15 July 2025

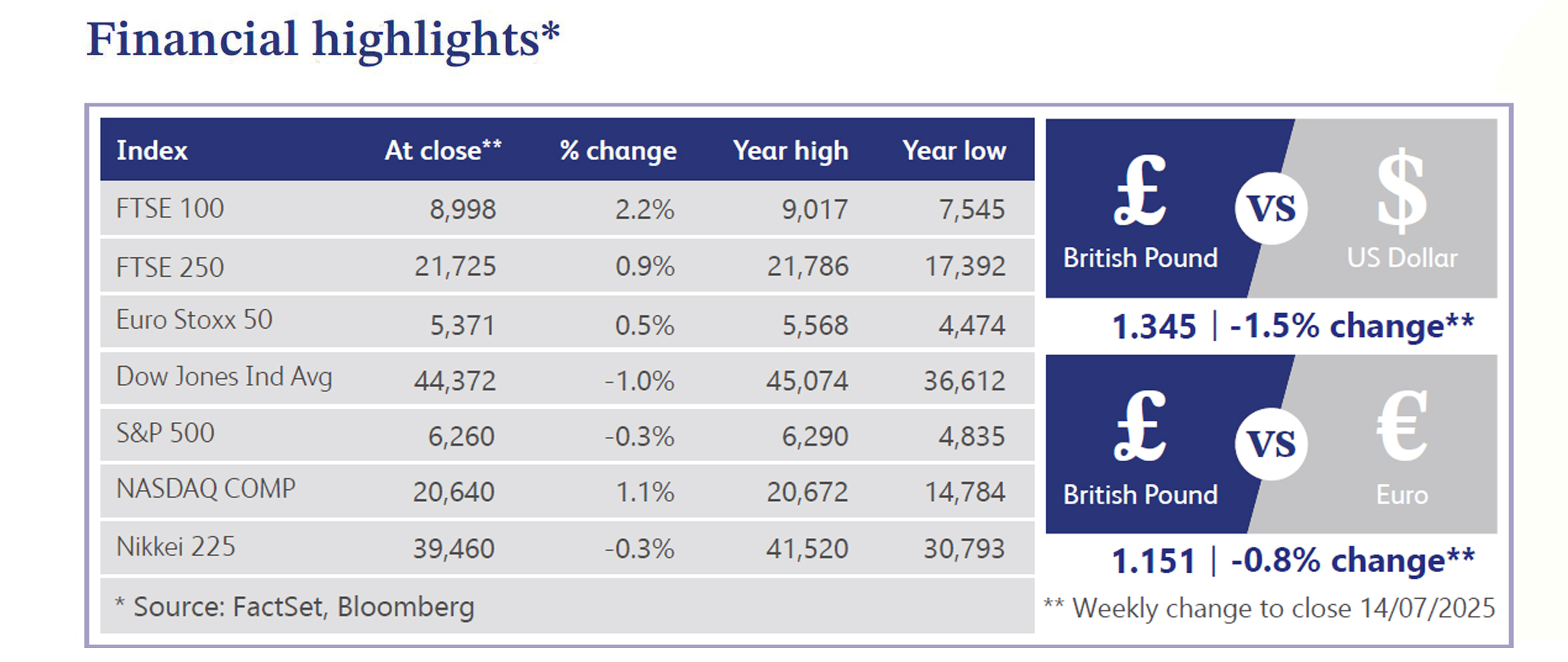

UK economic data reinforced expectations for an August Bank of England ("BoE") rate cut despite near-term inflation risks. Gross domestic product (“GDP”) unexpectedly contracted 0.1% in May, marking a second consecutive monthly decline, while first-quarter growth was revised up to 0.4%. Services grew modestly but falls in production and construction dragged overall output. Updated Office for National Statistics (“ONS”) data revealed higher-than-reported producer inflation, with input prices rising 0.6% in January. Monetary Policy Committee (“MPC”) member Alan Taylor warned of downside risks and urged faster easing. Business sentiment remained fragile, with BDO’s hiring index at a 13-year low and Institute of Chartered Accountants in England and Wales (“ICAEW”) confidence at a three-year low. Yet, Royal Bank of Scotland reported a pick-up in services-driven private sector activity. Firms also flagged price hikes to offset payroll tax rises, highlighting persistent cost pressures.

UK fiscal concerns deepened last week as the government signalled tax rises may be needed to offset welfare U-turns. Chancellor Rachel Reeves could not rule out autumn tax hikes, while Prime Minister Kier Starmer declined to dismiss a wealth tax amid pressure from the Office for Budget Responsibility (“OBR”), which warned fiscal risks are mounting. Think tanks flagged structural risks, projecting the state pension could become unsustainable by 2036 and the Centre for Economics and Business Research (“CEBR”) warned that Labour’s non-dom reforms risk a £4 billion shortfall. Meanwhile, polls show voter frustration mounting, with Reform UK leading and Labour seen as being as chaotic as the previous government. Reeves is reportedly reviewing fiscal rules to boost investment and stability, but criticism continues over stealth taxes and trade uncertainty, including looming US steel tariffs.

UK markets came under pressure last week as rising gilt yields fuelled calls for the BoE to slow its quantitative tightening, with analysts warning it could undermine the rate cut cycle. Despite fiscal concerns, Deloitte’s survey ranked the UK joint-top for investment appeal with India, reflecting improved sentiment. Fund flows showed caution amid Middle East tensions, with equity outflows and strong safe-haven demand. Meanwhile, Shein filed for a Hong Kong initial public offering (“IPO”), housebuilders agreed to a £100 million Competition and Markets Authority (“CMA”) settlement, and business leaders urged bold equity market reforms.

US equities slipped after recent record highs, with weakness in banks, insurance, software, and consumer names. Nvidia rose 3.5%, hitting a $4 trillion valuation, while energy, airlines, and steel outperformed. Treasuries weakened, and the curve steepened; the dollar gained 1%. Gold rose 0.6%, oil 2.2%, and copper surged 8.9%. Markets looked ahead to Consumer Price Index (“CPI”) and second quarter earnings. Trump’s new tariffs on major partners added trade uncertainty. Federal Reserve expectations imply 0.5% of cuts in 2025. Jobless claims were mixed, and small business optimism declined slightly.

Halifax data showed UK house prices stagnated in June, beating expectations of a small decline, while annual growth held at 2.5%. The data suggests underlying resilience, supported by strong BoE mortgage approvals and stabilisation seen in the latest Royal Institution of Chartered Surveyors (“RICS”) survey. New buyer enquiries turned positive for the first time since December. However, the Building Societies Association warned Reeves’ ISA reforms could raise mortgage costs by reducing deposit funding.

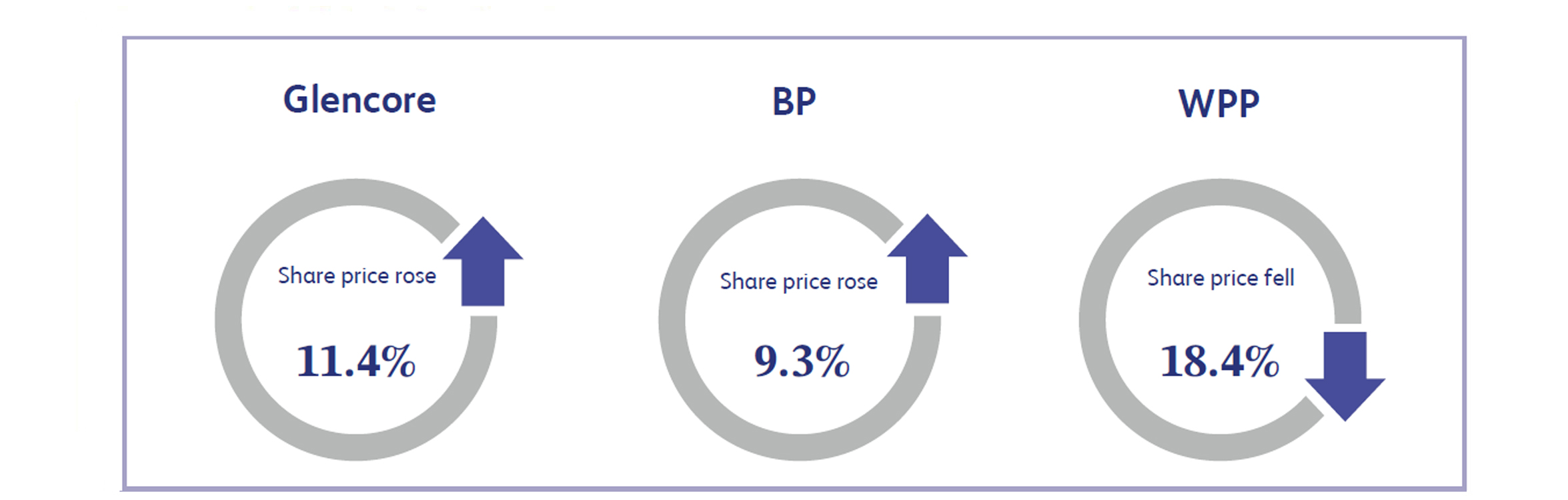

Glencore rallied 11.4% following news that the US will impose a 50% tariff on global copper imports starting 1 August, lifting short-term price expectations. As one of the world’s largest commodity producers, Glencore is set to benefit from the surge in copper prices driven by tighter supply sentiment and trade-related positioning. Investors shrugged off medium-term trade risks, betting on the company’s exposure to rising metal prices. Additional support came from improved sentiment in precious metals and reports of Glencore’s joint venture exploring ExxonMobil’s retail assets in Singapore, suggesting continued strategic expansion. Market optimism outweighed geopolitical concerns for the week.

BP shares surged 9.3% after the company forecasted stronger-than-expected upstream production for the second quarter (“Q2”), signalling a recovery from weaker first quarter levels. This offset concerns about lower realised oil prices, which could hit earnings by up to $800 million. Investors were encouraged by higher average refining margins and an anticipated decline in net debt below $27 billion. Despite crude price headwinds from the Organisation of the Petroleum Exporting Countries (“OPEC+”) easing supply cuts, BP’s operational resilience and improved production outlook reassured markets. The update came ahead of Q2 results and was seen as a positive sign of cost discipline and strategic execution amid volatile commodity markets.

WPP tumbled 18.4% after cutting its full-year guidance, warning of worsening trading conditions in Q2. Management cited execution challenges linked to its ongoing strategy shift and macroeconomic pressures, including client losses and reduced spending. The company now expects a 3% to 5% revenue decline, compared with previous guidance for flat growth. Additionally, new business momentum weakened, reversing prior expectations of a neutral impact into a 1% to 1.5% top-line drag. The update sparked concerns over WPP’s ability to manage its transformation while retaining clients, driving sharp investor repricing. Shares fell to multi-year lows as confidence in the near-term outlook eroded.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management' own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.