27 May 2025

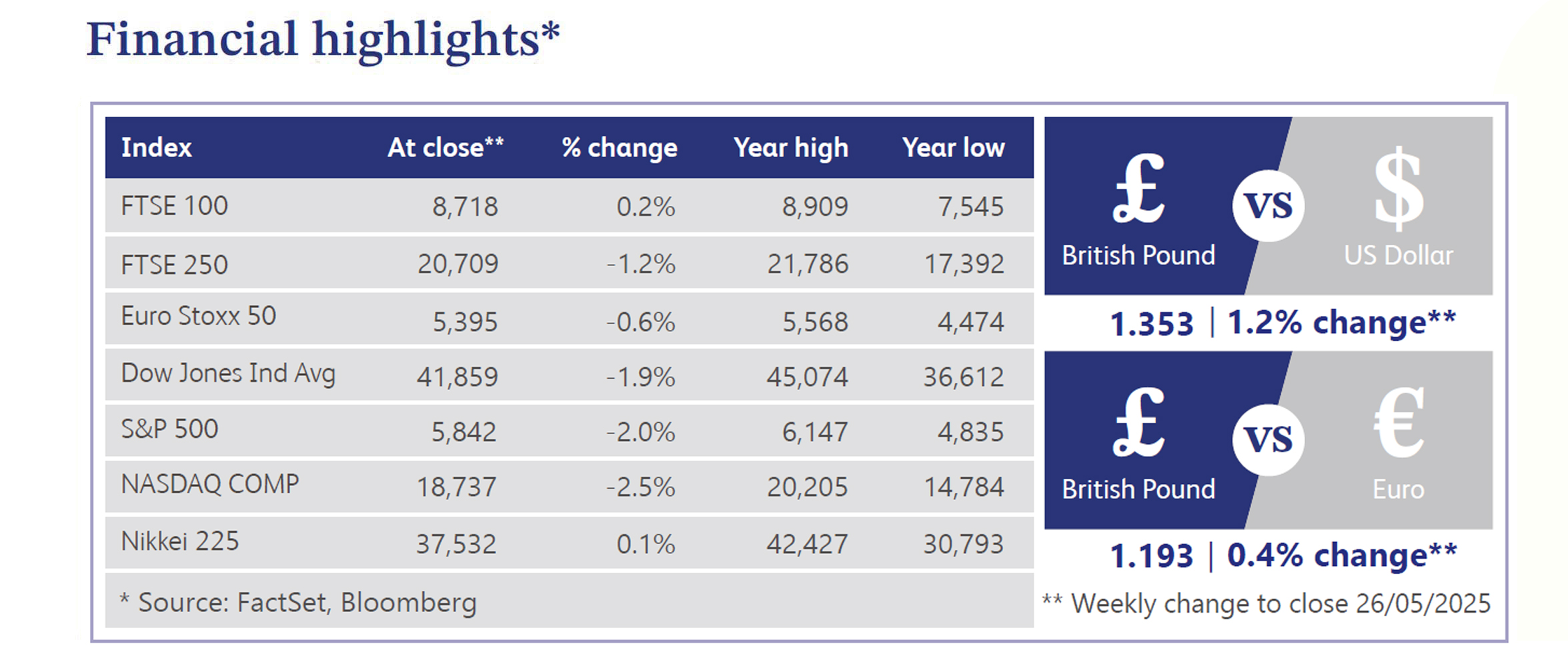

Last week, UK markets digested a slew of conflicting economic signals. April’s inflation unexpectedly rose to 3.5%, a 15-month high, driven by higher energy costs, tax changes and wage pressures, dampening expectations for further Bank of England (“BoE”) rate cuts. Gilt yields surged and the pound touched a two-year high. BoE Chief Economist Huw Pill warned against aggressive easing, citing persistent services inflation and weakening disinflation momentum, while policymaker Swati Dhingra defended her vote for a 0.5% cut, highlighting a long-term outlook. The Purchasing Managers' Index (“PMI”) data showed the private sector contracted slightly in May, dragged by manufacturing weakness, despite services expansion. Retail sales jumped 1.2% in April, buoyed by sunny weather, supporting first-quarter growth of 0.7%. Consumer confidence improved, helped by better economic prospects and recent trade deals. The outlook remains uncertain as inflation risks challenge the case for monetary easing.

UK Prime Minister Keir Starmer announced a “Brexit reset” deal with the EU, projecting a £9 billion annual boost by scrapping food export checks and aligning energy markets. Though backed by business groups, critics slammed concessions on fishing and agricultural compliance. Starmer reaffirmed opposition to rejoining the EU customs union to protect future trade deals. Politically, he identified Nigel Farage and Reform UK - not the Conservatives - as his main rivals, underscoring a reshaped political landscape. Meanwhile, a leaked memo revealed Deputy PM Angela Rayner’s proposals for tax hikes on banks and high earners, exposing tensions with Chancellor Rachel Reeves. April’s borrowing hit £20.2 billion, raising debt to 95.5% of gross domestic product (“GDP”), prompting calls for fiscal restraint. Net migration halved, bolstering Starmer’s stance on legal immigration. Rayner admitted housing targets are ambitious amid weak construction.

US equities declined last week, trimming prior gains, with the S&P 500 slipping into a year-to-date loss and the Russell 2000 ending a six-week winning streak. Big tech led the decline, with Apple (-7.6%) the standout laggard. Losses were widespread across sectors, including energy, apparel and financials, while relative strength was seen in pharma, software, industrial metals and utilities. A key market headwind was Moody’s downgrade of US sovereign credit, highlighting persistent fiscal deficits and rising interest costs. This, combined with weak Treasury auctions, amplified concerns over debt sustainability and bond demand. Trade tensions resurfaced as Trump threatened a 50% EU tariff from 1 June, casting doubt over recent de-escalation momentum, though he agreed to extend negotiation deadlines by over a month. However, economic data offered some support, including strong April new-home sales and improved May Purchasing Managers’ Index (PMI) figures. Treasury yields rose, the dollar weakened and gold surged 5.6%, reflecting investor caution amid macro and policy uncertainty.

UK house prices hit a new record in May, rising 0.6% to £379,517, according to Rightmove, despite signs of market cooling. This marked the slowest May increase since 2016, as a surge in listings pushed supply to a 10-year high and buyer demand fell 4% in April after stamp duty incentives ended. Regional trends diverged, with the North West leading at 3.9% annual growth, while London and the South East underperformed. Separately, Office for National Statistics (“ONS”) data showed a 6.4% year-on-year rise in March - the fastest since 2022 - as buyers rushed to beat tax changes. Lower mortgage rates and improved affordability may offer near-term price support.

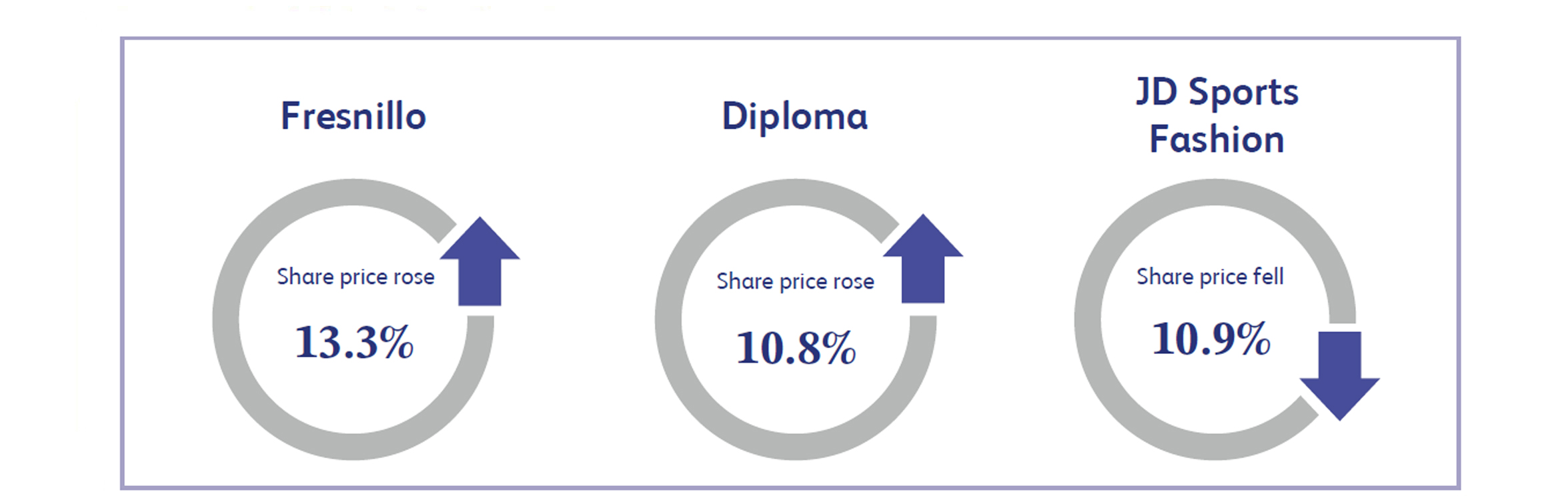

Fresnillo is a precious metals mining company primarily focused on silver and gold production, with operations in Mexico and ongoing explorations in Chile and Peru. Its shares surged 13.3% last week following a confident outlook from Chairman Alejandro Baillères during the company’s annual general meeting. Baillères highlighted “positive” long-term prospects for operations and strong demand forecasts for both gold and silver. The upbeat sentiment was underpinned by expectations of favourable precious metal prices and successful exploration progress. This reassurance came amid broader market uncertainty, positioning Fresnillo as a defensive play with potential upside in an inflation-sensitive commodity environment.

Diploma, a supplier of technical products and services, gained 10.8% last week after releasing a strong interim earnings report and raising full-year guidance. The company now expects 8% organic revenue growth, up from 6%, and raised its operating margin target to 22%. Chief Executive Officer (“CEO”) Johnny Thomson highlighted the resilience of its decentralised, locally-sourced supply chains, which are expected to limit exposure to global tariffs. Investors responded positively to the company’s ability to navigate uncertainty while maintaining operational momentum. The results reaffirmed Diploma’s robust business model and strategic clarity, pushing shares to a record high on improving investor confidence.

JD Sports Fashion, a leading retailer of sports and outdoor clothing, dropped 10.9% last week after posting weaker-than-expected full-year results. Profit fell to £540 million from £605 million, and the final dividend was reduced. Sales in North America declined 5.5% in the first quarter, significantly underperforming expectations, as the company maintained full pricing in a heavily discounted market. While management maintained confidence in the medium-term outlook, the weak US performance and muted Fiscal Year 2026 guidance weighed on sentiment. Despite low valuation multiples and long-term potential, near-term headwinds - tariffs, competition and cautious consumer spending - spurred the selloff.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management's own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.