26 October 2021

Investors continued to look on the bright side last week but, with persistent inflation becoming an inconvenient truth, it’s more the case that every silver lining is now accompanied by a cloud. A new all-time high for the US stock market was only momentarily punctured after the US central bank’s Chairman Powell admitted he had been wrong about inflation. “The risks are clearly now to longer and more persistent bottlenecks, and thus to higher inflation” he said and, though he declined to change policy guidance, the change in tone is clear. Bond markets had already arrived at this conclusion, and have been bidding up the prospects for early rate rises for several weeks.

The latest global round of business activity surveys was slightly better than expected but not without inconsistencies. The bright spots were in the service sectors in the US, UK and France. However, the rebound in manufacturing activity everywhere continued to erode, and even slipped to a seven-month low in the US. The surveys for Germany were especially weak compared with expectations, and another worry is that many of the recent inflationary trends, as well as a renewed slowdown in Chinese manufacturing, have yet to fully enter the data.

Business activity in the UK was particularly perky and may have been assisted by the full removal of Covid-related restrictions. However, the UK is now paying the price for this in rising Covid cases at a time when the effectiveness of vaccinations is waning and colder weather is coming. Moreover, the impact of the recent fuel shortages in the UK became apparent in September’s retail sales data, which marked the fifth consecutive month of declining sales, the longest unbroken run since the data began in 1988.

Attention is focused on whether the Bank of England will raise base rates at its meeting next week to combat rising inflation, at a time when the majority of UK data suggests that the economy is softening. Incomes and spending are expected to decline in response to the end of the furlough scheme, as well as the £20 per week reduction in Universal Credit payments and rising inflation. Having been buoyed by prospects for a rate rise, Sterling is at risk of renewed weakness if the Bank of England does not follow-through with a rate increase. Moreover, the spectre of a No-Deal Brexit is back, with the UK threatening to suspend parts of the existing trade deal and the EU threatening to cancel the whole thing.

President Biden’s Build Back Better agenda has struggled to make its way through the US legislative process, and looks set to shrink from the $3.5 trillion originally sought to about $1.5 trillion. Nevertheless, markets still crave stimulus and the bill is a positive for growth, albeit growth that is funded by more government spending. Last week, the French stock market jumped by a percent after the French government promised to alleviate inflation in energy prices by making EUR100 payments to private individuals. That would cover 38 million people. The worry, on the other hand, is that renewed government stimulus packages will exacerbate inflationary pressures in the short-term, especially the idea of compensating voters against inflation itself, something that the British government has also hinted at as part of its Budget tomorrow.

The first exchange traded fund (ETF) to track the price of Bitcoin, launched last week, attracted capital so quickly that it already risks exceeding the Chicago Mercantile Exchange’s limits on ownership of underlying Bitcoin futures contracts. The ETF added over $1 billion in assets in its first few days, despite the price of Bitcoin rising by 50% in the run-up to its launch.

Nothing captures the current zeitgeist better than Trump Media & Technology Group, the former president’s new business enterprise. An announcement that the company would go public using a Special Purpose Acquisition Vehicle (SPAC) sent retail investors into a frenzy, bidding up the value of the SPAC by over 1,000% in just a few days. Trump fans on social media pumped the stock, and orders dominated American retail share trading platforms. It’s as yet unclear how any of the company’s plans to build a social media platform and streaming service will be achieved.

The chorus of warnings about the shortage of magnesium is getting louder: last week a trade group of European magnesium users warned that a shortfall in deliveries of the metal from China risks “an international supply crisis of unprecedented magnitude”. This followed similar comments by US producers, including Alcoa, the previous week. China mines and controls most of the world’s supplies of magnesium, which is a crucial element in the fabrication of construction materials.

Facebook is suffering from Apple’s decision to give users rights over their own data, and warned that revenues for the fourth calendar quarter will disappoint expectations. The company also missed analysts’ estimates for the third quarter and is embroiled in a damaging disclosure of emails by a former employee. Nevertheless, the announcement of a $50 billion stock repurchase programme looks likely to boost its share price.

Intel Corp, a stock market darling from the last tech bubble, dropped 8% in a day after warning that profitability will suffer for a number of years due to increased spending on manufacturing processes. The decline wiped out gains for the year-to-date, and comes only a few months after the shares had managed to exceed their June 2000 price for the first time.

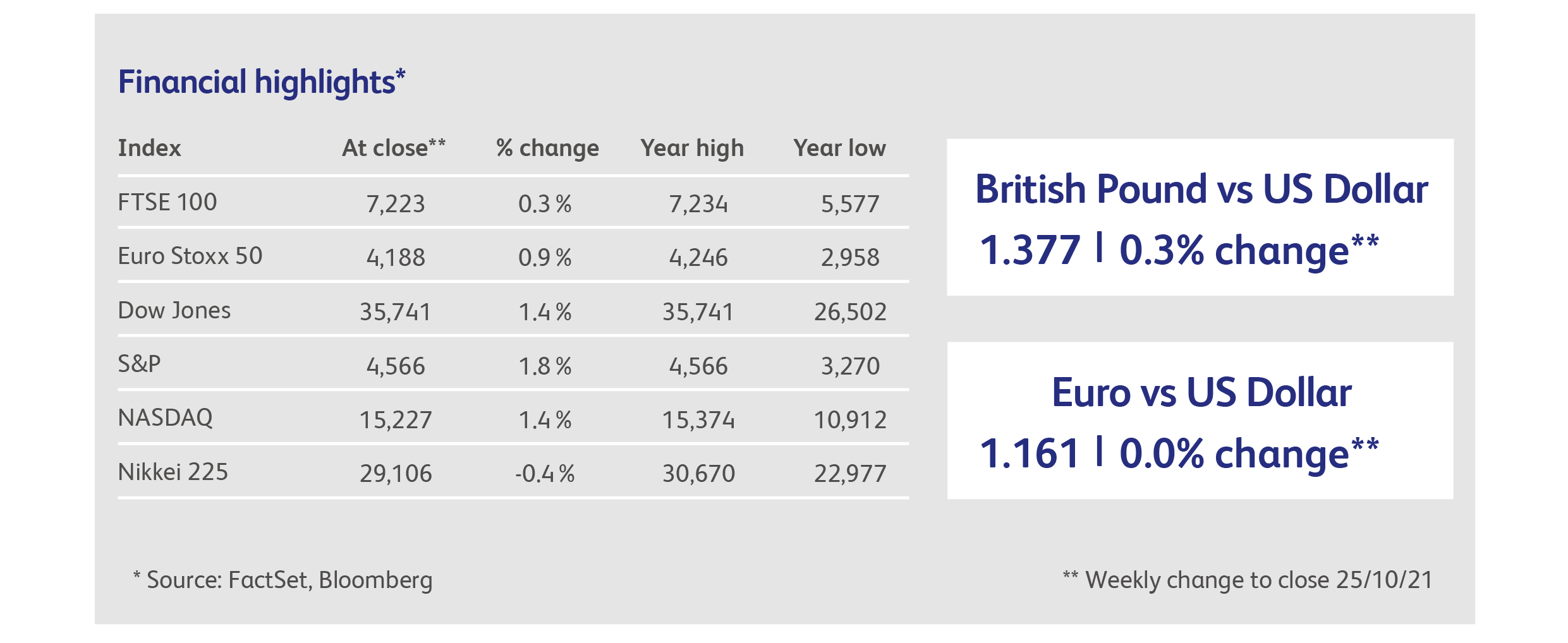

Highlights

Calendar

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.