23 December 2025

Last week the Bank of England (“BoE”) cut interest rates by 25 basis points to 3.75%, with Governor Andrew Bailey signalling optimism for hitting the inflation target by late spring and suggesting openness to further easing. This dovish shift, which also noted artificial intelligence-driven job displacement risks, contrasts with other policymakers' hawkish concern over "hot" wage growth. Analysts believe further cuts beyond 3.5% will require stronger evidence of cooling pay pressures. UK retail sales unexpectedly fell by 0.1% in November, driven by drops in food and online sales. However, the GfK Consumer Confidence index surprisingly rose to -17 in December on increased major purchase intentions, indicating moderating caution despite a subdued economic outlook.

The UK’s fiscal pressure continues, with public sector borrowing hitting a near-record £132.3 billion for the fiscal year to November. The £11.7 billion monthly deficit exceeded the £10 billion forecast, underscoring national balance sheet stabilisation difficulties despite rising tax receipts. This strain is mirrored privately; UK merger and acquisition values fell 8% to $217.2 billion in 2025, a decline unique among major European nations, reflecting business confidence eroded by tax policy uncertainty. Compounding this, low fertility and rising life expectancy make retaining older workers vital to avert a fiscal crisis, as warned by a House of Lords committee. Combined with slumping business investment, the UK faces an exceptionally challenging fiscal and structural outlook, even if the BoE eases monetary policy.

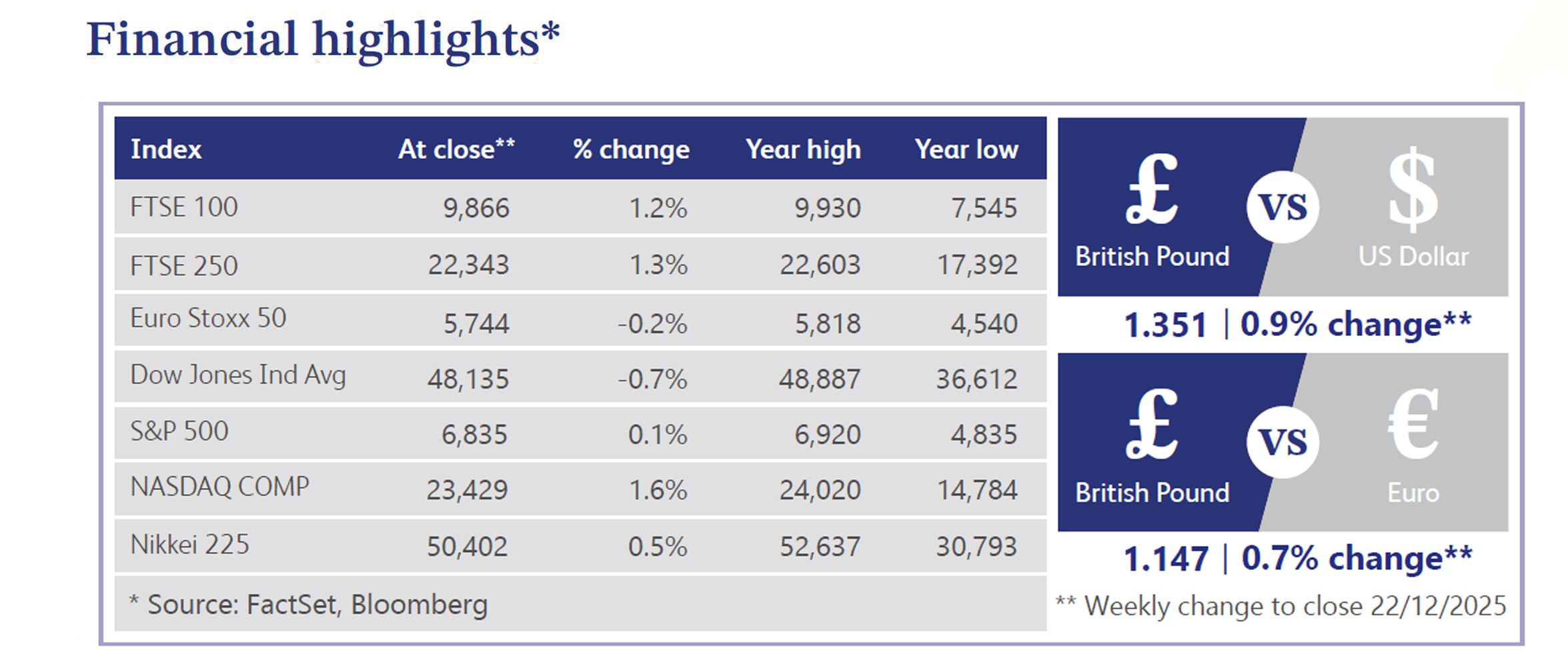

US stocks were mixed last week; Big Tech drove the S&P 500 and Nasdaq higher, while the Dow Jones and Russell 2000 fell. Artificial intelligence (“AI”) was a key driver; Micron surged 10.3% on strong earnings, and Amazon's potential $10 billion OpenAI investment boosted sentiment, despite scrutiny on some infrastructure names like Oracle. Released data backlogs showed a cooling economy year to year: the November Consumer Price Index (“CPI”) dropped to 2.7% (below 3.1% consensus), and the unemployment rate rose to 4.6%; the highest since 2021. Federal Reserve officials were divided on the need for immediate further rate cuts. Treasury yields remained largely unchanged, reflecting stable inflation expectations. The US Dollar Index rose 0.3%, gaining against the Yen after the Bank of Japan raised its short-term interest rate to 0.75% from 0.5%. Commodities varied: gold gained 1.4%, while oil fell 1.6% on 2026 oversupply worries. Bitcoin futures dropped 2.4%.

The UK housing market is in a period of transition as it digests last month's budget. Despite a challenging Royal Institution of Chartered Surveyors survey, the BoE's rate cut to 3.75% will encourage buyer interest. The GfK Consumer Confidence index showed a four-point jump in "major purchase intentions," suggesting policy easing may stabilise household outlooks. However, the prime market is pressured by fiscal uncertainty. Speculation around the "mansion tax" is causing a cautious approach to high-value sales, with £2 million homes potentially losing over £50,000 in value. While cheaper credit helps affordability, the combined effect of high public borrowing and tax-driven pressure is currently offsetting the BoE's dovish stance, keeping the overall market subdued as we head into 2026.

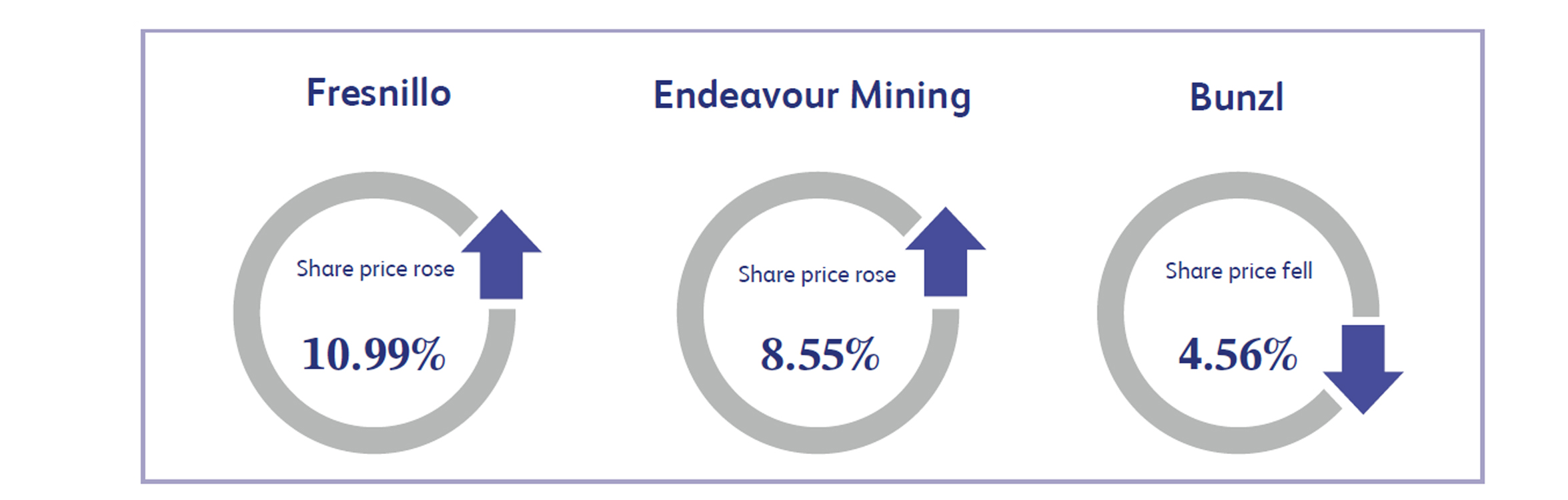

Fresnillo led the FTSE 100 this week, gaining 10.99%, as the world’s largest primary silver producer and a major Mexican gold miner benefited from gold and silver reaching historic all-time highs. Once deemed a safe haven, the 'gold rush' of 2025 has brought new risks to the surface. Massive retail inflows have pushed bullion prices to levels that some analysts view as frothy, raising the spectre of a sharp correction if sentiment shifts. While the fundamental case for gold as a hedge against easing monetary policy remains intact, the current crowded nature of the trade suggests that investors must now balance the metal’s safe-haven status against the risks of high-street euphoria.

Endeavour Mining, the largest gold producer in West Africa, also saw robust gains of 8.55% in line with the broader sector’s upward trajectory. Positioned as a strategic defensive asset, the company attracted investors looking for an essential hedge against ongoing market volatility. With global central banks clearly moving toward policy easing, this stock has emerged as a preferred way to gain exposure to gold. This popularity is driven by bullion's role as a safe haven asset, appealing to investors who seek to mitigate macroeconomic uncertainty.

Bunzl was the week's biggest laggard, falling 4.56% due to a cooling global macroeconomic outlook, evidenced by weak UK retail sales and contractionary US manufacturing data. Compounding this, the global distributor of non-food essentials faces margin pressure. Bunzl recently warned that 2025 operating margins are expected to drop to approximately 7.6% (from 8.3%), hurt by deflationary European headwinds and North American foodservice execution issues. This margin compression, coupled with the broader economic indicators, has raised concerns among investors about the company's near-term growth prospects and ability to maintain its historical premium valuation.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management's own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.