20 October 2020

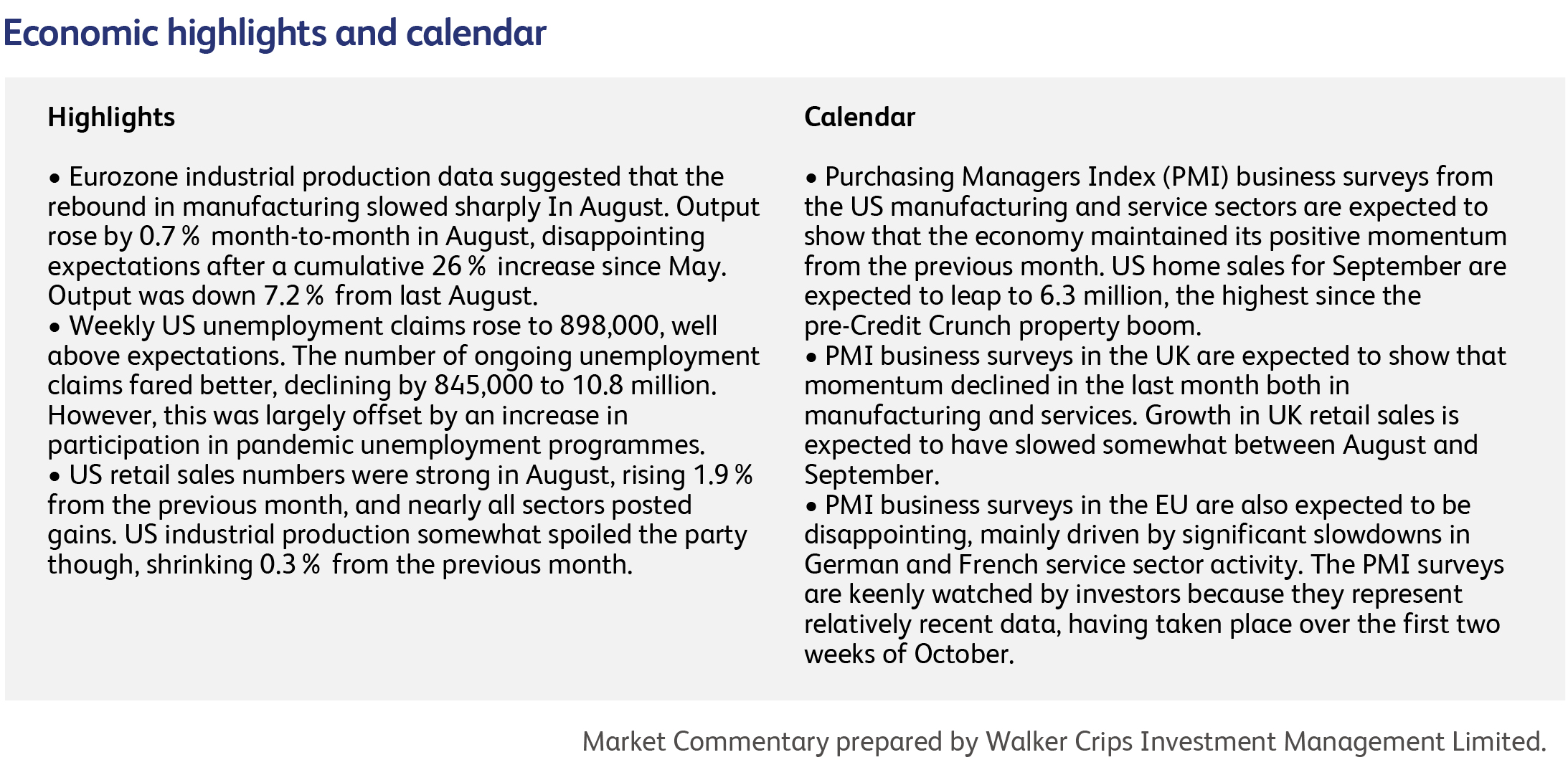

When central bankers speak, markets listen, and last week central bankers all over the world urged governments to spend more in combatting the pandemic. Prior to its annual meeting last week, the International Monetary Fund published its most detailed study of the pandemic’s impact on public finances. According to the IMF, global government debt will “make an unprecedented jump” this year. Governments have injected $12 trillion of stimulus, widening their budget deficits by an average 9 percentage points of GDP. Even so, the global rebound shows signs of losing momentum and excessive debt is “not the most immediate risk. The near-term priority, instead, is to avoid premature withdrawal of support.” The IMF had, historically, been a champion of budget restraint.

European Central Bank chief Christine Lagarde kicked off the IMF meeting by highlighting the new coronavirus-related restrictions currently being introduced across Europe, and saying her biggest concern is that fiscal aid to workers and businesses may get phased out too abruptly. Unlike other economic crises, the dramatic destruction of work from the pandemic has occurred in the services sector, rather than the manufacturing sector, and services account for about three quarters of employment in most developed countries. Any recovery in the services sector will be slower because it doesn’t benefit like manufacturing does from pent-up demand. “The car that you did not buy in March you are going to buy in September,” Lagarde said, “but the vacation you could not take in March, you are not going to take in October.”

US Federal Reserve officials, led by Chair Jerome Powell, lined up to make the same argument for the US, where talks on the renewal of pandemic stimulus have been deadlocked for weeks. Fed officials said their own tools, such as another round of bond-buying, won’t be as effective as government spending. The Governor of the Bank of Japan warned that the Japanese economy is at risk of a “full-fledged recession” if things turn sour. The message from the most powerful central banks is loud and clear: they are concerned that there are limits to what monetary policy can do to help. Governments, who can borrow at rock-bottom interest rates, and possess tools better-suited to deliver a rapid boost, should finish the job.

The US Treasury reported last week that the federal deficit tripled in the most recent government fiscal year to a level not seen since World War II. Government spending exceeded more than $6.5 trillion, up from $4.4 trillion in fiscal 2019, due in no small part to coronavirus relief measures. Other US data, meanwhile, showed that the level of retail sales in September rose to 4.2% above the pre-Covid level, a clear illustration of the power of the cash provided by coronavirus relief programmes, given that 10.7 million jobs have been lost since the virus struck. Despite the strong retail sales figures, US consumers have not yet spent all the stimulus cash; in fact, they have saved a great deal of money since Covid began, about $1.1 trillion more than would usually have been saved over this period. About half of this appears to have come from one-time stimulus payments and enhanced unemployment benefits, with the other half arising because consumers were unable to spend on discretionary services due to restrictions triggered by the virus. When savings rise, people tend to invest more in financial assets and it seems likely therefore that, bizarrely, the pandemic has led to the surge in the US stockmarket. Whether those investments will turn out to be good ones remains to be seen.

Gilead Sciences’ antiviral drug Remdesivir does not reduce deaths among COVID-19 patients, as compared with standard care, according to the results of a large, international trial sponsored by the World Health Organization. The drug has been authorised in the US for use in all patients hospitalised with COVID-19, not only emergency cases. Thousands of US patients have received Remdesivir, including the President. The trial included more than 11,200 people from 30 countries.

South Korean chip maker SK Hynix Inc. is to buy most of Intel Corp's NAND Memory Unit in a $9 billion deal. NAND flash memory products are primarily used in devices such as hard drives, thumb drives and cameras, and the acquisition would make SK Hynix one of the world's largest NAND memory makers. Driven by challenging prices for flash memory, Intel has been weighing getting out of the business for some time. According to Taiwan-based research firm TrendForce, the combined SK Hynix and Intel NAND memory unit will account for approximately 20% of the market, trailing only South Korean giant Samsung Electronics Co., which holds over 30% of the market.

ConocoPhillips has agreed to buy shale rival Concho Resoruces Inc. in a $9.7billion all-stock deal. This would be the largest US oil deal since the coronavirus pandemic began, and the combined company would be the largest US oil independent. The deal is the latest in a series of combinations in the US oil patch, where companies are seeking to consolidate to get through weak demand and low prices as the coronavirus pandemic has roiled energy markets.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.