20 April 2021

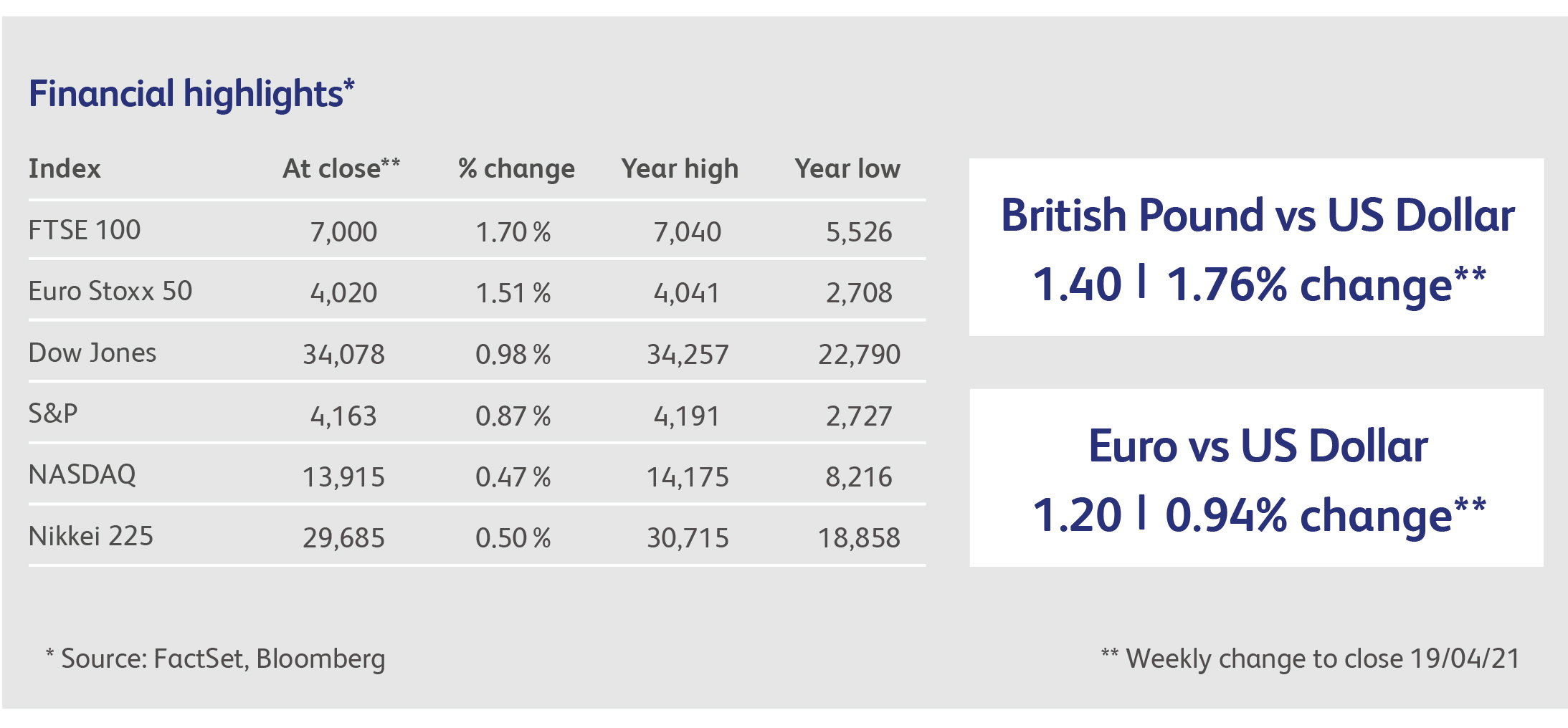

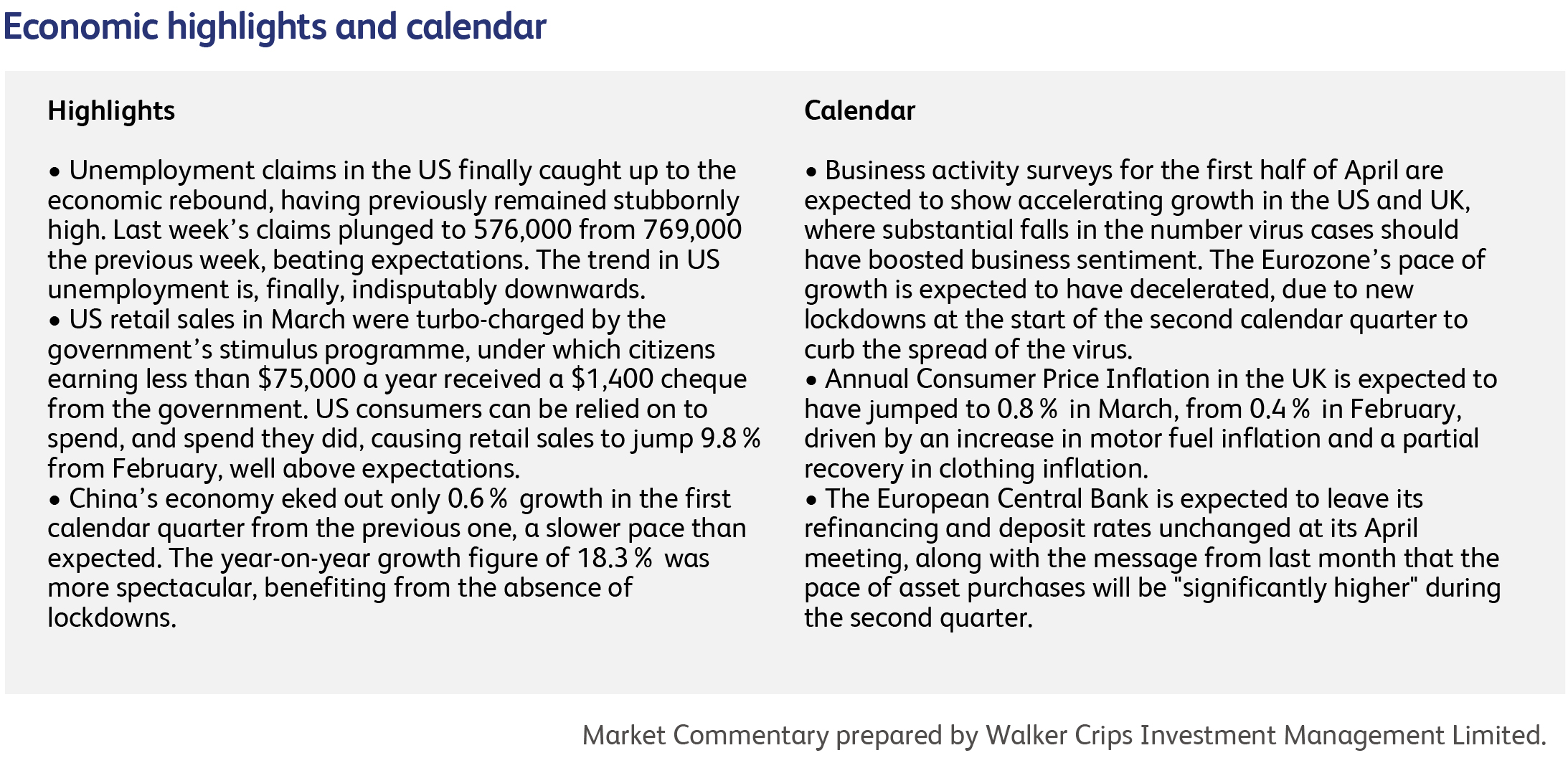

Investors in domestic UK companies are enjoying some of the best returns in years, with UK shares having been caught up in the all-encompassing global stockmarket rally. The smaller down the size-scale you go, the better it gets: the FTSE 100 index, which tracks the very largest UK-listed companies, has rallied but less than other markets, and is still 10% or so below its peak of 2018. The FTSE 250 index, however, which tracks small and mid sized companies, reached a new all-time high this week and the FTSE AIM, which tracks the smallest UK listed companies, is about 28% above its pre-pandemic level and is also at an all-time high.

The conventional wisdom is that, unlike equities in other markets, the UK currently offers a reasonable valuation opportunity for international investors. Brexit risks have faded as it becomes more of a known quantity, and the most recent trade data hints that the hit to the UK’s exports to the EU might not be too concerning. The B117 variant of the virus was crushed by the lockdown, and the UK’s outstanding vaccination programme puts it in the forefront of the recovery. And there’s more, as the government continues to provide a healthy amount of stimulus spending.

The pound sterling is the missing piece, however, for international investors. Typically, in bullish environments the pound can be relied on to add substantially to returns on UK assets: between 2002 and 2007, for example, the pound rose from $1.41 to $2.05 against the US dollar. The gains against the dollar were more modest during the internet boom, but still reached double figures in percentage terms. Although the pound has recovered substantially from its pandemic lows, its momentum of the early part of this year has faded. Moreover, at $1.40 to the dollar, the pound still sits well beneath its referendum-night level of $1.50. Against the Euro, the pound has yet to break out of its post-referendum malaise, and is still at an enormous 20% discount to its pre-referendum highs.

This is somewhat puzzling. Currencies are more vulnerable to political risks than other asset classes but, with the Conservatives holding an eight percentage-point lead over Labour in the latest opinion polls, investors do not to have to worry about whether Labour's policies would hurt their portfolios. The threat of another Scottish independence vote is years away and is tempered by the fact that, even if it did result in separation, that would leave the Conservative Party in an even more commanding majority in Westminster.

It’s possible, nevertheless, that global investors are still avoiding UK assets. The acrimonious post-Brexit dealings with the EU have hardly inspired confidence in the prospects for the UK’s biggest trading relationship. Actions by the British government to walk away from its treaty obligations with the EU set a worrying precedent, and are hardly likely to encourage investors from the EU. The EU is aggressively encouraging providers of financial services – one of the UK’s biggest exports – to relocate and, while the status of the financial services industry’s ability to export to the EU is in doubt, the pound’s wounds may not fully heal.

The listing of Coinbase Global, the biggest cryptocurrency exchange in the US, prompted another bout of volatility in the crypto world. Coinbase Global’s valuation at launch was more than the value of the New York Stock Exchange and Nasdaq Stock Market holding companies combined, but it promptly plunged by nearly 20%. Cryptocurrencies themselves followed suit with plunges of their own, prompting some to consider whether “going mainstream” signals the death knell for cryptocurrencies as an investment.

Peloton Interactive shares fell over 8%, capping a decline of 30% for the year so far, after US regulators warned consumers to stop using the exercise equipment maker’s treadmill machine if there are young children or pets at home. The warning follows investigations into incidents involving injury or death. Peloton’s exercise bikes still represent over 90% of hardware revenue.

Oatly Group AB, the Swedish plant-based milk producer, has on Monday formally filed paperwork for an initial public offering in the US. They plan to raise $100 million from a sale of its American depositary shares, a placeholder figure often used to calculate filing fees and is often changed. The company was started in 1994 by brothers Rickard and Bjorn Oste, and launched its first oat milk product under the brand Oatly in 2001. In the filing Oatly reported a $60 million net loss on $421 million revenue in 2020, compared with a loss of $36 million on revenue of $204 million.

The UK government is starting a national-security review of Nvidia Corporation's $40 billion deal to buy British chip designer Arm Holdings from SoftBank Group Corp. The deal, which is already undergoing an antitrust review by the UK government, is potentially industry-reshaping, and is also likely to face regulatory scrutiny from around the world.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.