10 November 2020

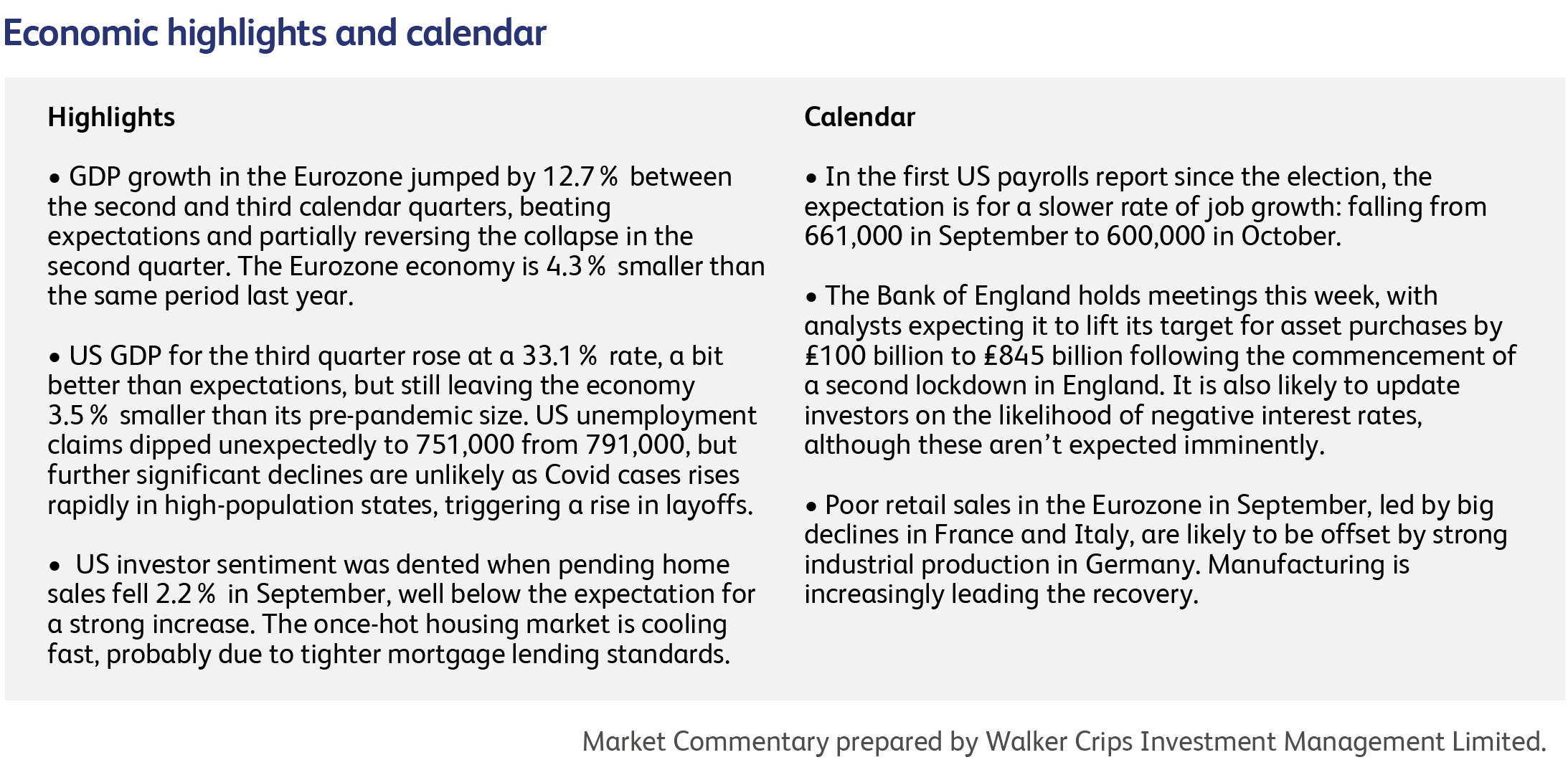

Global equity values gained $6.3 trillion in market value last week, more than half of the GDP of China, and are now equal to 107% of global GDP (source: Bloomberg). Needless to say, this is a record high by some margin. This was accomplished despite the most up-to-date economic data now suggesting a double-dip recession is inevitable in most, if not all, developed world economies. Uncertainty surrounding the US election had been expected to deter investors from taking risk but, in the event, it prompted an onslaught of buying and spawned a cottage industry of after-the-fact explanations. Initially, the favoured narrative had been that a “blue wave” (a Democrat clean sweep) would be good for equities because it would unleash huge stimulus. When the blue wave failed to appear, but the market kept going up, the argument surfaced that a divided congress was good for equities because it would prevent Biden’s administration raising taxes, or increasing regulatory burdens, or going after the tech companies. An alternative argument says that a Biden presidency is good for markets because it would put an end to trade wars and market-disrupting tweets. A more technical argument is that a reduced stimulus package would place less stress on bond markets, keeping bond yields low and equity markets calm. You can pick your poison. The one thing in common with all these explanations is that they were conceived with the benefit of hindsight – sometimes we just have to admit that short-term market moves can be mystifying, and shouldn’t be trusted as a source of valuable information.

With about 52 potential vaccines (or other Coronavirus treatments) in the pipeline, exciting updates on vaccine progress will increasingly become the norm as we enter the final phase of the pandemic. Shortly before Pfizer’s market-moving press release on their vaccine, Chinese medical company Sinopharm had announced that none of the 56,000 people who were inoculated with its vaccine, and then travelled abroad, had contracted the virus. This 100% success rate compares favourably to Pfizer’s own 90% success rate. Pfizer’s own announcement was immediately followed by one from Eli Lilly, to the effect that its antibody treatment had been authorised for use in the US. The reality of the medical prospects for vaccines is always a lot duller than the stockmarket hype: although Pfizer’s announcement had seemingly added trillions of dollars to global equity values, its own stock ended up a decent, but hardly astounding, 7.7%, and was still trading below its pre-pandemic highs.

Spare a thought for Australia, whose export industry suffered a multi-billion dollar blow last week when China's government suspended imports of Australian wine, lobsters, sugar, coal, copper ore, barley and timber. The suspension threatens to cut the value of Australian exports to China by $5-6 billion dollars annually. Relations had deteriorated since Prime Minister Scott Morrison’s government led calls in April for an inquiry into the origins of the coronavirus outbreak. The suspensions reverse a comprehensive free-trade agreement signed between the two countries in 2015. This sends a clear message to those who had followed President Trump’s an anti-China agenda.

China made headlines when it suspended Ant Group’s $37 billion listing, thwarting the world’s largest stock market debut with just days to go. The Shanghai stock exchange suspended the company’s initial public offering (IPO) following a meeting with China’s financial regulators, during which founder Jack Ma was told that Ant’s lucrative online lending business would face tighter scrutiny. Analysts interpreted the move as a slap-down for Ma, who had criticised Chinese regulators in a speech at a recent conference.

McDonald's Corp. announced on Monday that it is to make changes to its menu and restaurant operations in light of the ongoing coronavirus pandemic. The company is set to focus on to-go orders and new "McPlant" vegetarian items. Earlier in the year McDonald's ran a pilot program in Canada to sell patties made by Beyond Meat Inc., and has said it would test a range of new plant-based products in some markets this year. However, McDonald's declined to discuss which companies would supply the new items or what ingredients they would include in the new "McPlant" line.

VF Corp., the parent company of Vans and Timberland, is set to buy the streetwear brand Supreme from founder James Jebbia and a pair of private-equity firms, Carlyle Group Inc. and Goode Partners LLC, in a reported $2.1 billion deal. Supreme is known for its skateboarding T-shirts, hats and sweatshirts and has 12 stores and a cultish following. The company operates a different model to traditional retail chains by focusing instead on scarcity and word-of-mouth to generate hype around its name. VF said on Monday that Mr Jebbia and the current senior leadership team will continue to manage the business after the deal.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.