28 September 2021

Having wobbled the previous week, equities climbed the proverbial "wall of worry", shrugging off poor economic data, tighter monetary policy and further Chinese discomfort in order to recapture lost ground. European surveys of business activity disappointed expectations, confirming that the post-lockdown boom is over. Economic forecasters had underestimated the impact of sustained and intensifying supply-side constraints on the manufacturing sector, and the disruptions also appear to be feeding through into the service sector. Employment intentions among European businesses remained strong, but eased to a four-month low. All-in-all, this was not a report that gave much support to all-time highs in equity prices, but that is where stock markets are, currently, heading.

The US Federal Reserve signalled that tapering is imminent, stating that, “If progress continues broadly as expected, the Committee judges that a moderation in the pace of asset purchases may soon be warranted”. The consensus of expectations is that November will mark the start of the reduction, with asset purchases being wound down to zero over an eight-month period. It’s hard to believe that asset purchases will go from their current level of $120 billion a month down to zero, in eight months, without tantrums. That will be the acid test: the widespread conviction among equity investors is that central banks will come riding to the rescue at the first sign of a correction.

Bond markets were not so fortunate as equities, reacting negatively to the Federal Reserve’s news, despite the fact that the "tapering" had been comprehensively telegraphed in advance, including in the editorial section of the Wall Street Journal. The UK gilt market was particularly weak, reaching new lows for the year-to-date as gilt yields jumped to levels not seen since May 2019. The Bank of England was the chief culprit here, having signified that “some developments during the intervening period appear to have strengthened that case” for a “modest” tightening of monetary policy. It did not help that the Bank reduced its expectations for economic growth, while increasing its expectations for inflation.

The doom-mongers were out in force, heralding the end of the bubble in bond prices, but the case for central banks to bail bondholders out of any crisis is far stronger than the case for bailing out equity investors: rising bond yields feed directly into government borrowing costs, and that prospect is not remotely conceivable given the mountains of government debt that have been accumulated during the pandemic. Having doubled, and then tripled, down on asset purchases as a strategy for constraining normal bond market yields, central banks will struggle to let go.

The authorities in China smacked markets on the head again, this time declaring that all crypto-currency transactions are illegal. This was their boldest statement yet in the struggle to control crypto-currency transactions, and it was simultaneously issued by the People’s Bank of China and nine other government institutions, including the supreme court and the police. The problem is that crypto-currencies are, of their very nature, decentralised and hard to control. The news from China was not all bad, however, as the People’s Bank of China poured cash into inter-bank markets, in an attempt to forestall any chaos from the default of property developer Evergrande.

A mere three days after its EUR33 billion spin-off from owner Vivendi, Universal Music Group (UMG) was the target of pressure from MPs urging an investigation into its dominant market share. Nevertheless, investors are still sitting on a 25% gain versus the listing price. Shares in Vivendi, which still owns 40% of UMG, enjoyed a 20% bounce. Even rival Warner Music Group benefited, rising by 3% on the day of UMG’s listing, as investors appeared to see value that had previously been overlooked.

Nike’s latest quarterly report disappointed, sending the stock price down 7%. Revenues of $12.2 billion were about $200 million below the average of analysts’ expectations, which management attributed to problems with supply chains. The company reported that demand has "never been higher", but that the time taken for a pair of Nike shoes to travel from factories in Asia to shops in the US has doubled, from 40 to 80 days.

Google takes the European Union to court this week, protesting its record-breaking EUR8 billion in fines for anti-competitive behaviour. At issue are contracts requiring phone makers to take Google’s search app along with access to other apps. The case is regarded as setting an important precedent for the company’s US investigation, where exactly the same bundling issues are concerned.

Tesla shareholders were recommended to reject two board members, who are standing for re-election, by the largest US proxy-voting advisers. The firm, Institutional Shareholder Services, argued that “Votes against directors James Murdoch and Kimbal Musk are warranted due to concerns regarding excessive compensation to named executive officers and to non-executive directors.”

In the midst of the malaise brought about by the Evergrande debt crisis, Chinese property developers saw gains of 6% to 10% after the central bank said it would work to protect the health of the Chinese property market and home buyers’ rights. The biggest gainer was Sunac China Holdings, up 18% after it denied that it was seeking support from local authorities.

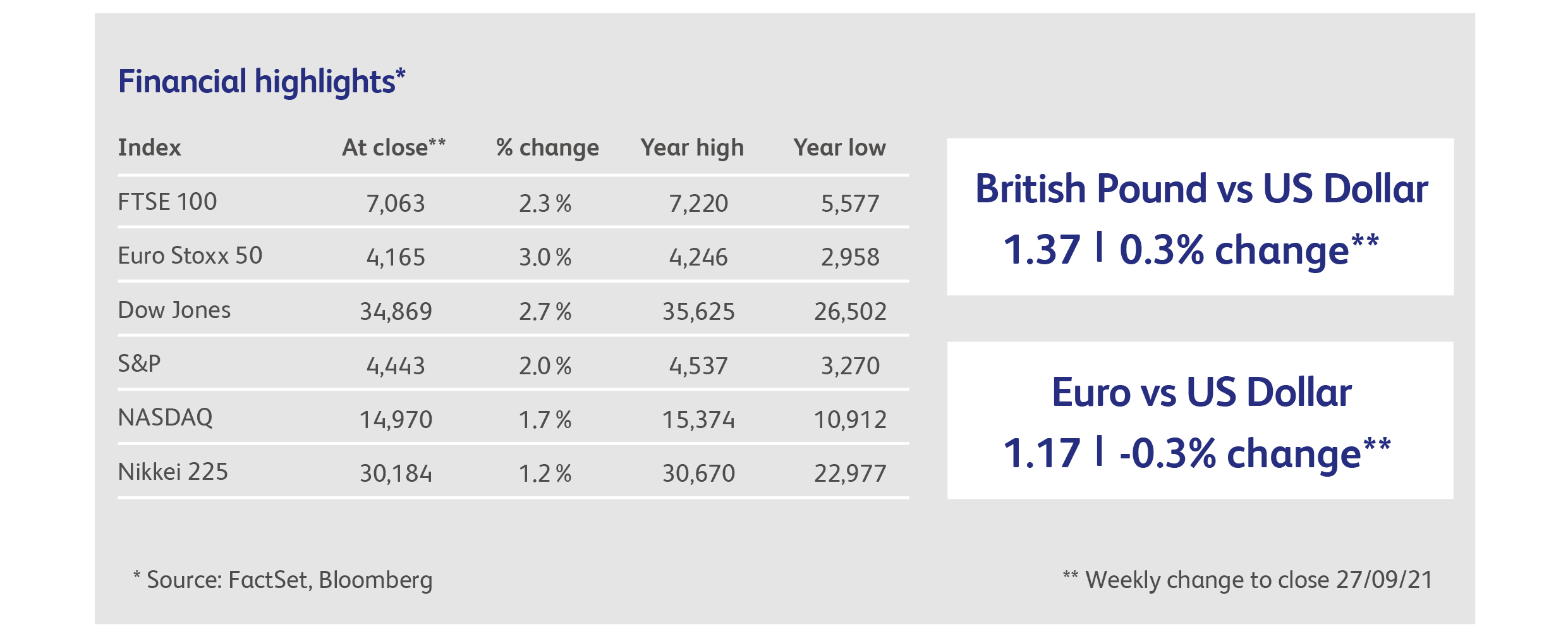

Highlights

Calendar

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.