1 December 2020

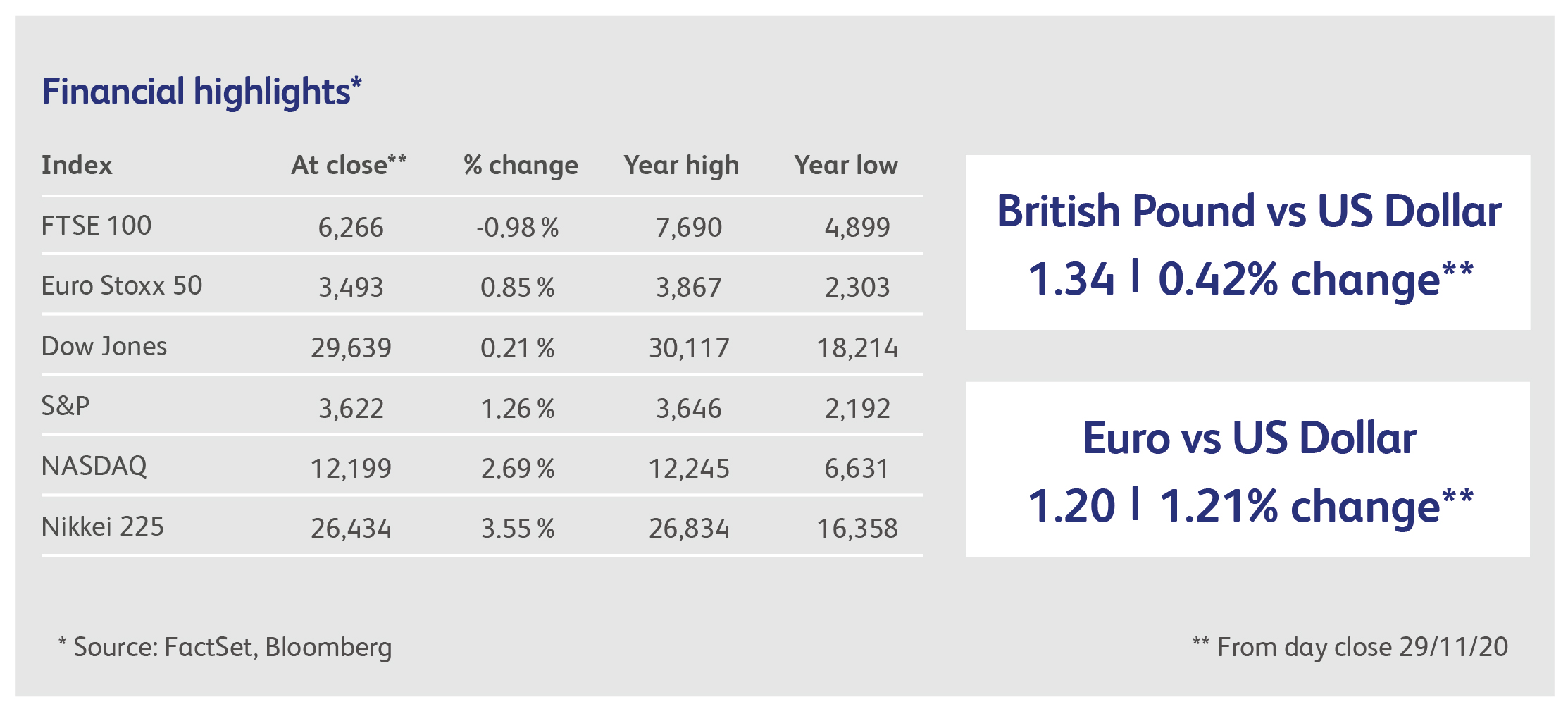

Another week, another round of record highs in stockmarkets around the world. The Dow Jones Industrial Average, the world’s oldest stockmarket index, made the news by closing above 30,000 for the first time in its long history, but there were also all-time highs for the US blue-chip S&P 500, indices tracking US small and medium sized companies, and various stockmarket indices in the Asia-Pacific region. The week’s activity was characterised not only by “back-to-normal” trading, where post-pandemic laggards are bought in anticipation of the beneficial effects of mass-vaccination, but by “peak-pandemic” trading, where technology stock prices are driven up in anticipation of the beneficial effects (on profits) of lockdowns.

Is this due to rational expectations or irrational exuberance? The key factors that could possibly justify such optimism include a rapid return to pre-pandemic levels of employment. Currently, about 21 million Americans are either out of work, or on a form of pandemic unemployment assistance. This is about twice the peak reached during the Credit Crunch, after which it took about eight years for the workforce to return to pre-Credit Crunch levels. Economic forecasters are much more sanguine this time around: in the UK for example, the Office of Budget Responsibility (OBR) predicts that a full recovery will take only four years. But this depends, crucially, on the assumption that consumer behaviour returns to normal. If consumers continue to shop online, and workers continue to work from home, some industries affected by the pandemic, including retail and transport, may never recover to previous levels of employment.

Another critical factor is the rebound in consumer spending. This is one the strongest economic arguments supporting stockmarkets, because the evidence for a huge build-up in savings is manifest. There will be a spending splurge and it will make headlines. What happens afterwards though, once the economy settles down, is less certain, and depends partly on how much saving has been forced by lockdown restrictions, rather than being a precaution against reduced future earnings potential or tax increases.

A third issue is the increased level of debt in the economy, both in the corporate sector and at the level of government. This is where the optimism of equity investors is most likely to come unstuck, because any post-pandemic profits will accrue first to creditors and to servicing debts, rather than to shareholders or new investments; plus creditors now have a much larger claim. With interest rates so low, that debt may not be costly to service but, unlike government debt, it actually has to be repaid.

Finally, there is the issue of government and central bank stimulus. Both need to stay in place for a considerable period of time in order to guarantee stockmarket stability. The OBR’s most recent forecast is for UK government spending to remain £100 billion in deficit (nearly twice the pre-pandemic level) well into the 2020s. Above all, however, the continuation of central bank support is needed to hold this rally together: in addition to the drastic cuts to interest rates at the start of the pandemic, the world’s central banks have spent $8 trillion this year buying financial assets. That has been the cost of resurrecting investors’ confidence in capital markets.

American biotechnology company Moderna Inc. has asked US and European regulators to authorise the use of its Covid-19 vaccine. In a pivotal study the vaccine was shown to be 94.1% effective. The Moderna vaccine would be the second to undergo regulatory review by health regulators, with the Pfizer Inc. and BioNTech SE vaccine being the first. On 17 December a panel of outside experts advising the US Food and Drug Administration (FDA) will meet to review the evidence for the Company's vaccine and vote on whether to recommend that the agency authorise its emergency use. If the FDA does authorise the vaccine, distribution could start within weeks.

The British High Street's woes continue to mount as the Arcadia Group has gone into administration, putting 13,000 jobs at risk, and Debenhams faces liquidation after JD Sports pulled out of rescue talks. Sir Phillip Green's Arcadia owns Topshop, Burton and Dorothy Perkins and has seen sales "severely impacted" by the pandemic. However, even before the pandemic the company was struggling in the face of newer, online-only fashion retailers such as Boohoo and ASOS. While Debenhams, which has been in "light touch" administration since April, had been in talks with JD Sports. But, in a single-line paragraph statement released today, JD Sports said that "discussions with the administrators of Debenhams regarding a potential acquisition of the UK business have now been terminated". If no buyers can be found Debenhams is likely to be broken up and liquidated in the new year.

Kustomer, a New York based startup specialising in customer-service platforms and chatbots, is set to be bought by Facebook Inc. in an estimated $1 billion deal. The deal comes as part of an effort by Facebook to help companies use its platforms to do business as increasingly customers are communicating with companies by messaging instead of calling. Kustomer was founded in 2015 by entrepreneurs Brad Birnbaum and Jeremy Suriel, and joins Facebook as Chief Executive Mark Zuckerberg makes a big push into what he calls "social commerce".

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.