5 October 2021

The credibility of central bankers took another knock last week, as surging costs in the energy sector not only increased estimates for peak inflation, but also prolonged the peaks themselves. It was always the case that the post-lockdown economic rebound would be accompanied by growing pains, but now the growth impetus is fading and the growing pains are taking centre stage. By writing inflation off as “transitory” before it had even got going, central bankers now appear complacent, and this could undermine the delicate compromise between encouraging growth and unleashing inflation. Higher inflation means central banks have less room to cut rates or ease monetary policy and, as a result, investors are likely to be far less forgiving of weak company revenues or data showing poor economic growth.

Energy prices are not the only concern. Investors are already familiar with rising commodity prices, shipping prices and the shortage of semiconductors, but the next most pressing issue is likely to be a shortage of labour. And it’s not just lorry-drivers in the UK: millions of workers in the western world have withdrawn from the labour market during the pandemic. It was thought that the end of government support would send them straight back to work, but it now seems probable that Covid-related problems will prevent their immediate return.

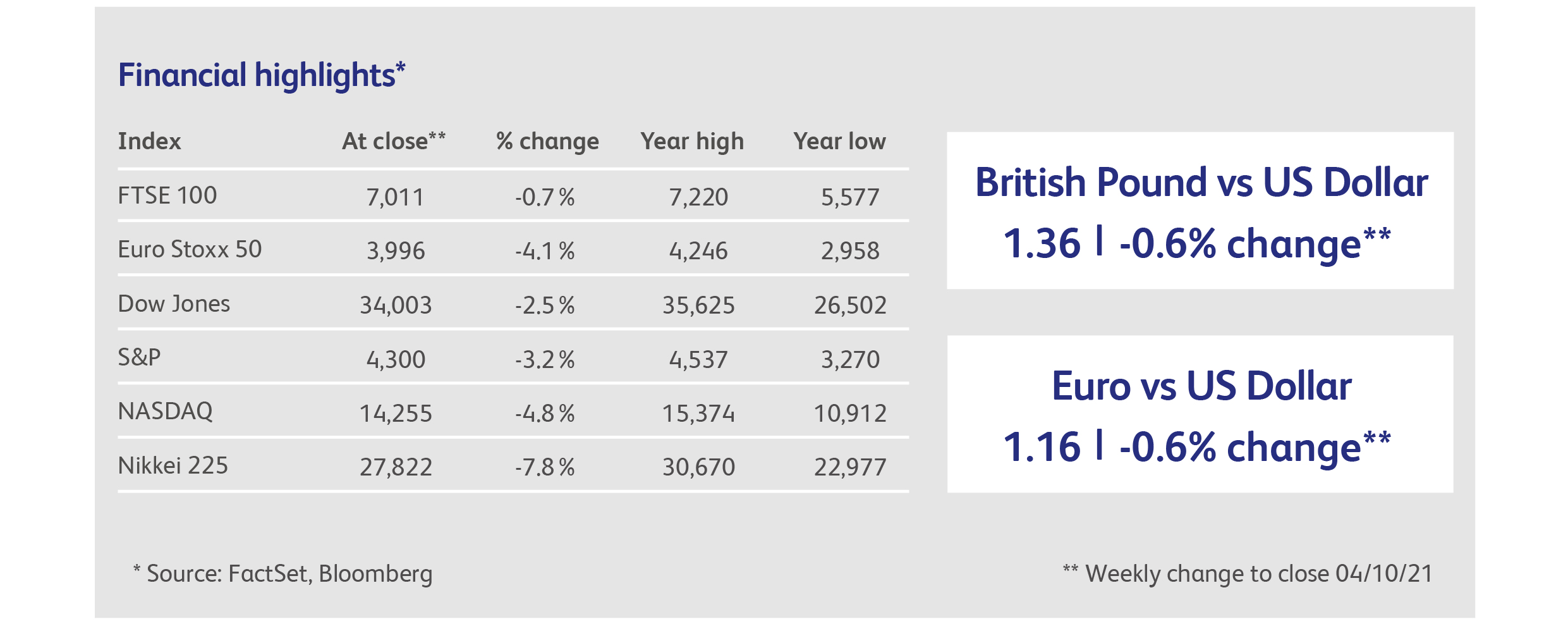

Given the backdrop of tortuous negotiations in Congress over funding the US government, and the on-again, off-again US infrastructure bill, the accumulation of worries was too much for stock markets, many of which slipped to their lows of the past several months. The question is whether this represents a sea-change in investor sentiment or another opportunity to buy the dip. Adding to the uncertainty, another catalyst for change is just round the corner: companies are due to start reporting their earnings for the third calendar quarter, which is likely to bring some spectacular numbers but also some harsh warnings about supply chains and input costs.

Sterling staged a recovery late in the week, having fallen against the US dollar to levels last seen in December. The decline was more due to dollar strength than sterling weakness, as the dollar has surged against most currencies since the start of September. Given the recent sell-off in government bond markets, the dollar is increasingly looking like one of the few remaining safe havens. That’s not the full story for sterling, however, as hawkish comments by the Bank of England, plus the recent rise in gilt yields, would normally have offered some support. Moreover, a large positive revision to UK economic growth in the second quarter could have been expected to boost sentiment.

This support was notable by its absence, however, as the pound was restrained by the concern over energy prices and the implications for inflation. Natural gas prices have doubled in the past year, and are up 16% in the last two weeks alone. Although this is a Europe-wide phenomenon, the UK is especially prone to higher natural gas prices because it is far more dependent on natural gas for electricity generation than its neighbours: 40% of electricity generation is derived from natural gas in the UK, compared with 17% in Germany and 7% in France. It has not helped that the UK’s departure from the EU’s Internal Energy Market reduced access to EU gas networks. Add this to the long list of self-inflicted wounds on the economy, and it could be a hard winter for sterling.

Hong Kong-listed property developer Sunac may be the next domino to fall in Chinese markets, after a letter from the company to a local government was leaked, in which the company asked for special policy support to counter “big hurdles and difficulties in terms of cash flow and liquidity”. Some of Sunac’s dollar bonds were down nearly 20% in September.

Shares in the US pharmaceutical manufacturer Merck & Co had their best day in five years, after the company announced the results of a clinical trial into a pill that aims to prevent Covid. The drug, known as Molnupiravir, reduced the risk of hospitalisation or death by 50%. The results were so encouraging that the company stopped enrolling patients in its clinical trials and will proceed immediately to seek authorisation from the US government.

Tesla comfortably beat expectations for car sales in the third calendar quarter, delivering 241,000 cars worldwide versus expectations of 224,000. The previous quarter had seen sales of 201,000. The numbers bucked a trend in the car industry for slower sales due to the shortage of semiconductors, and could demonstrate that electric cars are less vulnerable.

Shareholders in Daimler will be offered a vote on whether to spin off its notoriously low-margin truck-manufacturing business. The idea is that, by separating the car and truck divisions, each will be able to respond more quickly to developments such as battery power, hydrogen fuel cells and autonomous driving. The remaining Mercedes-centred business expects to retain a 35% stake in the truck division.

Facebook shares fell 5% after the company was hit by a double-whammy: a whistle-blower emerged who will testify before the US senate that Facebook knowingly ignored harm caused by its services, and a spectacular outage shut down the firm’s Facebook social network, Instagram photo app and WhatsApp messaging service for hours.

Highlights

Inflation in the Eurozone rose to 3.4% in September, above expectations and up from 3% in the previous month. The culprits were energy, food and services. In particular, energy prices were 17.4% higher than a year ago.

Surveys of Chinese business activity sent conflicting messages, with a lurch downwards in manufacturing activity at odds with a surge in the service sector. Over half of the manufacturers surveyed saw their businesses shrink in September.

US unemployment claims rose for the third consecutive week and, at 362,000, were well above expectations. Other US data was more encouraging, with a key survey of manufacturing activity registering a surprise to the upside, and other data showing robust consumer spending in September.

Calendar

Job creation in the US has disappointed over recent months, so Friday’s data on payrolls for the month of September will be closely scrutinised. The expectation is for 460,000 jobs to have been created, a big improvement from 235,000 last month. Surprisingly, economists have found little evidence so far that the removal of enhanced employment benefits at the start of September encouraged more workers to return to the workforce. It now seems more likely that the risk of catching Covid has deterred workers who were only marginally inclined to find employment.

As central banks have started to pivot towards the winding-down of their enormous asset purchase programmes, forthcoming speeches this week by senior officials at the European Central Bank, Federal Reserve and Bank of Japan will carry special significance.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.