22 September 2020

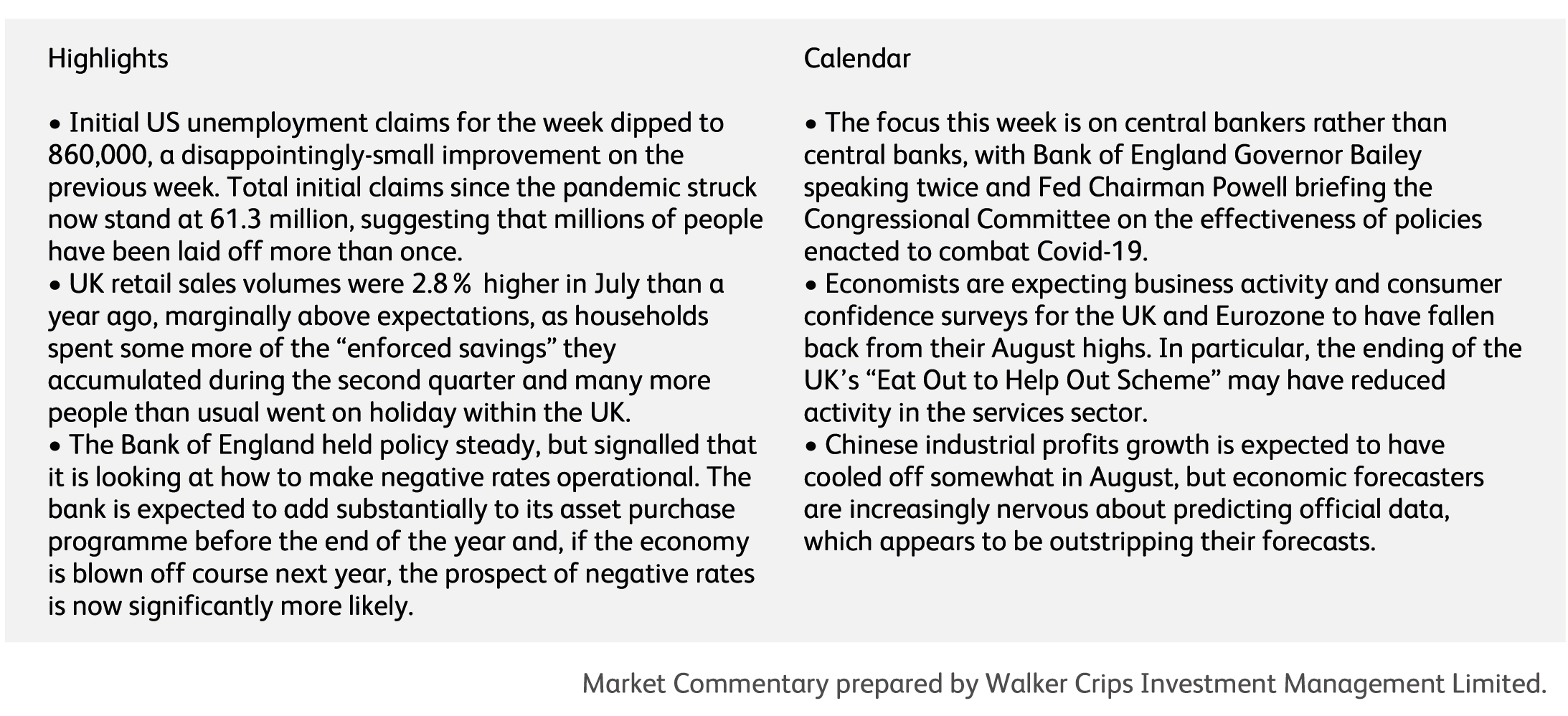

Stockmarkets lost their nerve last week, apparently succumbing to the alarming rates of coronavirus transmission across Europe. The reported number of new virus cases each day in the Euro-zone and UK combined is now higher than in March, when lockdowns were first put in place. However, the link between rising virus cases and markets may not hold for long: the second wave in the US slowed, but did not derail, the economic recovery. Like the US, the increase in cases in Europe has not been accompanied by a sharp rise in deaths, and governments have not yet had to reintroduce national lockdowns. Moreover, extensive fiscal and monetary support limits the economic damage from the pandemic, and the belief that policymakers will do whatever it takes to prop up their economies has certainly helped to underpin markets.

A different explanation for the unease is that, of the three major central banks that met in the last two weeks, none of them added to their current policy measures. The thinking here is that central banks have helped to stabilise markets using enormous asset purchase programmes, but must continually add to those programmes in order to keep volatility sedated. What matters is not just the level of support, but its rate of change. Another fear-factor is the spat over the nomination to the Supreme Court in the US, which has effectively ended any possibility of agreeing another stimulus bill before the election. With current stimulus programmes ending, tens of millions of Americans will start to see their income evaporate and the post-pandemic recovery could start to reverse.

China's post-pandemic recovery accelerated in August, with strong industrial production, retail sales and exports sending economists into a flurry of upgrades to their forecasts for Chinese economic growth. These trends have added to China's surplus of exports over imports to the US, exactly what President Trump originally set out to curtail using tariffs. Tariffs have long since been superseded by a more general anti-China policy, culminating in Sunday's banning of Chinese apps WeChat and TikTok. Responding to the bans, China's Ministry of Commerce stated that China "will take necessary measures to safeguard Chinese firms' legitimate rights". Chairman Xi, moreover, went on the offensive, issuing “important instructions" last week that call for greater Party control over private enterprise and entrepreneurs. Among other things, the Party aims to "build a backbone team of private businesspeople that is dependable and usable in key moments". In other words, China is demanding even more patriotism and political correctness from its private sector. This couldn't be more antagonistic to the US, whose bans on WeChat and TikTok are explicitly linked to the close ties between Chinese business and the Chinese government.

The antagonism goes far beyond business concerns, and Beijing flew military aircraft close to Taiwan on the same day that a senior American diplomat met with Taiwan's president as part of a series of recent moves to improve ties. Beijing warned that "those who play with fire will burn themselves". It's a sign of the times that none of this has phased the Chinese stockmarket, or its currency. The Shanghai Stock Exchange A Share Index fell a mere 0.6% during the last week, and the Renminbi has appreciated nearly 6% against the US dollar over the last few months.

US competition authorities are preparing a possible antitrust lawsuit against Facebook, following an investigation that has lasted more than a year. This would mark another escalation by US officials in their campaign against America's technology giants, which have come under intense scrutiny in Washington over their dominant market positions. The Justice Department is preparing to sue Alphabet's Google in a matter of weeks.

Having urged employees to return to work, some of JP Morgan Chase's Manhattan workers had to be sent home following an employee testing positive for Covid-19. Earlier in the week, Goldman Sachs' Chief Executive Officer had reinforced to the bank's traders the importance of bringing people back to work, only to suffer the same setback after at least one employee tested positive for Covid-19.

Trevor Milton, founder of Nikola Corp. is leaving the electric-truck maker after allegations he misled investors. The startup has attracted backing from some of the industry's biggest names, but has come under scrutiny following a critical report by the short seller Hindenburg Research. The report accused the company and Mr Milton of making exaggerated claims about the readiness of Nikola's technology and how much of it is proprietary. Stephen Girsky, a former General Motors Co. executive, who already sits on Nikola's board, will succeed Mr Milton.

Microsoft Corp. plans to acquire ZeniMax Media Inc., the owner of game developer Bethesda Softworks, in a $7.5 billion cash deal. Bethesda owns the popular video game Doom, but is also know for publishing franchises such as The Elder Scrolls and Fallout. The deal comes as Microsoft gears up to release its next generation of Xbox consoles, in competition with Sony Corp.'s new PlayStations 5. Microsoft has in recent years been adding to its gaming business and, the ZeniMax deal would expand Microsoft's portfolio to 23 games studios from 15.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.