27 July 2021

The tsunami in China’s capital markets finally reached the shore of the western world this morning, following the latest onslaught by the Chinese authorities. This time the focus was on the technology sector, after China’s monopolies regulator ordered online food platforms to pay their workers at least the minimum wage. This appeared to target the industry leader Meituan, itself backed by the Chinese internet giant Tencent Holdings. Between them, these companies have lost over £400 billion in value since their February peaks, largely in response to a series of investigations and fines levied by Chinese regulators.

The previous day, Chinese stockmarkets had also seen significant losses after the authorities ordered the $100 billion private education sector to cease making profits. This clampdown, on a booming industry, shows how far the Communist Party will go to exert control over the private sector. Chinese stockmarkets are now formally in a bear market, defined as being more than 20% down from their peaks: the Hang Seng China Enterprises Index, which measures the values of Chinese companies with listings in Hong Kong, is now down 27% from its peak.

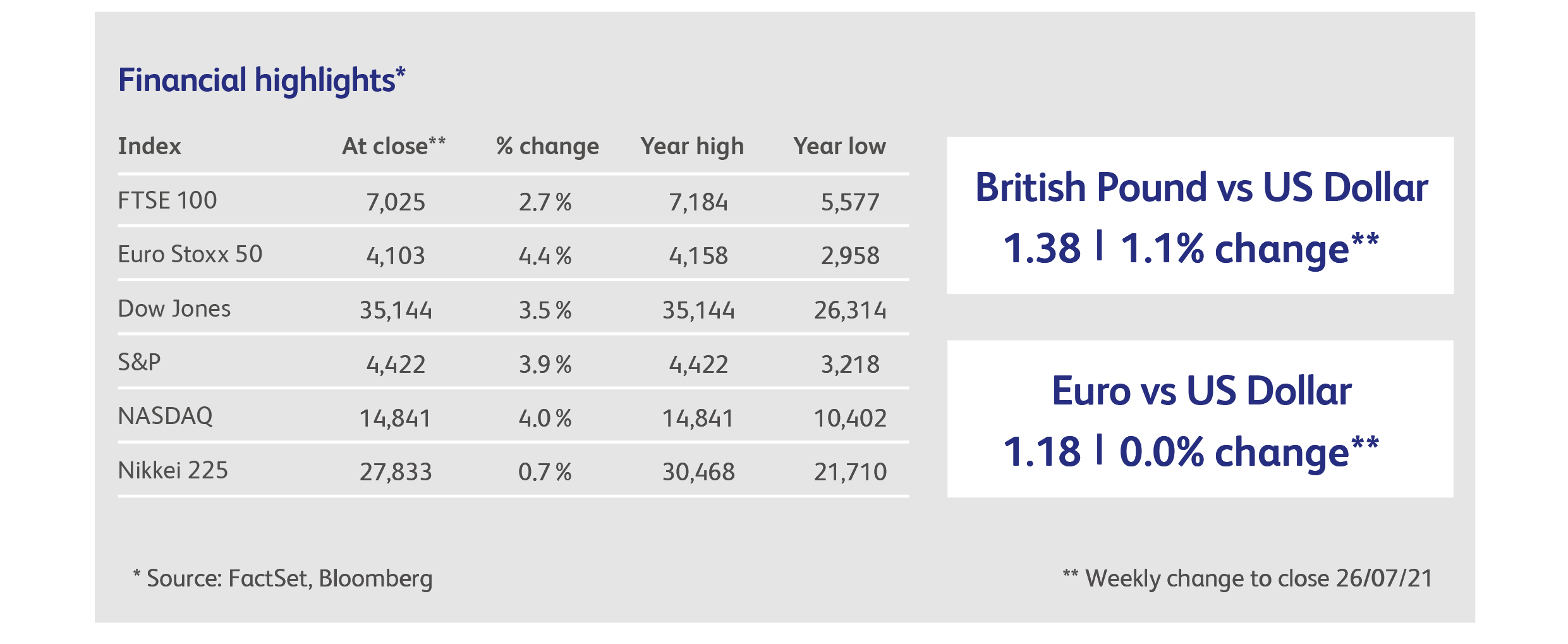

Another overnight collapse in Chinese stockmarkets was enough to spook European markets at the open. On top of the ongoing cooling of geopolitical relations between the west and China, these events bear some resemblance to 2015’s sell-off, when western investors were frighted by heavy-handed Chinese moves. Back then, China’s central bank engineered a sudden devaluation of the Renminbi. The consequences for investors in Europe were particularly serious: following the devaluation, the FTSE 100 stockmarket index fell by 12% in a couple of weeks, eventually ending up down 18% from its pre-devaluation level. The Euro Stoxx 50 stockmarket index, which comprises the top 50 listed European companies by value, ultimately fell 27%.

The latest wobble came after a strong rebound, in which the US Dow Jones Industrial Average and the S&P 500 indexes both reached all-time highs. In some respects, things could not get any better for investors: reported company earnings for the second calendar quarter have grown by record margins. However, this is partly due to the extremely poor performance of last year’s second quarter, and worries are also beginning to creep in as to whether profits can be maintained at these levels. After all, some slowdown is inevitable in the second half of the year because pandemic stimulus payments are coming to an end, and because most of the global economy reopened in the first half. It can't reopen all over again, plus we have to worry about the Delta variant.

That is precisely the message from recent UK surveys of business activity, which revealed that both the manufacturing and services sectors fell to their lowest levels of activity in four months. After the initial release of pent-up demand following the reopening of the economy in April and May, a slightly weaker underlying picture is emerging. Expectations for US economic activity have also moderated somewhat recently, following a sequence of sub-par reports for employment and industrial production. UK and US government bond markets have seized on the possibility of a return to slower growth, and are now trading back at their levels of February, before the eruption in inflation fears.

Tesla easily beat analysts’ expectations for profits in the second calendar quarter, boosted by sales of its new, mass-market models. Profits more than tripled from the same period last year. The company was able to overcome price cuts through even more sizeable reductions in manufacturing costs. Tesla shares rose 3% after the markets had closed, but are still down for the year.

Shares in luxury goods retailer LVMH bucked the market by rising after reporting its strongest ever set of half-year results. According to the company, demand from Chinese consumers “remains as good it’s been for quite some time,” with sales from Asia (excluding Japan) representing 38% of LVMH’s total revenue in the first half. LVMH managed to keep its cost-base flat compared with its pre-pandemic level, despite enjoying revenues that were up by about 40%. Profit from recurring operations was EUR7.6 billion for the first half of the year, exceeding analysts’ expectations of EUR6.6 billion.

A freak surge in cold weather in Brazil has upended the market for coffee, with the worst frost in two decades slashing expectations for harvests and destroying enough young trees to affect production for years. Arabica coffee futures are up 40% over the last month, but the expectation of higher prices has actually boosted shares of Starbucks, which are up 13% over the same period.

Cryptocurrency worries intensified with rumours that a US investigation into Tether is likely to spur a criminal prosecution. Tether is the most popular of the “stablecoins”, tokens designed to avoid volatile price swings and facilitate payment in more volatile cryptocurrencies. Criminal charges would represent an escalation of the US government’s ongoing crackdown.

Highlights

An unexpected decline in surveys of business activity in the UK caused jitters amongst economic forecasters. Both services and manufacturing responses were well below expectations, suggesting that the economic recovery is faltering. The Delta variant is the prime suspect. At least the surveys still indicate that the economy is growing, though more modestly than expected.

Business activity surveys in the Eurozone exceeded expectations for robust growth, pointing to a strong start to the third calendar quarter for the economy. The improvement was driven by a boom in the services sector as restrictions were eased further: service sector activity rose to a 15-year high. French service activity was the only disappointment, slipping to a 2-month low despite an easing of lockdown restrictions.

Calendar

Eurozone GDP data should show that the economy sprang back into life in the second calendar quarter, after recessions in Q4 and Q1. GDP is expected to have jumped 1.5% during the quarter, led by gains in Spain, Germany, and Italy, offset by lacklustre growth in France. A rebound in consumer spending on services is likely to have driven the rebound.

Consumer price inflation data in Germany is expected to show that inflation jumped sharply in July, to 3.2% from 2.3% in June. This is largely due to the ending of last year’s temporary VAT cut. Eurozone inflation is likely to have risen more modestly, from a 1.9% rate in June to 2% in July.

The US economy is expected to have expanded at an 8.5% rate between the first and second calendar quarters, led by double-digit growth in consumption and business investment. The Federal Reserve is expected to leave rates unchanged at their July meeting, but to have raised the unsettling question of “tapering” their asset purchases.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.