolve firmly around taxes, as Chancellor Rachel Reeves defended her stance against a formal wealth tax, highlighting recent levies on private jets, second homes and capital gains. Yet the fiscal backdrop turned more challenging after the National Institute of Economic and Social Research (“NIESR”) warned of a £50 billion shortfall, fuelling speculation about broader tax rises. Labour’s reforms have already triggered an exodus of company directors, while HMRC eyes private school fee schemes ahead of the 20% VAT charge. PM Kier Starmer hinted at possible income tax changes, whilst regional council tax shifts added to the tension. With growth slowing, September may mark the start of preparing the public for a tougher budget.

UK markets remained under pressure as retail investors continue to turn away from domestic equities. Bloomberg noted over £50 billion has left UK equity funds since 2020, while £25 billion flowed into foreign baskets, mirroring institutional trends. July saw a sharp acceleration in outflows, with Calastone reporting £1.13 billion withdrawn from equity funds, the second largest since Liz Truss’s fateful mini-budget in 2022. UK-focused funds bore the brunt, losing £543 million, whilst European equities saw modest inflows.

US equities rebounded strongly last week, with the S&P 500 and Nasdaq posting their best weekly gains since June, supported by gains in semiconductors, homebuilders and industrial metals, reflecting renewed investor optimism amid dovish Federal Reserve (“Fed”) signals and easing tariff fears. The dollar weakened 0.9%, while gold reached a record high before easing on White House tariff clarifications. Oil fell over 5% after the Organisation of the Petroleum Exporting Countries Plus (“OPEC”) announced plans to unwind output cuts. Despite the rally, concerns persist over rising inflation expectations and weakening consumer data. However, dovish remarks from the Fed officials raised hopes of a September rate cut, though Treasury supply pressures limited the gains. Markets remain focused on trade policies, Fed leadership and inflation growth dynamics.

Halifax data showed UK house prices rose modestly by 0.4% in July, beating expectations and marking a steady 2.4% year-on-year increase. This aligned with last week’s Nationwide report, highlighting resilience supported by more flexible affordability assessments. However, the Royal Institution of Chartered Surveyors’ (“RICS”) second quarter construction monitor revealed regulatory and planning delays are hampering housebuilding growth, with overall construction workloads slightly down and housebuilding activity falling sharply, despite strong infrastructure performance.

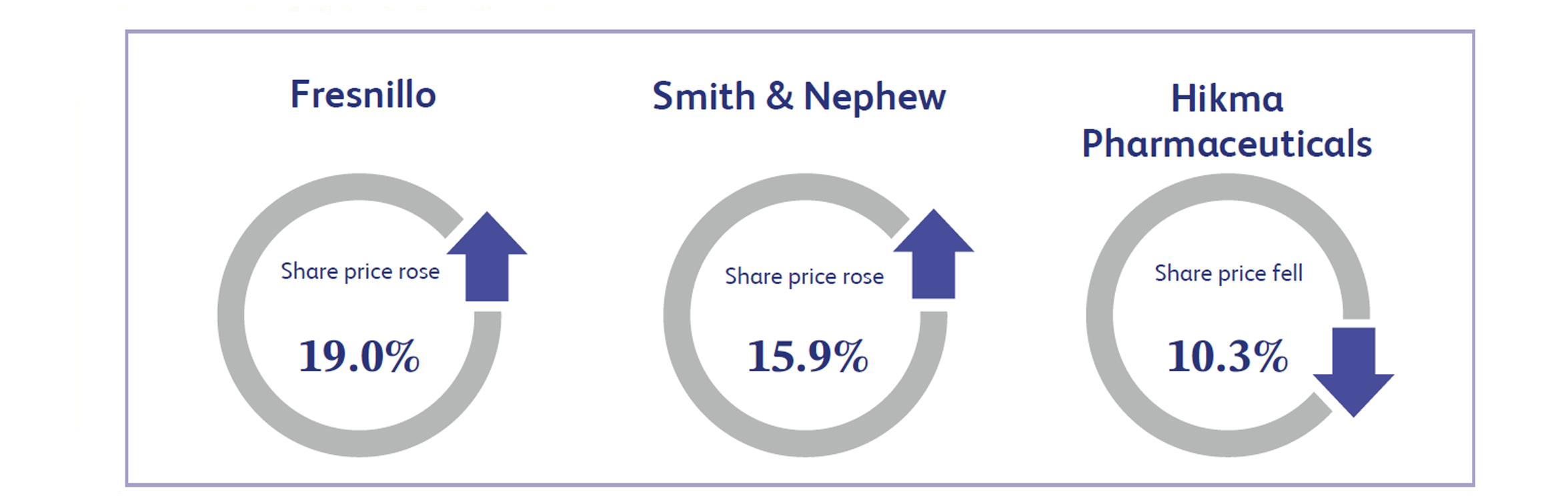

Fresnillo, a precious metals miner, surged 19% after raising its gold production guidance for 2025, supported by stronger output at its Herradura mine. The London-listed company reported a first-half pretax profit of $660.3 million, more than doubling from $277.8 million in 2024, driven by rising precious metals prices and robust cost controls. Revenue rose to $1.94 billion, beating estimates. Despite a dividend miss, the upgraded gold output target of between 550,000–590,000 ounces underpinned investor confidence, despite the silver production guidance being cut slightly. The rally was bolstered by higher gold futures after US tariffs on gold imports spurred demand.

Smith & Nephew, a UK-based medical technology firm specialising in hip and knee implants, sports medicine and wound care, gained 15.9% following a strong first-half report. Revenue rose 5% to $2.96 billion, surpassing expectations, driven by solid demand and cost efficiencies. Operating profit jumped 31% to $429 million, with a margin expansion to 17.7%, topping forecasts. The company confirmed its full-year revenue growth target and declared a $0.15 interim dividend alongside a $500 million share buyback plan. Despite ongoing challenges in the US knees division, upbeat earnings and margin progress boosted investor optimism.

Hikma Pharmaceuticals, a generic drugmaker, fell 10.3% as it cut margin forecasts for its largest injectables business amid rising costs and a strong euro, despite beating profit expectations. The company now expects full-year core operating margins of 32–33%, down from prior mid-30s guidance, reflecting tariff-related pressures and currency headwinds. Hikma reaffirmed 2025 revenue growth of 4–6% and core operating profit between $730–770 million. Chief Executive Officer (“CEO”) Riad Mishlawi highlighted the company’s resilience to US tariffs due to domestic manufacturing. Though facing industry uncertainties, Hikma’s substantial US footprint and ongoing research and development progress helped mitigate tariff impact concerns.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management' own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.