2 December 2025

The week was defined by Chancellor Rachel Reeves’ pivotal budget, which combined £26 billion in tax rises with increased spending commitments. Despite the Office for Budget Responsibility (“OBR”) upgrading 2025 growth to 1.5%, the reaction from the business community was negative. Following the tax rises, KPMG countered the OBR, warning growth will stall to 1% in 2026. Corporate sentiment crashed as the Institute of Directors (“IoD”) reported near-record low confidence, while the Confederation of British Industry (“CBI”) saw service optimism fall at its fastest rate in three years. Although a £22 billion fiscal buffer calmed markets, the cost was a collapse in business investment intentions to pandemic lows. Furthermore, with the Bank of England (“BoE”) warning it may "look through" one-off price cuts, the rate path remains complicated despite markets pricing a near-certain December cut.

Political unity appears to be fraying alongside business trust. Reports emerged that Cabinet ministers have accused Keir Starmer and Rachel Reeves of "misleading" them regarding the scale of the fiscal hole to justify tax hikes. S&P Global Ratings also warned that despite £26 billion in tax rises, the UK’s fiscal position remains "fragile" with deficits averaging 5.5% of gross domestic product (“GDP”). To counter damaged sentiment, Keir Starmer launched a "growth reset" agenda focused on deregulation and welfare reform, seeking to restore business confidence now that major tax changes are complete.

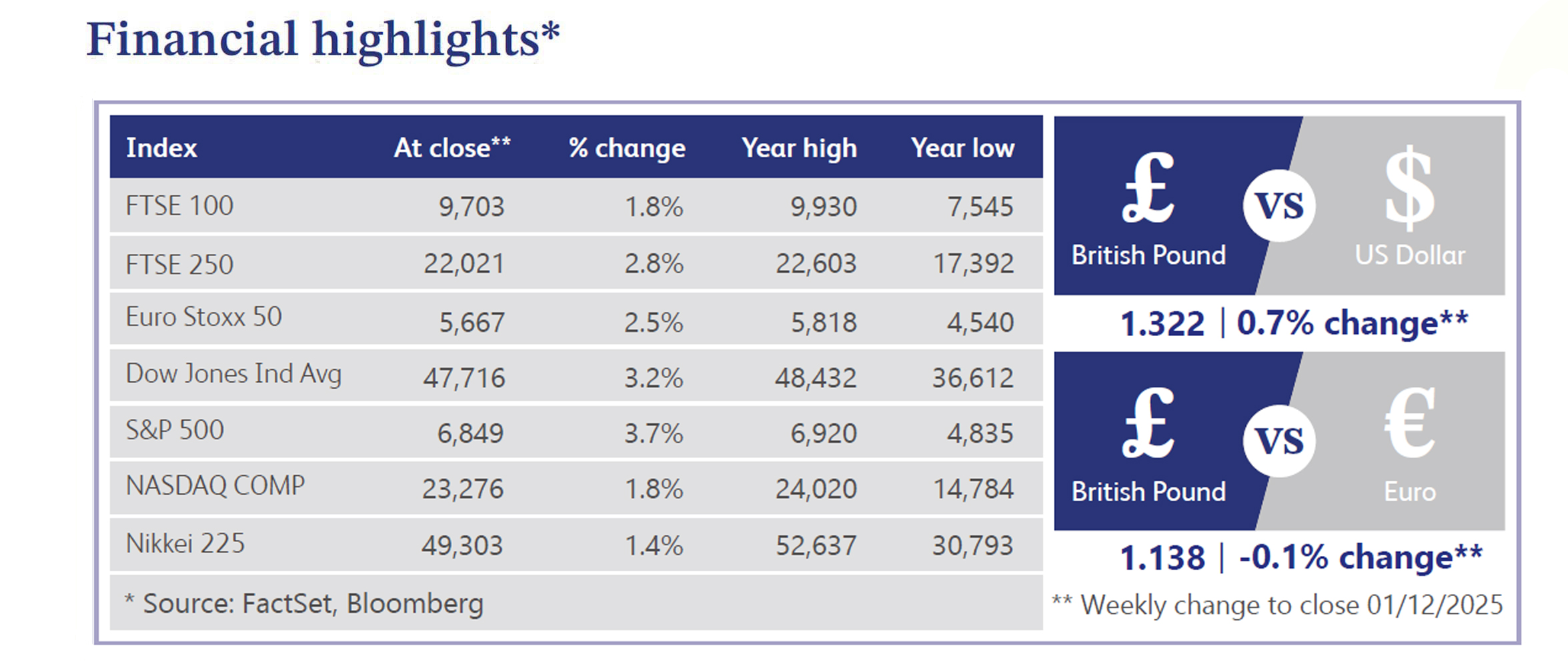

In UK markets, the FTSE 100 climbed 1.8%, the FTSE 250 rose 2.8%, whilst Sterling strengthened to USD 1.32. Following the turbulent period preceding the budget, financial markets offered a sigh of relief, with the gilt market delivering an immediate verdict. Fears of a borrowing blowout proved unfounded as the Chancellor announced gilt issuance lower than consensus fears. This triggered a rally on Wednesday, sending the benchmark 10-year yield down 0.09% to 4.41% as investors cheered the fiscal restraint. Equity markets saw specific winners, particularly the banking sector, which surged after the budget sought to reinvigorate UK equity ownership and the BoE loosened capital rules, avoiding a feared tax raid.

US equities staged a powerful rally with the Nasdaq up 1.8%, the Russell 2000 surging 5.54%, while the S&P 500 posted strong weekly gains of 3.7%. Momentum was driven by renewed bets on a December Federal Reserve (“Fed”) rate cut at around 80%, following dovish commentary from Fed officials John Williams and Christopher Waller. Tech and Consumer Discretionary outperformed, supported by a Google artificial intelligence (“AI”) rally and strong retail earnings from Kohl’s and Best Buy. Black Friday online sales rose 9.1% to $11.8 billion, according to Adobe Analytics. In the commodities market, gold gained 2.1% and oil stabilised, while the end of the government shutdown highlighted a continued economic data gap. Geopolitically, Trump warned Venezuela’s airspace is "closed" as the US could expand its strikes. China resumed, then upped, US soybean purchases following late-October talks, after largely shunning US soybeans for months amid a tense trade standoff.

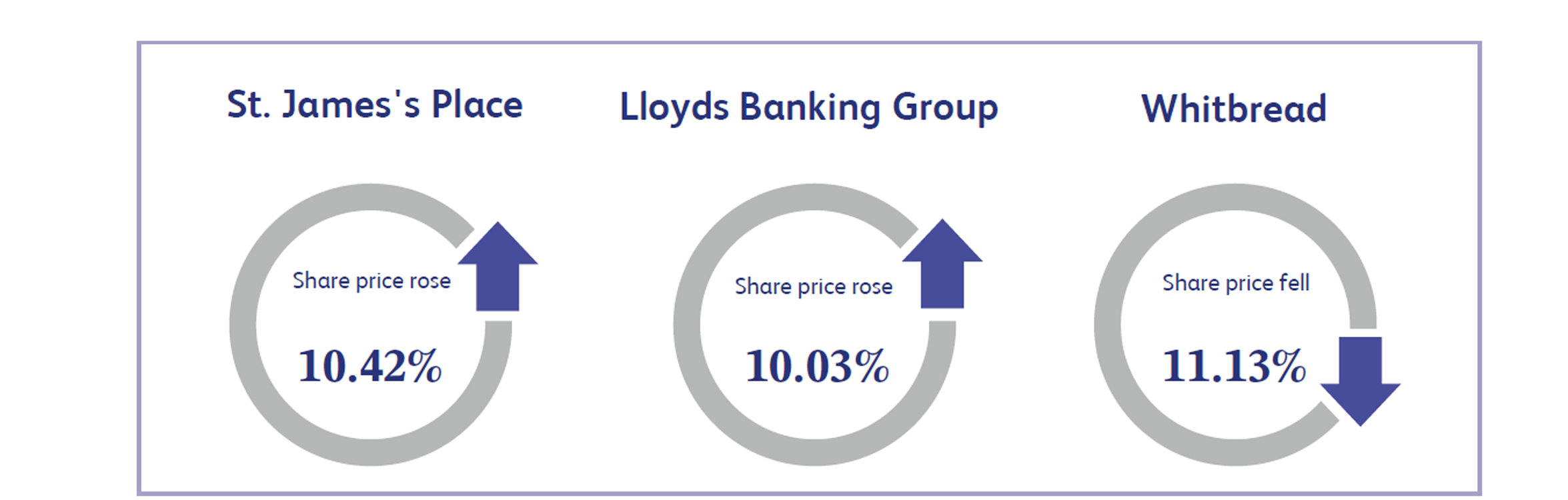

St. James's Place, a leading UK wealth management group, was the week's top performer, rising 10.42% as the sector reacted positively to a budget aimed at boosting UK equity ownership. Chancellor Reeves announced a stamp duty holiday on newly listed shares for up to three years, a move strategists believe will make "buying British" more enticing. Sentiment was further boosted by significant ISA reforms; from April 2027, £8,000 of the £20,000 allowance must be allocated to UK stocks.

Lloyds Banking Group, the leading UK banking group, surged 10.03% as the banking sector breathed a collective sigh of relief following the budget. Lenders were spared the highly anticipated "cash grab" of a new windfall tax, removing a significant overhang of fiscal volatility. In a move seen as a "quid pro quo" to reassure the government, Lloyds immediately unveiled £35 billion in new financing for UK businesses for 2026 — a commitment publicly praised by the Chancellor. Analysts highlighted the sector’s attractive valuations and the clarity provided by the exemption from further taxation as key drivers for the rally.

Whitbread, the UK’s largest hotel operator, was the week's biggest laggard, plummeting 11.13% after warning of a significant hit from the budget. The Premier Inn owner expects an impact of between £40 million and £50 million, driven largely by increasing rates for businesses operating commercial properties with higher rateable values. CEO Dominic Paul expressed he was "extremely disappointed" with the outcome for the wider industry. Although the company affirmed its Full Year 2026 guidance and pledged to accelerate cost efficiencies by £60 million in fiscal 2027 to mitigate the headwinds, investors sold the stock heavily on fears of the immediate pressure on the cost base.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management' own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.