6 April 2021

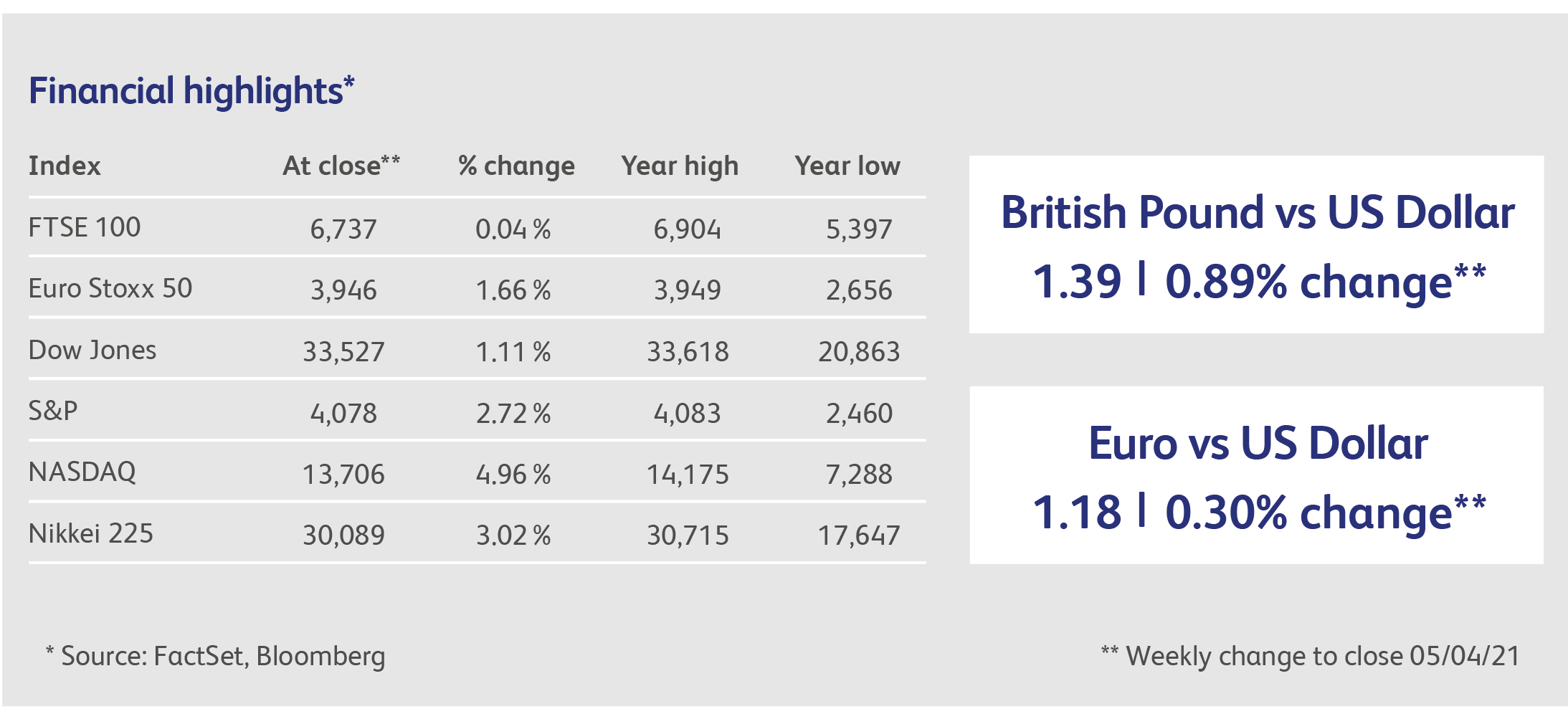

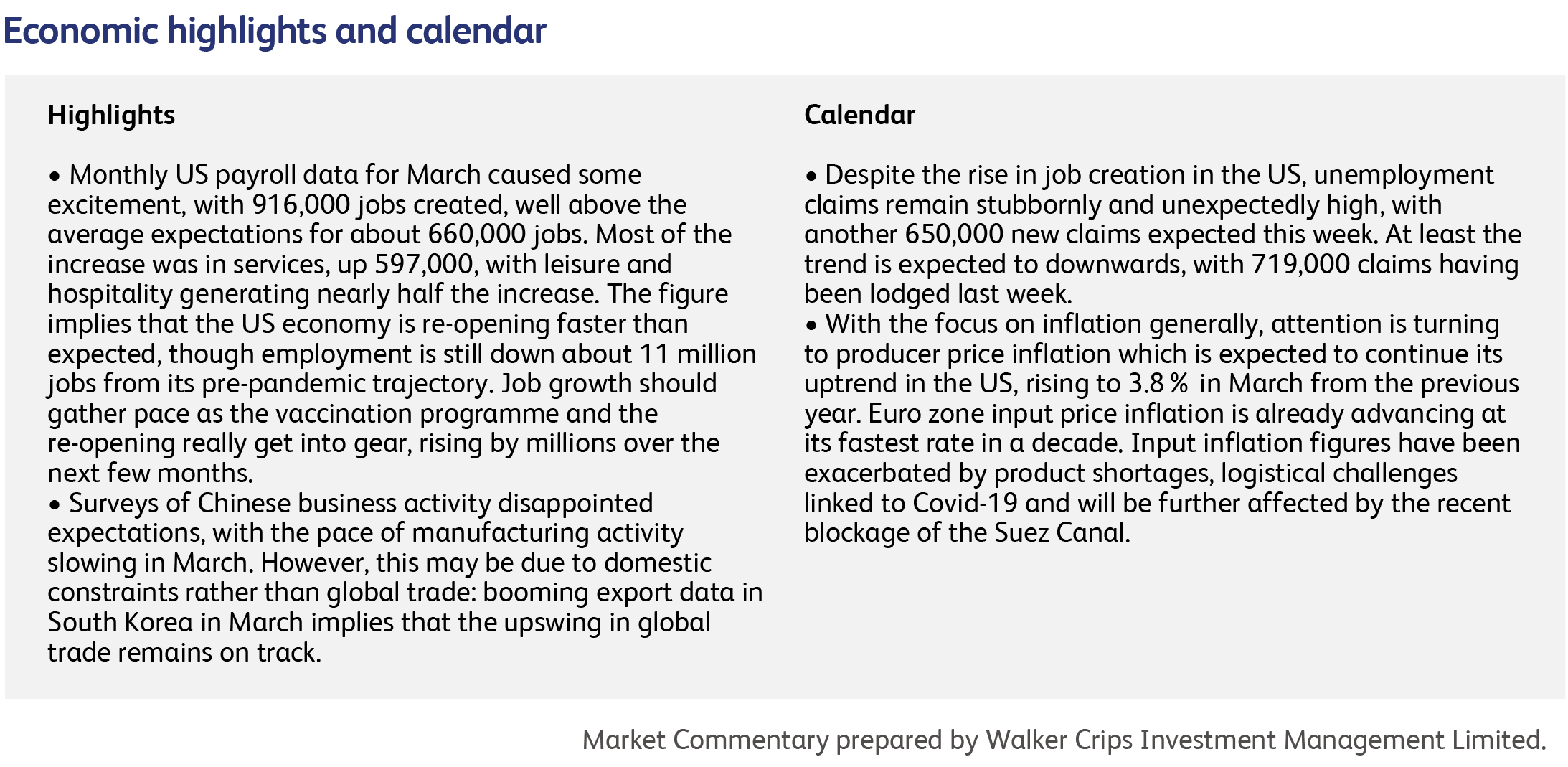

The news that President Biden would raise taxes on corporations to fund the proposed $2 trillion infrastructure programme did not dampen investors’ enthusiasm, with several US equity indices hitting all-time highs over the past week. Treasury Secretary Yellen confirmed the change in policy by re-committing the US to a global minimum corporate tax rate, something that would prevent technology companies in particular from shopping around for the lowest tax jurisdictions. This did not stop a surge in technology sector share prices: only a month ago some of the biggest technology companies were struggling to regain their levels of August 2020, now they are pushing towards all-time highs. This rally comes despite the conventional wisdom that tech companies will see their revenues and profits underwhelm as society returns to normal; after all, an evening spent at the pub is an evening not spent watching Netflix.

The rally in US stockmarkets is really only playing catch-up to the rally in Europe, where blue-chip equity indices have already surged far past all-time highs. The German DAX stockmarket index is a notable example, having recently risen about 10% beyond its pre-pandemic level. The predominance of (previously) unfashionable industrial sectors in European markets has now become their strongest asset, and the slow pace of European vaccination programmes has, seemingly, been irrelevant.

But this pales by comparison with the cryptocurrency universe, whose value has doubled since the start of the year. The total market value of cryptocurrencies exceeded $2 trillion for the first time last week, supposedly driven by “institutional” demand as traditional asset managers supposedly discover its true value. To put that in perspective, $2 trillion eclipses the cash in circulation of most national currencies, and you could buy the entire German stockmarket with it.

The default explanation for recent exuberance is that investors are anticipating the surge in economic activity that will occur as economies re-open. It’s certainly true that year-over-year growth rates for economic data will go haywire to the upside from March and into the second calendar quarter. This is obviously due to the collapse in economic activity that occurred at this time in the previous year but, with markets at lofty heights and in the grip of speculative fervour, many investors may simply be looking for any reason to celebrate.

Just as likely, however, the enormous amounts of cash being pumped into the economy by central banks and governments continue to find their way into financial assets, with the nature of the asset being bought showing very clearly who is doing the buying. And President Biden may not be finished with stimulus: soon after the infrastructure programme was announced, Democrats urged another stimulus, this time aimed at aid for poorer households. It’s also worth pointing out that, in asking the corporate sector explicitly to fund the infrastructure programme, President Biden was implicitly not asking it to fund any of the $5.6 trillion in previous, Covid-related stimulus programmes. Meanwhile, US corporate buybacks (companies buying their own shares) reached an all time high in March.

Facebook’s travails with personal data continued with the news that 533 million Facebook users' phone numbers and personal data have been leaked online. The exposed data included the personal information of Facebook users from 106 countries, including over 32 million records on users in the US, 11 million in the UK, and 6 million in India. It included phone numbers, Facebook IDs, full names, locations, birthdates, bios, and - in some cases - email addresses. Facebook responded that the data was a couple of years old, having been hacked due to a vulnerability that the company patched in 2019, and its share price ignored the news, rising to a new all-time high.

Japanese conglomerate SoftBank Group Corp. has agreed to pay $2.8 billion for a 40% stake in AutoStore, the Norwegian warehouse-automation company, valuing the company at $7.7 billion including debt. Founded in 1996 AutoStore's technology, which employs giant cubes packed with bins, makes it possible for warehouses to be operated almost entirely by robots. In the deal, SoftBank will acquire the 40% stake from funds affiliated with majority shareholder Thomas H. Lee Partners LP, and Swedish private-equity firm EQT AB, which holds a minority stake.

The UK-listed SDCL Energy Efficiency Income Trust Plc has announced that it will acquire a 100% interest in the commercial district energy system RED-Rochester LLC, located in Rochester, NY, for around $177 million in cash. The company said the deal will be funded from existing cash reserves.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.